Weekly Energy Update (July 9, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After rising above $76 per barrel on news of the OPEC+ impasse (see below) prices have corrected modestly.

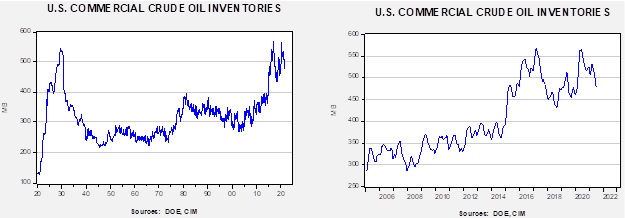

Crude oil inventories fell 6.9 mb compared to the 4.0 mb draw expected. The SPR fell 1.2 mb, meaning without the addition from the reserve, commercial inventories would have declined 8.0 mb. We note the SPR is at its lowest level since October 2003.

In the details, U.S. crude oil production was unchanged at 11.1 mbpd. Exports rose 0.1 mbpd, while imports fell 0.5 mb. Refining activity rose 0.4%.

(Sources: DOE, CIM)

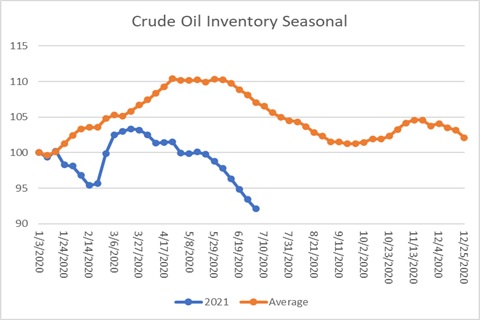

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are already below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 553 mb. Our seasonal deficit is 77.1 mb. At present, inventories are falling faster than normal.

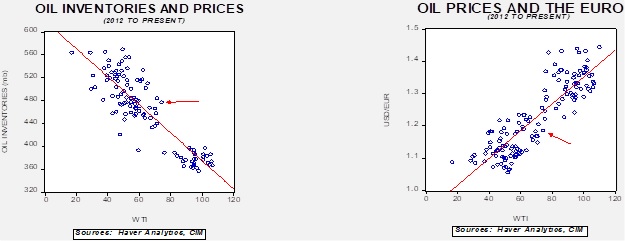

Based on our oil inventory/price model, fair value is $59.48; using the euro/price model, fair value is $63.41. The combined model, a broader analysis of the oil price, generates a fair value of $61.09. Oil prices are well above fair value for all the models. The ability of oil to maintain current levels is dependent on sentiment towards OPEC.

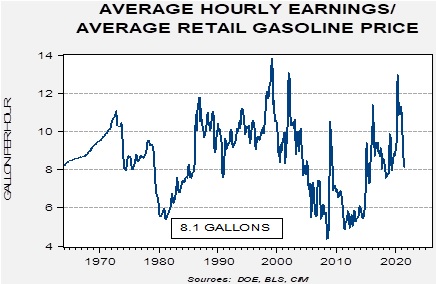

Rising gasoline prices can be a political problem for the White House. However, the key isn’t just the rise in prices but the relationships to income. Clearly, consumers prefer lower prices to higher prices, but the combination of high prices and low wage growth creates a much more serious problem. One way we try to measure this relationship is to divide the current wage for non-supervisory workers into the national average gasoline prices. This calculation measures how many gallons of gasoline an average worker can purchase from working one hour.

Currently, a worker can buy just over eight gallons at the average hourly wage. The average since the mid-1960s is 8.6 gallons, so the current level is probably not enough to cause political turmoil.

Market news:

- Alaskan crude oil production is steadily declining, which will support higher prices over time.

- A Greenpeace activist was able to capture video comments from an Exxon (XOM, USD, 61.37) lobbyist that revealed some of the activities the company supported in Congress. The report put the company in a bad light and has triggered apologies.

- Propane prices are soaring. It is unusual for this time of year, as demand is seasonally weak in the summer. If supplies remain tight, it could boost crop drying costs (farmers often use propane to dry their crops before storing them in silos) and may become a crisis by winter, when rural households use the fuel for home heating. What’s behind the rise? Propane is a byproduct of oil refining and natural gas processing. When production rose with the shale revolution, the propane market became oversupplied, leading the industry to build export capacity. Now, nearly 70% of U.S. production is exported. To reduce exports, domestic prices must exceed foreign prices.

- As natural gas prices rise, coal demand is making a comeback.

Geopolitical news:

- The failed OPEC+ meeting dominated the news earlier this week. The cartel failed to agree on a plan to increase oil production gradually. The sticking point is that the UAE wanted a higher baseline of production; since the country has increased its productive capacity, this would mean a larger market share compared to the other members. Opening up capacity discussions is fraught with risks. Several nations have seen capacity fall, such as Venezuela and Libya, and their having higher quotas means that larger producers can fill the gap. Interestingly enough, the news sent prices higher, at least initially. In the past, a failure to make a new production agreement usually raised fears of higher output, leading to falling prices. The UAE seems content to maintain the current agreement going into April 2022, which means the failure will lead to steady production levels. So far, non-OPEC producers have shown little interest in increasing output. As we have detailed in earlier reports, the investing climate has turned hostile towards oil and gas, so OPEC+ is gaining market power. At the same time, higher prices will spur conservation and lead to lower demand growth.

- The increase in tensions between the UAE and the KSA is something new. The two kingdoms have been traditional allies but the UAE’s demand for what is effectively a quota increase is threatening the KSA’s plan to keep oil prices elevated.

- Interestingly enough, there is some evidence of a thaw between the KSA and Qatar, which may be due to the aforementioned issues with the UAE.

- So far, high prices are not triggering a rapid increase in U.S. production. Policy and ESG concerns are limiting investment to boost drilling. However, another factor is that firms that hedged future production locked in a price lower than the current one, meaning that the signal of higher prices isn’t working, and it won’t until these hedges expire.

- As we noted last week, Russia has been restricting flows of natural gas to the EU, sending prices higher. It appears the restrictions are affecting gas that transports across Ukraine; the Russians are apparently using the ploy to speed up the Nord Stream 2 project.

- Iran announced it is making uranium metals, bringing Tehran a step closer to materials required for an atomic weapon.

- Hossein Taeb, head of the Iranian Revolutionary Guard Corps intelligence wing, made his first visit to Iraq this week. He is said to have met with various groups supported by Iran.

Alternative energy/policy news:

- The EU tends to favor biomass to energy as a way of meeting carbon goals. Apparently, bureaucrats in Brussels are having second thoughts about the process and could implement restrictions on the practice. If implemented, it will make achieving carbon goals more difficult.

- The EU is also working on a carbon border tax that would effectively raise the price of goods produced under conditions of weaker environmental rules. However, it appears that the longer the measure is negotiated, the less onerous it becomes for importers.

- The direct carbon capture industry is attracting investment capital.