Weekly Energy Update (July 1, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices are moving steadily higher although momentum is starting to slow.

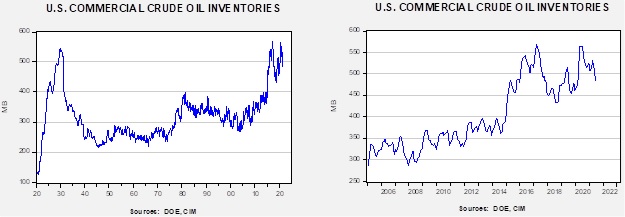

Crude oil inventories fell 6.7 mb compared to the 4.0 mb draw expected. The SPR fell 1.4 mb, meaning without the addition from the reserve, commercial inventories would have declined 8.1 mb. We note the SPR is at its lowest level since October 2003.

In the details, U.S. crude oil production was unchanged at 11.1 mbpd. Exports rose 0.1 mbpd, while imports fell 0.5 mb. Refining activity rose 0.4%.

(Sources: DOE, CIM)

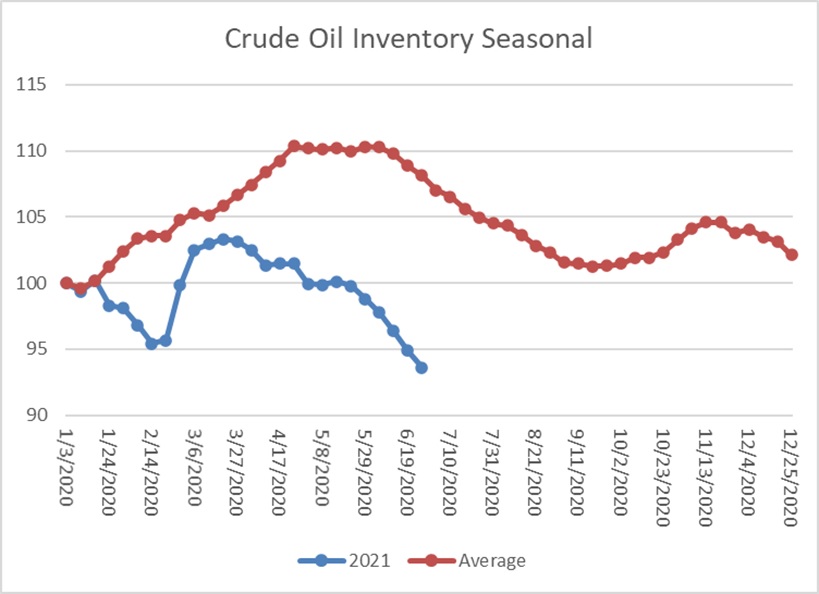

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are already below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 465 mb. Our seasonal deficit is 75.1 mb. At present, inventories are falling faster than normal.

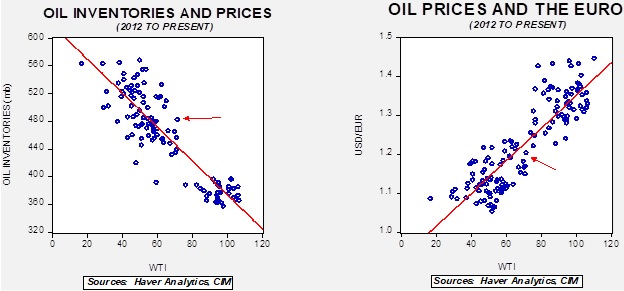

Based on our oil inventory/price model, fair value is $57.17; using the euro/price model, fair value is $67.63. The combined model, a broader analysis of the oil price, generates a fair value of $62.15. Oil prices are still “rich” relative to inventory levels. Recent dollar strength caused by uncertainty surrounding Fed policy has also reduced the dollar model’s fair value.

Market news:

- The Dallas FRB produces quarterly surveys of oil and gas activity in its district. The report suggests that production and investment are recovering. At the same time, the survey indicates costs are rising as well. So far, we have only seen a modest rise in production. Some of this is due to concerns about future regulation. The shale industry, in particular, is trying to shed its reputation as a capital consumer. Thus, the previous pattern of rapid output increases does not appear to be occurring this time around…so far.

- The Supreme Court has backed refiners in their disputes over biofuel waivers. The renewable fuel standards mandated the required amounts of biofuels to be used, assuming steady growth in demand. However, after the Great Financial Crisis, demand growth fell, and the only way to meet the standard was to move beyond the 10% “blend wall.” The courts have pushed back against the mandated level of usage.

- This report examines the idea that we may be at peak oil consumption.

Geopolitical news:

- Libya has been in a civil war since 2014. The situation became volatile in the wake of the ouster of Gaddafi in 2011. Libya has a natural east/west division that has been exhibited during this ongoing conflict. Outside nations are also involved. Russia, Egypt, the KSA, and the UAE supported the Libyan National Army, led by Khalifa Haftar, which operated in the east. Meanwhile, Turkey supported the Government of National Accord, which controlled the West. In March, the two sides created a national unity government. There are peace talks underway in Berlin to try to end the conflict. Libya once produced almost 2.0 mbpd of crude oil. Since the conflict, it typically generates 0.5 mbpd. If the conflict is resolved, we could eventually see increased output.

- Iran has a new president, Ebrahim Raisi. Nuclear deal talks continue, but rising tensions between the U.S. and Iran are complicating the discussions.

- We also note new reports of sabotage of Iran’s nuclear industry.

- Russia has reduced natural gas supplied to Europe, driving prices higher. It appears the decision to reduce supplies is politically motivated.

Alternative energy/policy news:

- We have often discussed how climate activists have targeted pipelines ultimately to reduce the availability of fossil fuels. Such actions are controversial; pipelines move oil and products with less environmental impact compared to trains and trucks. The goal of activists is to reduce consumption, so if a pipeline disruption is resolved by trucks or trains, it makes conditions worse. After the initial support from the Biden administration in halting the Keystone XL pipeline, the White House has become less active, disappointing environmentalists. There is a political risk from rising gasoline prices, and we suspect the administration is trying to avoid voter dissatisfaction from higher energy prices while maintaining some level of creditability with environmentalists.

- Last week, we discussed ideas about placing sails on ocean-going vessels to reduce carbon consumption. This report expands on that notion.

- A groundbreaking nuclear power plant, which uses molten salt instead of water, is being constructed in Wyoming. It is replacing a coal plant. Such plants have interesting features, including the ability to create intermittent power, unlike traditional nuclear reactors, which provide baseload power. These reactors have the promise of being cheaper and safer and may provide a way to provide reliable carbon-free electricity.

- Renewable diesel, a plant-based product, has the potential to be a better replacement than biodiesel, which has suffered from poor performance in cold weather. This new product is refined from the same feedstocks as biodiesel, but since it is refined much like crude oil, it has properties similar to fossil diesel.

- Direct carbon capture from the atmosphere remains the great hope of reducing CO2. This report is an update on progress.

- The Senate has passed a measure (S.1251) that would give farmers and foresters the ability to sell carbon credits for the CO2 their activities capture. The fact the bill passed overwhelmingly (92-8) shows that it is still good politics to be seen as farm friendly. However, the actual execution of such policies is complicated.

The U.S. has moved to ban some solar products produced in Xinjiang.