Daily Comment (August 9, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday. It’s inflation week—the CPI comes out on Wednesday. U.S. equity futures are modestly lower this morning, but the real story is in commodities. Oil and precious metals are tumbling this morning in the face of higher Treasury yields. Overnight, gold futures fell over $60 per ounce; prices have recovered well off their lows but are still down this morning. What’s going on? The solid employment data has lifted expectations of Fed tightening. But it is also important to remember that market liquidity tends to thin in August as traders take vacations. Thus, market moves can be exaggerated. Our coverage this morning begins with economics and policy. China news is up next, followed by the international roundup. We close with pandemic news.

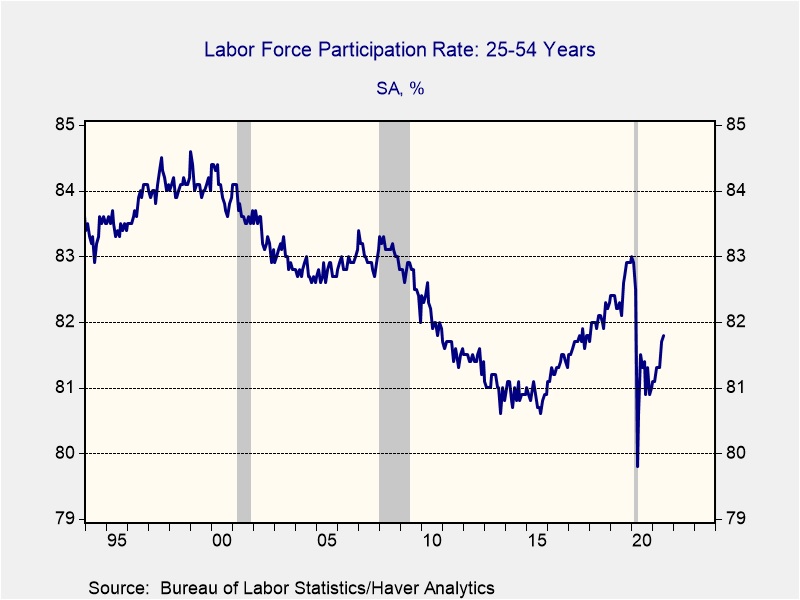

About that employment data: Much of the turmoil we are seeing in markets was tied to the employment report. The data showed clear improvement in the labor markets and raises pressure on the FOMC to react. Although there is some concern that the survey period did not catch the recent delta variant issues, we suspect that labor markets will continue to recover. One item worth watching is the participation rate of the 24-54 age bracket. The 65+ participation rate continues to decline as older workers, more vulnerable to COVID-19, opt for retirement. Although we are not at a level of complete recovery, we are at a point consistent with a fed funds target of around 1%.

A reading above 82 will increase the likelihood of some form of tightening.

Economics and policy: The infrastructure bill is near the finish line in the Senate. The IPCC has released its updated climate report.

- It looks like the bipartisan infrastructure bill will pass the Senate this week. The CBO has scored this bill, saying it will add $256 billion to the deficit over a decade. The crafters of the bill have argued it would be deficit-neutral, but it is not unusual for the CBO to discount some sources of revenue. Another area of dispute is the idea of “dynamic scoring,” which means that the growth generated by the measures taken will raise revenue. The CBO rarely accepts such concepts.

- The Intergovernmental Panel on Climate Change (IPCC) released its most recent analysis and, as expected, it shows that global temperatures will likely rise5o centigrade by 2040. The report makes it clear that even if carbon emissions reach zero now, temperatures will continue to rise. We expect more spending on mitigation going forward.

- Wildfires in Greece continue. Neighboring nations are sending firefighters and areas are being evacuated.

- One of the challenges of the current economic situation is figuring out temporary and permanent changes triggered by the pandemic. It has been often said that the pandemic accelerated trends that were already in place. Although we agree this is at least partially true, other developments probably would not have occurred otherwise. Work from home is likely to be much more common going forward than it would have been otherwise. As workers realize they can work from just about anywhere with a reliable internet connection, the allure of smaller cities, with lower costs of living, are elevated. As workers move to these areas, they affect the local real estate markets and shuffle shopping and entertainment patterns.

- We note the SEC has brought action against a decentralized financial firm for issuing unregistered securities.

China: Markets continue to grapple with regulatory changes, and nationalism is on the rise.

- From 1979 to mostly the present, China has had its own efficiency cycle, which allowed entrepreneurs to build businesses and become rich. Although Hu Jintao commented on the problem of inequality, Xi is doing something about it. His anti-corruption campaign weakened the ability of capital owners to affect policy. Now, Xi is going against out-of-favor industries directly. The losses are notable. There is wide debate about the path forward; is Xi merely trying to weaken power rivals, or is this move tied to industrial policy? Although the answer might be “yes” to both, we suspect the latter is the most important. If so, investors can probably still do ok in areas that China favors. At the same time, industry leaders would be advised to keep a low profile.

- One emerging trend we are watching is the generational attitude differences developing in China. The millennials in China have only seen an ascendant China. They appear no longer content to bide time and wait, and they are intolerant of foreign criticism of China. This emerging nationalism looks to us to be similar to conditions seen during the Cultural Revolution.

- The crackdown on China’s tutoring industry appears to be an attempt by the CPC to reduce social tensions. However, the drive for tutoring is partly driven by rising youth unemployment. If good jobs at the entry level are scarce, it makes sense to take whatever steps are necessary to acquire one.

- Despite these trends, some business leaders are calling for new trade talks with China and tariff reductions. Although we think tariffs are a misguided policy (a deliberate policy to appreciate the CNY would be far more effective), it appears to us that business leaders are out of step with the political trends. If anything, there is a higher likelihood of additional trade and investment restrictions.

- Underlying all these issues is China’s shaky financial system. A recent directive argued that the banking system should stop lending to local government financing vehicles; if this were to occur, widespread defaults would likely follow. The directive was pulled shortly after its release. Its disclosure could have been a mistake, or a trial balloon. But it does show that China has a serious delinquent debt problem that won’t get better by continued funding. However, cutting off liquidity will only lead to default and the consequences of default could be destabilizing. Everything we are seeing from the CPC leadership suggests consolidation and centralization. So, our take is that the central government will use the indebtedness of the local governments as an opportunity to bring them under control.

International roundup: The Taliban’s role; Lukashenko remains in power in Belarus a year after the elections.

- The Taliban continues to consolidate gains as the U.S. steadily withdraws. There is no evidence that the U.S. will take steps to counter these gains, meaning that Afghanistan will likely face civil war after the U.S. leaves. There is also little evidence to suggest Afghan government forces will be effective against the Taliban.

- Germany will be holding elections next month as Chancellor Merkel retires. German voters are unimpressed with their choices; recent polls show 45% would vote for “none of the above.” Armin Laschet, the CDU candidate, wants to lead Europe, but his recent comments surrounding Poland and his actions during recent flooding suggest he lacks political skills. Polling indicates the SPD is gaining ground. Although it’s still a long shot, a Green/SPD/FDP coalition might gain power.

- It’s been a year since the Belarus elections that led to unrest. Lukashenko remains in power but is clearly weakened, becoming increasingly dependent on Putin to stay in control. The opposition continues to press against Lukashenko. As we noted last week, the latest tactic being deployed by Belarus is to create a refugee conduit into the EU via the Baltic nations. Russia will be holding its annual war games in the region soon and Latvia is warning that a border incident is possible.

- Michael Calvey is a longtime proponent of investing in Russia. He has recently received a suspended sentence for various crimes. His arrest and conviction signal a warning to Westerners about the risks of investing in Russia.

COVID-19: The number of reported cases is 202,872,928 with 4,297,550 fatalities. In the U.S., there are 35,765,233 confirmed cases with 616,829 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 407,561,705 doses of the vaccine have been distributed with 351,400,930 doses injected. The number receiving at least one dose is 194,866,738, while the number receiving second doses, which would grant the highest level of immunity, is 166,477,481. The FT has a page on global vaccine distribution.

- The delta variant continues to spread rapidly across the U.S. Community transmission rates remain elevated across the country. States with high infection rates are scrambling to find hospital bed capacity. The variant has become dominant due to its high contagion rates.

- Although we don’t expect widespread lockdowns to return, the spread of infections is still affecting business planning. Companies are reconsidering office reopening plans and some events are being cancelled.

- Fears that disruptions will affect the economy are leading commodities lower, especially oil prices.

- In light of the delta variant, we will likely see the need for booster shots.

- Although the mRNA vaccines were the first out of the gate, the technology remains finicky. Handling procedures make them difficult to distribute and the new technology is probably one factor behind vaccine resistance. Much of their success was due to deft management; the companies involved tested their vaccines when infection rates were elevated, which gave them lots of test subjects, and emerging firms teamed up with established ones to ramp up production. The Novavax (NVAX, USD, 189.89) vaccine is near the end of its clinical trials and should be available soon. It has some distinct advantages. Because it’s based on an existing technology, its handling is less stringent. The fears surrounding mRNA should not be part of this vaccine. And, trial data so far suggest it is more effective than the mRNA vaccines. Reports indicate that side effects are less, which has been a barrier for some low-income groups who fear missing work if they become ill from the injection.