Weekly Energy Update (July 15, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices appear to be consolidating between $72 to $76 per barrel.

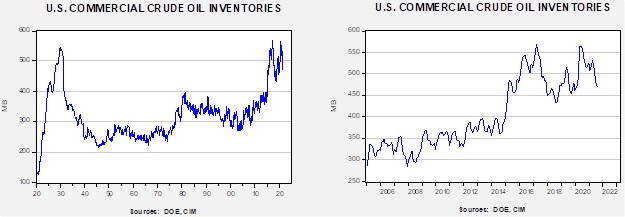

Crude oil inventories fell 7.9 mb compared to the 4.4 mb draw expected. The SPR was unchanged this week.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.4 mbpd. Exports rose 1.4 mbpd, while imports rose 0.3 mb. Refining activity fell 0.4%.

(Sources: DOE, CIM)

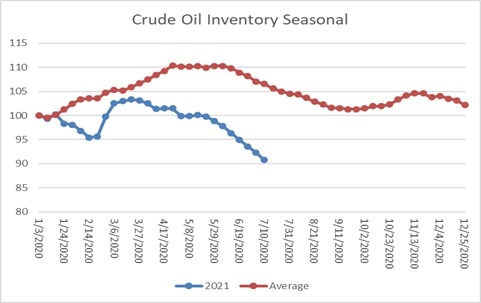

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are well below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 553 mb. Our seasonal deficit is 81.7 mb. At present, inventories are falling faster than normal.

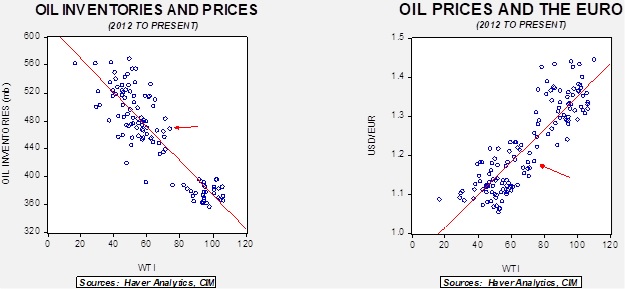

Based on our oil inventory/price model, fair value is $61.99; using the euro/price model, fair value is $63.36. The combined model, a broader analysis of the oil price, generates a fair value of $62.42. Oil prices are well above fair value for all the models. The ability for oil to maintain current levels is dependent on sentiment towards OPEC, although the continued decline in oil stockpiles is improving the valuation gap.

Market news:

- One reason capitalism has triumphed over communism is that, due to the profit motive and the ability to tolerate disruption, capitalist economies tend to use commodities with ever-increasing efficiency. In other words, capitalism tends to generate greater output with less input over time. Communism, at least as it was practiced by the Soviets, tended toward high levels of commodity intensity. In the 1970s, rising oil prices, coupled with tighter monetary policy to counteract inflation, led to two deep recessions, one in 1973-75 and another in the early 1980s. In 1980, the U.S. needed 5,000 BTUs[1] of petroleum to make $1 of GDP; now that is down to around 1,700.[2] Simply put, rising oil prices are not yet a threat to economic growth.

- Although we are seeing a slow rise in U.S. oil production, we are still well below previous peaks. A change in oil company behavior is an important element of this slower production growth. In the past, companies would tend to maximize production rather than profits. That is no longer the case.

- As oil prices rise, speculators are increasingly taking bullish positions on oil.

- Qatar is poised to expand its LNG production by 63% over the next decade.

Geopolitical news:

- OPEC+ and the UAE have reached an agreement. The emirate wanted its baseline production, which would set its quota, to be increased by 0.6 mbpd. After extended negotiations, the UAE agreed to a baseline increase of 3.9 mbpd. Oil prices retreated on the news. The cartel is expected to gradually increase output into next year, which may act to cap prices. The IEA has warned OPEC that without production increases, oil prices might rise enough to adversely affect global growth.

- The G-20 endorsed carbon pricing as a way to address climate change. The EU has detailed an expanded plan to reduce carbon output. It is broad-based, including a carbon pricing scheme and a carbon border adjustment plan. Basic material and ag mineral industries could be hard hit by the measures. The plan affects households as well. It is still unclear whether the plan will be adopted.

- China is also launching its own emissions trading platform, which would be the world’s largest.

- U.S. negotiators are beginning to fear they will not be able to reach an agreement with Iran on reviving the Obama-era nuclear deal.

- Tehran is pleased to see the U.S. withdraw from Afghanistan, although it is also worried that increasing unrest could spill into Iran. The Taliban is Sunni and has tended to oppose Shiites. Iran’s new president, Ebrahim Raisi, recently met with India’s minister of external affairs to discuss the situation in Afghanistan.

- There is some evidence that Russia is pleased with Iran’s new president, as President Putin was unusually quick to contact Raisi after his recent win. Overall, Russia/Iranian relations have improved over the past decade; meetings with the Rouhani government and Russian officials were frequent. However, Moscow was probably a bit concerned that relations with the U.S. would improve, and Russia generally prefers American isolation in the Middle East.

- There are reports that Iran was recently hit with a series of cyberattacks.

- The KSA has continued to limit the number of pilgrims coming to Mecca due to COVID-19 concerns.

Alternative energy/policy news:

- The annual BP (BP, USD, 25.43) report on energy showed that wind and solar capacity rose at their fastest pace on record. China’s capacity growth was the world’s largest.

- There is a growing battle between centralized and distributed electricity. Large utilities want to build long transmission lines from the central part of the U.S., which is rich in wind power, to bring this electricity to urban areas. Other activists want to acquire funding to buy rooftop solar panels to foster local power. If the former wins out, utilities will still control the flow of electricity; if the latter wins, the power of utilities will be weakened.

- The China National Nuclear Corporation broke ground on the world’s first small nuclear reactor. The Chinese hope this modular reactor will become a model for the more widespread development of nuclear power, which does not emit greenhouse gases.

- Thawing permafrost is threatening the Alaska pipeline.

View PDF

[1] Which is 0.4 gallons of crude oil, or four cups and 3 ounces.

[2] Roughly 13 ounces.