Weekly Energy Update (August 5, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

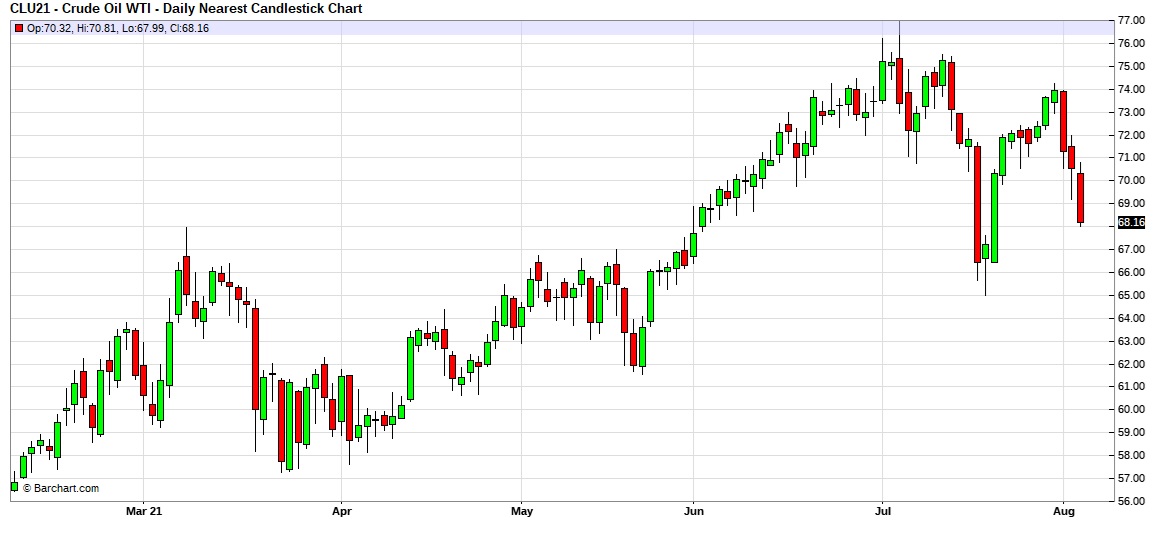

After last week’s recovery, selling has resumed; this week’s data and fears of weaker demand due to COVID-19 are pressuring prices.

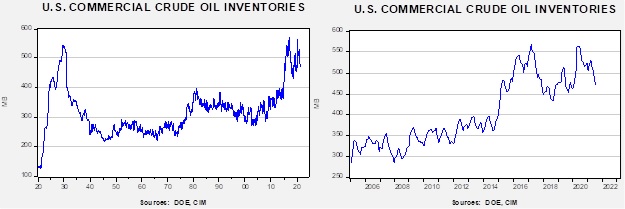

Crude oil inventories unexpectedly rose 3.6 mb compared to the 3.2 mb draw forecast. The SPR was unchanged this week.

In the details, U.S. crude oil production was steady at 11.2 mbpd. Exports fell 0.6 mbpd while imports fell 0.1 mb. Refining activity rose 0.2%.

(Sources: DOE, CIM)

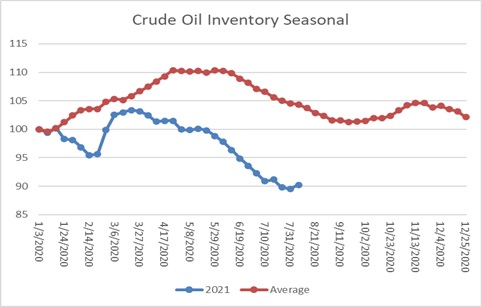

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are well below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 69.7 mb. Since early July, inventory levels have stabilized; as the chart indicates, seasonal inventory stabilization usually occurs in September, so if this pattern continues, the seasonal deficit should narrow.

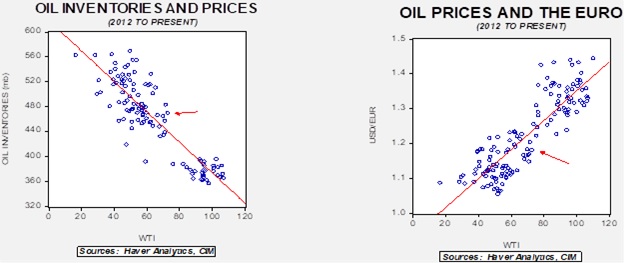

Based on our oil inventory/price model, fair value is $61.46; using the euro/price model, fair value is $62.98. The combined model, a broader analysis of the oil price, generates a fair value of $61.92. The weaker EUR has started to affect the model forecast, putting all the models’ fair value calculations well below the current price.

Market news:

- Environmental policy generally finds support among voters until the inevitable increase in fossil fuel prices result. As the financial system provides less investment capital to the fossil fuel industry and the economy recovers, energy prices rise. In fact, higher prices are likely a necessary component to encourage consumers to invest in energy conservation. But higher energy prices are seldom popular, and as they rise, it makes implementing climate change policy challenging.

- Spain is pushing back against EU climate policy as electricity prices surge and consumers complain.

- The Biden administration is looking to increase fuel efficiency standards. Environmentalists are pushing for stricter standards, while the auto industry wants easier ones.

Geopolitical news:

- Over the weekend, an oil tanker, the MV Mercer Street, was attacked by drones, and two people were killed, a Briton and a Romanian. Zodiac Maritime, an Israeli company, manages the vessel; it is owned by Taihei Kaiun (1968, JPY, 2723). According to reports, the drones, which apparently carried explosive charges, crashed into the ship’s bridge, killing two crew members. The U.S., U.K., and Israel have blamed Iran for the attack. Tehran denies its involvement. This attack has been part of a series of strikes between Iran and Israel. We noted in June that Iran’s largest warship, the Kharg, caught fire and sank under suspicious circumstances. Market reaction has been mostly nonexistent. Oil prices are lower this morning on pandemic concerns. However, an attack on oil shipping in the region around the Strait of Hormuz does raise the potential for a supply disruption.

- Following this event, suspected Iranian gunmen seized a tanker in the Persian Gulf. Reports say the situation has been resolved, and the gunmen have left the ship, although details are still scarce. Iran denies involvement, but there is some evidence that a group linked to Iran may have been involved. Nations in the region are pushing for retaliation.

- These tensions coincide with President Raisi officially taking office today. With the change in administration, there are growing doubts about a restoration of the 2015 nuclear deal. The Biden administration has the goal of reinstituting the agreement, but Iran is less certain it wants to return to it. Iran has been increasing its uranium processing and likely wants to maintain progress towards nuclear technology. Another major issue is that the Iran nuclear deal was not a treaty. Opposition in Congress meant that the measure could not pass through the legislature, so, and this occurred with the Trump administration, a new president could pull out of the agreement again. Grand Ayatollah Khamenei wants guarantees that the U.S. won’t pull out again, but the structure of the agreement cannot provide that assurance. It appears that Raisi’s plan is to focus on four areas—sanctions and other restrictions lifted, guarantees of irreversibility, normalization of trade, and the ability of Iran to verify sanctions are no longer in force. We view these as non-starters; for instance, the U.S. is planning sanctions against Iran’s drones and guided missiles, meaning that some form of sanctions will always be in place. Irreversibility can’t be offered either. So, overall, we doubt the nuclear deal will return.

- There is one factor to watch. Iran engaged in what was called “strategic patience” during the Trump years, limiting retaliation to avoid a stronger response from the U.S. With Trump out of office, Iran appears to be escalating its activities in the region, apparently because it assumes a more measured response from Washington. With the U.S. wanting to reduce its involvement in the Middle East to focus on China, Iran may see it as an opportunity not just to retaliate against earlier provocations but to expand its area of influence.

- Iran is facing a serious water problem caused by the lack of rainfall, mismanagement, and an attempt to become food independent.

- Iran is also facing electricity instability, with blackouts raising social tensions.

- As the world electrifies, the need for strategic metals is rising. China has been making large investments in Africa. It is now seeing pushback from African nations unhappy with Beijing’s behavior in the region.

- China has made major investments in the U.K. nuclear power industry. The Johnson government is having second thoughts about that decision. Investor reluctance to join a project with Chinese involvement has played a role, so have concerns about security given China’s involvement.

- Qatar is considering an investment in submarines. It is negotiating with Italy to purchase the vessels. If Qatar acquires submarines, it adds to concerns about an arms race in the region.

Alternative energy/policy news:

- The SEC is looking to force companies to make additional climate disclosures. Firms are concerned that doing so will expose them to litigation and are, thus, trying to dilute the proposal. Pressure to do so is coming from fossil fuel companies.

- One issue that new forms of energy discover is that often the process of developing cleaner forms of energy is, at least initially, also dirty. The building of solar panels in China requires coal-fired electricity, for example. The transition creates geopolitical issues as well. China, for instance, processes two-thirds of the world’s lithium, a key metal in batteries. The U.S. needs to build that capacity, but it won’t be clean.

- The U.S. applied tariffs on solar panels coming from China. The tariffs did help lift domestic production but imports still represent about 85% of U.S. installations. Domestic companies are lobbying for the tariffs, due to expire, to be extended.

- Battery companies are exploring other elements in battery production. Last week, we reported that iron was being tested for utility batteries. Sodium is being considered for EVs. Recycling batteries is also becoming an issue.

- Hydrogen can travel through the existing pipeline network.