Weekly Energy Update (September 2, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

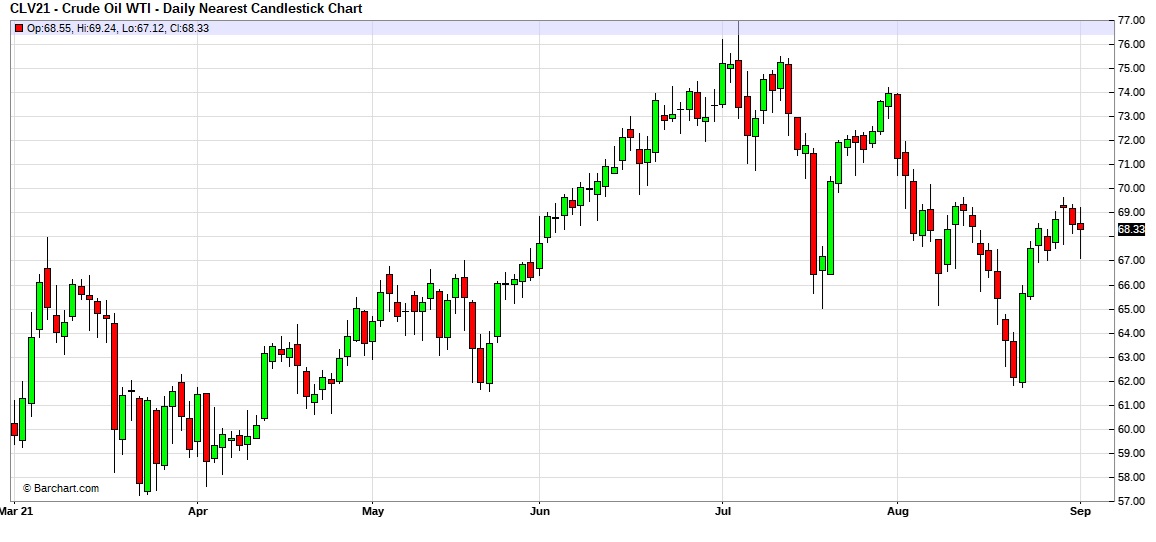

After reaching $62 per barrel support, prices have snapped back and are consolidating around $68 per barrel.

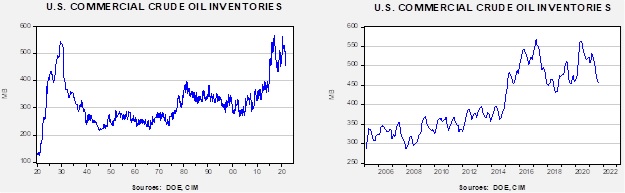

Crude oil inventories fell 7.2 mb compared to the 2.5 mb draw forecast. The SPR was unchanged this week.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.5 mbpd. Exports rose 0.2 mbpd, while imports were unchanged. Refining activity fell 1.1%.

(Sources: DOE, CIM)

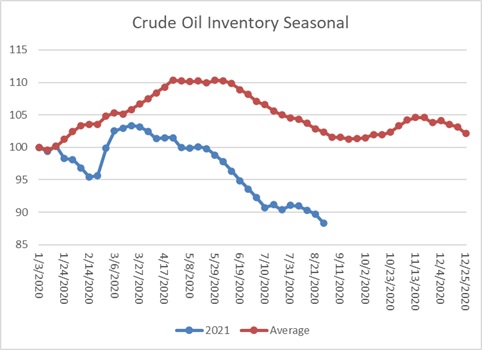

This chart shows the seasonal pattern for crude oil inventories. We are at the end of the summer withdrawal season. Note that stocks are significantly below the usual seasonal trough. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 72.3 mb. We expect the disruptions from Hurricane Ida (see below for updates) will affect this data in the coming weeks.

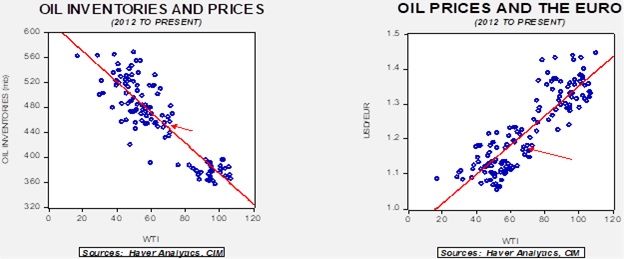

Based on our oil inventory/price model, fair value is $65.91; using the euro/price model, fair value is $61.96. The combined model, a broader analysis of the oil price, generates a fair value of $63.78. Continued dollar strength is weighing on oil prices; the decline in inventory, on the other hand, is a bullish factor.

Ida

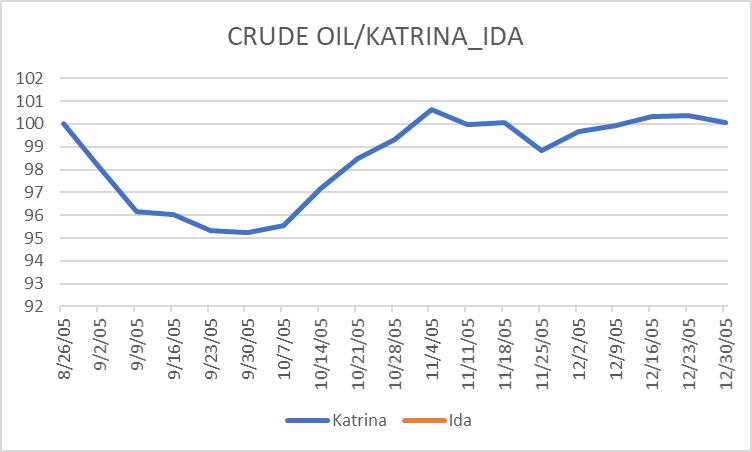

Hurricane Ida followed a path similar to Hurricane Katrina. Power outages have been widespread, and the oil and gas industry is still trying to determine the level of damage. For the next few weeks, we will be tracking the impact of Ida on the oil and gas market, using Katrina as a baseline comparison.

(Source: DOE, CIM)

This chart indexes the level of inventory for the week after the two hurricanes struck. Since they hit at the same time of year 16 years apart, we can easily track the impact. Katrina led to a 5% decline in stockpiles, and inventory wasn’t replenished until late October.

Market news:

- Widespread drought in the West has curtailed hydroelectric power. As water levels decline, dam managers can struggle to keep the turbines spinning.

- As oil prices rise, the Biden administration is taking the tack that industry concentration is the reason for high oil prices. The oil industry has always had some degree of concentration; after all, the government did break up Standard Oil. But it is a hard case to make that industry concentration, rather than environmental policy, better explains the lack of supply response to high prices.

- Earlier this summer, OPEC+ agreed to production increases. Kuwait has recently argued that the decline in demand caused by the Delta variant may require the suspension of that earlier agreement. The cartel, which met today, agreed to its earlier policy of expanding production. We note they ignored calls from the U.S. to lift output in a bid to reduce oil prices.

Geopolitical news:

- Although Afghanistan is not a major oil producer, the withdrawal of U.S. and NATO troops will destabilize the region and might affect other oil producers nearby. At the same time, Iran, which is under sanction, now has a customer for its oil that isn’t sanction’s sensitive.

- Last weekend, at a regional summit held in Iraq, senior officials from the KSA and Iran attended the meeting. They met directly for the first time in five years, at least officially.

Alternative energy/policy news:

- The drought and hot weather in the West and Hurricane Ida have all raised worries about climate change, bringing a rising frequency of extreme weather events. Current forecast models support this idea, but the effects may be longer term in nature. At the same time, recent studies confirm a pattern we have noted in the past; bad economic periods tend to reduce environmental concerns.

- China has been moving to expand its electric vehicle industry with the goal of being a world leader in this area.

- The pipeline industry, which has faced pressure from environmentalists on new construction, is pressing to be part of carbon capture and storage systems, which should support additional construction.