Weekly Energy Update (September 10, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices continued to consolidate in the high $60s.

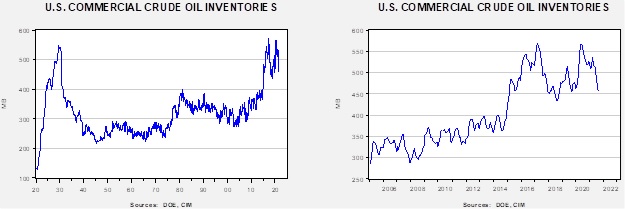

Crude oil inventories fell 1.5 mb compared to the 6.0 mb draw forecast. Analysts (including us) were clearly expecting Ida to bring a large draw. However, the drop in exports and the slide in refinery operations prevented a significant decline. The SPR was unchanged this week.

In the details, U.S. crude oil production fell 1.5 mbpd to 10.0 mbpd. Exports fell 0.7 mbpd, while imports declined 0.5 mbpd. Refining activity fell 9.4%, led by a 16.7% slide in the Gulf region.

(Sources: DOE, CIM)

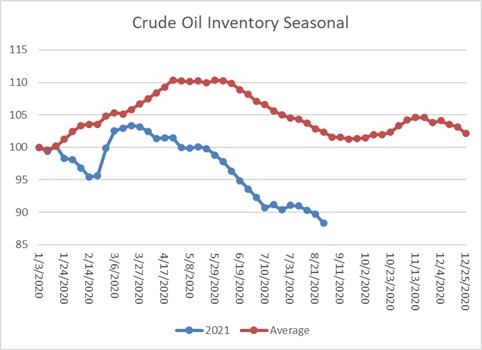

This chart shows the seasonal pattern for crude oil inventories. We are at the end of the summer withdrawal season. Note that stocks are significantly below the usual seasonal trough. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 69.7 mb. We expect the disruptions from Hurricane Ida (see below for updates) will affect this data in the coming weeks.

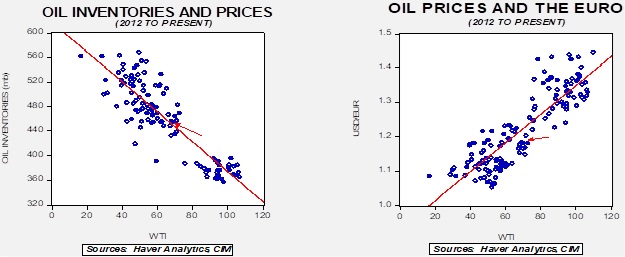

Based on our oil inventory/price model, fair value is $66.42; using the euro/price model, fair value is $63.76. The combined model, a broader analysis of the oil price, generates a fair value of $65.05. Continued dollar strength is weighing on oil prices; the decline in inventory, on the other hand, is a bullish factor.

Ida

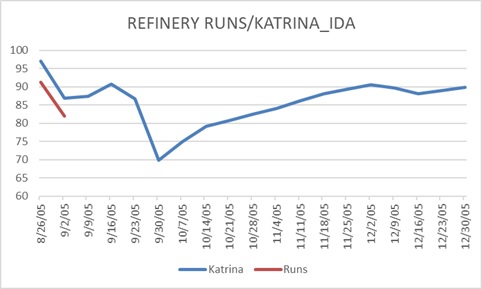

Hurricane Ida followed a path similar to Hurricane Katrina. For the next few weeks, we will track the impact of Ida on the oil and gas market, using Katrina as a baseline comparison. This week, we will look at refinery operations.

(Source: DOE, CIM)

This chart compares refinery runs during the two periods. Refineries require electricity to operate, and damage to the electrical grid will slow the recovery from the storm. With Katrina, runs stabilized over the following few weeks, only to fall further by the month’s end. We doubt we will see a similar plunge this year, as outside the Gulf region, most refinery activity was already depressed.

- An oil spill occurred after Ida. It remains unclear if it was caused by an operating pipeline, a well, or an abandoned pipeline. If it is the latter, the damage will probably be limited. If an active pipeline or well is involved, and the slick widens, it could cause a further backlash against the oil industry.

- Ida has also reduced oil production in the Gulf of Mexico.

Market news:

- Natural gas prices have been on a tear this year.

Although these increases pale in comparison to the first decade of the century, they are in a range of highs seen in the shale era. With the expansion of LNG, natural gas has become a more global commodity. We note supplies are tight in Europe, making the region vulnerable to a cold winter. It will also support U.S. prices as producers struggle to meet global demand.

- China tapped its SPR for the first time in response to higher oil prices. The news did send prices lower initially. Although Beijing could justify the release because of Hurricane Ida, the National Food and Strategic Reserves Administration indicated the release was due to rising raw materials prices. In general, the U.S. rarely uses the SPR to control prices. It is usually tapped as a result of a weather-related supply event or for budgetary reasons. It is possible that China may operate its SPR as a buffer stock, buying when prices are low and selling when they are high. If they act in this manner, it will take some pressure off of OPEC+ to maintain prices.

- As the budget process begins, groups facing higher taxes, namely, the oil and gas industry, are pushing back. Of particular interest is a fee on methane leakages. Methane is a powerful greenhouse gas, and it often leaks into the atmosphere during oil and gas drilling. There is proposed legislation for new fees on methane leaks. The oil industry is pushing back against this proposal, as expected. As fees on carbon become more common, the likelihood increases that oil, gas, and coal resources become stranded.

Geopolitical news:

- The new regime in Iran has picked its nuclear chief. He is Mohammad Eslami. Although an engineer, he is a civil, not a nuclear one, unlike his predecessors. He does have experience in Iran’s defense industry, which is likely why he landed the position.

- On this front, it is looking increasingly like the 2015 nuclear deal with Iran will not be reconstituted. Although Iran has expressed interest in resuming the talks, Teheran has also blocked IAEA access to Iran’s nuclear facilities. This organization also claims that its surveillance equipment has been removed.

- The crisis in Lebanon is undermining Hezbollah’s control of the country. This Shiite group has become the dominant power in Lebanon, but the continued economic downward spiral is making Hezbollah appear impotent.

Alternative energy/policy news:

- Climate change appears to be causing increasingly volatile weather. On the one hand, the costs of these events are increasing; on the other, improved forecasting and investments in resiliency have led to fewer fatalities.

- As biofuels become more popular, the food processing industry is finding itself competing with biofuel refiners for vegetable oils and animal fats.

- Although reducing greenhouse gas output is important to managing climate change, in reality, without reducing existing gases in the atmosphere, the ill effects are likely to continue. In Iceland, a plant that uses thermal power is extracting CO2 from the atmosphere and storing it underground. This plant is the world’s largest and will begin reversing the levels of greenhouse gases in the environment. Even though this is positive news, the level it will withdraw is less than 1% of the annual emissions of a typical coal-fired power plant. So, this industry will clearly have to become much larger to have a serious impact.

- The Biden administration has a clean-energy plan that would require 44% of U.S. electricity to come from solar power. The cost will be $562 billion by 2035.

- We are seeing increased investment in batteries that store energy at the commercial level. Tying batteries to solar or wind generation removes the intermittency issue. Metals become critically important for battery production. Bill Gates is involved in a startup to use AI to find these metals.

- The electric vehicle market in China is growing rapidly, with numerous firms trying to compete. Beijing has decided to implement some control in this industry to better marshal resources.

- Remember leaded gasoline? The last nation on earth that used it, Algeria, has finally exhausted its supply, meaning that the entire world now uses unleaded gasoline.