Daily Comment (July 22, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equity futures were higher, and long-duration interest rates were rising overnight, but comments from the ECB (see below) have pushed equity futures into the red and have lifted bond prices. We are also seeing lots of volatility in grain prices; this time of the summer is important. Corn pollinates from July into August, so temperature and rain matter. Prices can swing violently on hourly weather forecasts. Since the May FOMC meeting, expectations surrounding monetary policy have been in flux. Complicating matters is that there could be some personnel changes on the Board of Governors this fall and winter. We begin today with comments on the odds of Chair Powell’s reappointment and other Fed matters. The ECB comes next. Like a bad penny, Brexit has returned to the headlines. And, the U.S. and Germany have come to an agreement on Nord Stream 2. Our usual coverage begins with economics and policy, with China news up next. The pandemic update follows, and we close with the international roundup.

Powell: It appears that Chair Powell is getting enough support to probably be reappointed to a second term as Fed Chair. Aides to President Biden have indicated that they generally support his reappointment, which will be in February. Randal Quarles, the vice-chair for regulation, has been a target of LWP criticism. His term in his current role ends October 13, but he could stay as a governor until 2032. Although it is customary for vice-chairs to resign when their leadership term ends, there are indications that Quarles may stay on. Vice-Chair Clarida’s term expires in January. Currently, there is one vacancy on the Board of Governors. The end of Clarida’s term would give the president two positions to fill on the FOMC. Although the LWP is pining for a heterodox appointment (Stephanie Kelton perhaps?), the Trump years proved that out-of-the-box governor appointments can’t get through the Senate. Look for Biden to nominate mainstream left-of-center types. However, we do note that some research does suggest age matters; younger FOMC members tend to be dovish, likely because they missed out on the 1970s. Therefore, even a mainstream younger candidate could be a reliable dovish vote.

- The FOMC meets next week; we expect the topic of discussion to focus on balance sheet management.

The ECB: ECB President Lagarde has been making comments this morning about policy and the new inflation targeting regime. Although the policy comments suggest that accommodation will continue for the foreseeable future, financial markets are taking the news as bearish. It is possible that financial markets were hoping for even more policy support (given current levels, that looks like a long shot). It is also possible that we are seeing position squaring during her comments on worries about an unexpected surprise. If this is the case, look for a recovery when the statements end.

Brexit returns: The situation in Northern Ireland has remained a sore spot with Brexit. The current agreement has established a trade checkpoint in the Irish Sea, meaning Northern Ireland is, for purposes of trade, still in the EU. The Tories have never been comfortable with this arrangement since the unionist parties tend to affiliate with Johnson’s party. David Frost, a member of Johnson’s cabinet, wants to reopen negotiations that would create a mixed border. Essentially, goods destined from Britain, Scotland, or Wales to Northern Ireland alone would no longer need to pass customs, whereas goods exported or imported from the U.K. for the EU would need special customs arrangements. The EU has already rejected this proposal, as it will create a hard border on the frontier with Ireland. In addition, it will be nearly impossible to prevent U.K. goods from ending up in the EU via Ireland. The Johnson government is taking a risk here; the return of a hard border with Ireland will almost certainly lead to a rise in civil unrest, and the U.S. has indicated it won’t tolerate such a development. We will be watching to see how hard the U.K. pushes on this issue, but there is a risk of serious turmoil that might adversely affect U.K. assets.

Nord Stream 2: The Biden administration has made it official; the U.S. will go along with the German/Russian Nord Stream 2 project. We must admit this is a head scratcher for us. The administration is arguing that the pipeline was nearly done, so it was counterproductive to try to stop it, but the approval rewards Russia and allows Germany to adversely affect nations east of it which earn transit fees from existing pipelines. It’s hard to see how being nice with Russia will reap rewards, and Merkel will be out of office in less than two months. This is giving out favors and seemingly getting little in return, although the U.S. did make an agreement on climate investment with Germany. The president of Ukraine, Volodymyr Zelensky, is scheduled to visit Washington in August. Reports indicate the U.S. has told Ukraine to be quiet about the deal. This is going to be an awkward meeting. Meanwhile, criticism, both foreign and domestic, is pouring in. Governments do, at times, make pacts that can be hard to accept, but usually, it’s to get something important in return. This one seems to get the U.S. little of substance and will drain some of the president’s political capital.

Economics and policy: The debt ceiling is looming, the infrastructure debate continues, and house supply is still tight.

- Although the debt ceiling expiration is looming, the Treasury can postpone a crisis probably into October. However, these actions may reduce the availability of T-bills, potentially pressuring the money market industry. The GOP wants to use the debt ceiling to push for spending cuts. Although these debt ceiling events eventually get resolved, they give the party out of power some leverage. In the past, any drama tends to lead to risk-off market activity.

- Debate on the bipartisan infrastructure bill was blocked in the Senate but it appears negotiations are continuing. Majority leader Schumer is trying to create deadlines for both the infrastructure bill that will be voted on in regular order and the much larger bill that will go through reconciliation. Schumer’s worry is that if the bills aren’t passed by the August recess (August 9), lobbyists will hammer on members back home, making passage more difficult. Taking the approach of two bills carries risk, but given the narrow majority the Democrats hold, this is the only way to get a package through. We still expect these measures to pass, but this event will probably be the last item of significance to be legislated.

- The Distribution Financial Accounts data from the Federal Reserve shows that residential real estate is the largest asset held by the bottom 90% of households. The steady encroachment of financial firms into home rental could potentially compete with households for home ownership. So far, this hasn’t been a political issue, but we would not be surprised to see a pushback in the coming months.

- Regulators note that the supply of lower-cost “starter” homes is very tight, making it harder for young families to enter the housing market.

- Although Congress has provided around $47.2 billion in rent relief, the states have only distributed about $3.0 billion, or about 6.5% of the total. If the pace of aid doesn’t accelerate, we could see mass evictions in the coming months.

- So far, the states that ended extra unemployment benefits early have not seen a surge in new hiring.

- The Biden administration is expanding its antitrust activity. The Federal Maritime Commission announced an audit of seaborne carriers. In the wake of the Great Financial Crisis, global trade contracted, leading to industry consolidation. This action by the U.S. is to investigate whether this industry is engaging in anti-competitive practices.

- Non-compete clauses in labor arrangements have been slowly expanding over the years into areas that would not appear to need them (including fast food). Non-compete clauses bind the worker to the company and reduce competition for that worker, reducing their potential wages. The U.S. is looking to limit these clauses in a bid to improve conditions for workers.

- Internal polling is showing that Americans are becoming concerned about inflation. The administration is trying to address the issue, but in reality, there isn’t a good solution to current supply-driven inflation other than time. However, if inflation doesn’t begin to decline soon, it will be an important issue in 2022’s midterms.

- Recent research shows that the Midwest offers a large number of jobs that have high wages but don’t require a bachelor’s degree.

China: China is struggling with flooding, Sherman will go to Beijing after all, and tensions between Washington and Beijing are elevated.

- China is dealing with massive flooding, a trend that has been developing in recent years. Central China is receiving historic rainfall amounts; the city of Zhengzhou reported a daily rainfall record of 18”, with 7” reported in one hour. For reference, the average annual precipitation in Zhengzhou is just over 25”. Subways were submerged, trapping passengers. Thousands have been displaced, and dozens have perished or are missing. Zhengzhou is the home of iPhone’s (APPL, USD, 145.40) largest manufacturing site. Pictures from the city show the level of devastation.

- Earlier this week, Beijing had snubbed Deputy SoS Wendy Sherman when the U.S. requested a meeting with Wang Yi, China’s foreign minister. Initially, China offered a lower-ranking diplomat; the U.S. refused to make a visit and treated the action as a snub. Beijing has apparently relented, making Wang available for a meeting.

- In response to U.S. accusations against China hacking, Beijing has leveled similar charges against the U.S. On the one hand, the report originated in Global Times, a CPC mouthpiece. At the same time, American cyber capabilities are strong, so we would not be shocked if the charges are true. China is lashing out verbally against the accusations in its media. At the same time, there is evidence that China has made strong efforts to boost its cyber capabilities.

- Evergrande Group (EGRNF, USD, 0.95), the heavily indebted Chinese property developer, appears to be heading toward bankruptcy. Banks are no longer providing mortgages to the firm’s development projects, which will likely force it to restructure.

- U.S. and Chinese firms are increasingly being forced to deal with rules and restrictions from Washington and Beijing.

- S. tech social media firms are dealing with a new Hong Kong law against the practice of “doxing,” which is the practice of disclosing personal information online. This action is usually done in protest, encouraging social media participants to send unpleasant messages. In some cases, this harassment can move into “real life,” which can mean protests at a person’s home or hacking their financial accounts. The legislature gives broad latitude to security forces, including the ability to seize data from social media firms, even if they are outside of Hong Kong. Complicating matters further is that the law never precisely defines doxing, meaning the police will define the activity on the fly. It also allows security forces to detain employees of tech firms for failing to remove content deemed to be doxing. In effect, this is expanding the reach of China’s “Great Firewall.” This new law could easily force social media firms to exit Hong Kong and China altogether.

- As the U.S. attempts to ban goods from Xinjiang, suppliers who provide components to U.S. firms are starting to move operations out of the western region to other parts of China. Their hope is by moving they can still maintain business with U.S. firms.

- Eastman Kodak (KODK, USD, 7.74) has deleted an Instagram post showing images of Xinjiang taken by the French photographer Patrick Wack. Wack described this picture as providing a narrative of Xinjiang’s “abrupt descent into an Orwellian dystopia.” The company took down the post suggesting the page was to display creativity, not to make political statements. The Global Times touted Kodak’s apology. We would not be surprised to see a backlash to the decision from the U.S.

- Despite the problems in Hong Kong, there is little evidence to suggest the turmoil is hurting its standing as a financial center.

- As the U.S. and China continue to steadily decouple, China is attempting to expand its technology hardware industry. Beijing’s ambitions in this area are suffering a setback, as Tsinghua Unigroup (002049, CNY, 172.50) appears to be on the brink of bankruptcy.

- Bitcoin mining is mostly coming to an end in China.

- It appears Chinese leaders have concluded that Biden is more difficult than Trump because the former is building coalitions to contain China. However, we prefer to view China policy in the context of trend rather than personalities. Simply put, the U.S., on a bipartisan basis, is concluding that China is a problem.

- China was successful in reducing birth rates with its “one-child” policy. Now it is trying to increase births through policy as well; results thus far are not encouraging.

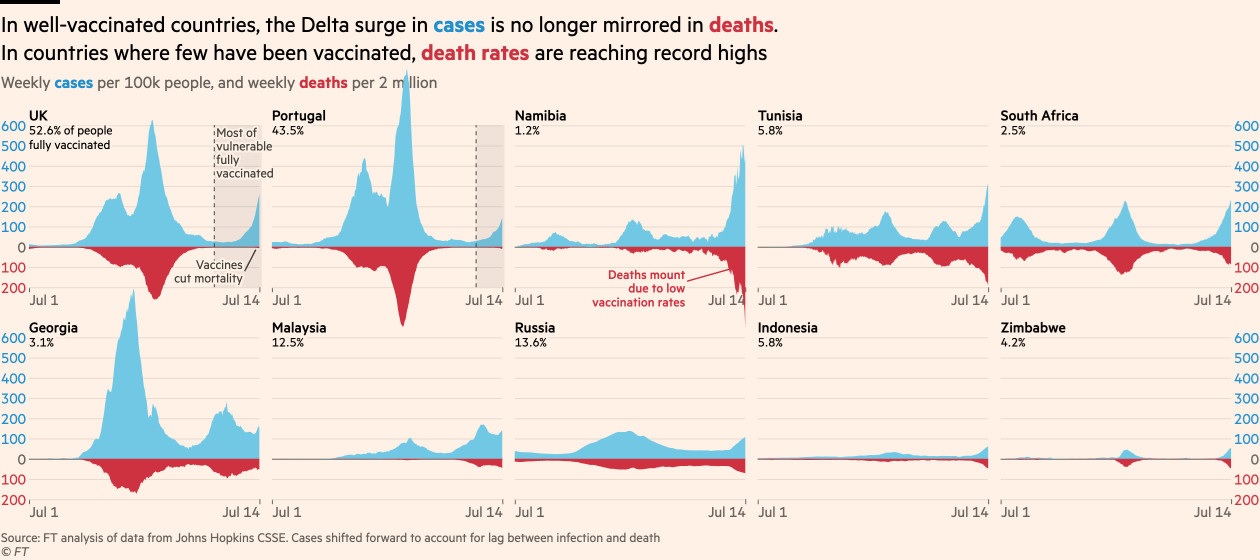

COVID-19: The number of reported cases is 192,149,552 with 4,129,954 fatalities. In the U.S., there are 34,229,841 confirmed cases with 609,870 deaths For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 391,248,955 doses of the vaccine have been distributed, with 339,102,867 doses injected. The number receiving at least one dose is 186,819,440, while the number of second doses, which would grant the highest level of immunity, is 161,895,045. The FT has a page on global vaccine distribution. The Axios map shows rising cases in most of the U.S.

- The WHO is calling for a new investigation of the Wuhan lab; Beijing is not happy.

- Australia has been controlling the virus through lockdowns and social distancing. It hasn’t moved rapidly on vaccine distribution, which now looks like a mistake.

- Asian nations are dealing with high levels of Delta variant infections.

- Although we hear of “believing in science,” it is important to remember that science is a process of inquiry, not an ideology. One scientist, in analyzing new data, has moved from the lab-leak hypothesis to the theory that the virus moved to humans from an animal host. This is how science works; a theory is constantly questioned by incoming data. Holding that position should be based on the strength of the explanation and not on a belief.

- The CDC reports that U.S. life expectancy fell last year, mostly due to the pandemic.

- In looking at death rates and infections, nations with higher levels of vaccinations are seeing lower death rates.

International roundup: Central Asia is in turmoil, and Cyprus might be next for unrest.

- As the U.S. leaves Afghanistan, nations in the area are preparing for instability. In response, Russia has become increasingly active in central Asia. It has sent 17 BMP-2 vehicles to Tajikistan to support infantry. It also moved T-72 tanks to the region.

- The city of Varosha, on the island of Cyprus, was abandoned in 1974, when the island was divided between Turkey and Greek Cypriots. It is on the border of the dividing line between the two powers. In a provocative move, Turkey claims it will partially reopen the city to supporters of Turkey. The U.S. and EU have protested the decision.

- The U.S. has launched airstrikes on al-Shabab located in Somalia, the first attacks since January.

- As the Olympics begin, PM Suga of Japan is in a difficult spot. He has pushed for the games to go forward, but pandemic restrictions and the massive costs required to conduct the games have sent his approval ratings to very low levels.

Earlier this week, we noted that flooding in Germany might lead to gains for the Greens. However, so far, no party seems to have an advantage from the disaster.