Weekly Energy Update (September 30, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices have rallied to above $75 per barrel.

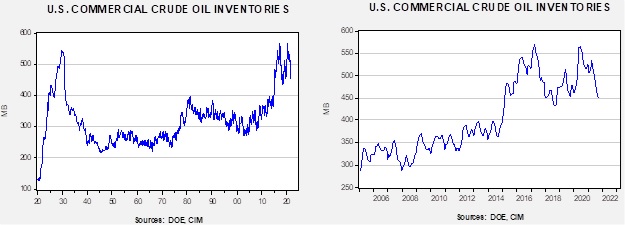

Crude oil inventories unexpectedly rose 4.6 mb compared to the 2.5 mb draw forecast. The SPR declined 0.9 mb, meaning the net draw was 3.8 mb.

In the details, U.S. crude oil production rose 0.5 mbpd to 11.1 mbpd, still below the 11.5 mbpd pre-Ida but also clearly recovering. Exports rose 0.2 mbpd, while imports increased 0.1 mbpd. Refining activity rose 0.6% as hurricane recovery continues.

(Sources: DOE, CIM)

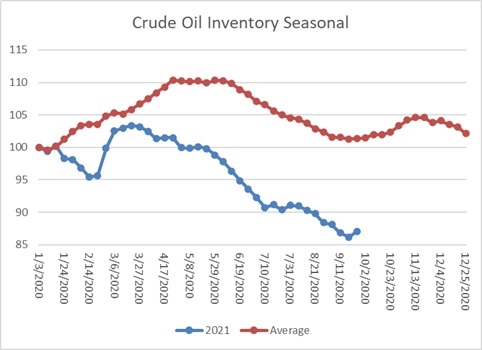

This chart shows the seasonal pattern for crude oil inventories. We are in the autumn consolidation and build season. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 73.8 mb. We suspect the disruptions from Hurricane Ida (see below for updates) have affected this data, but the impact is starting to fade.

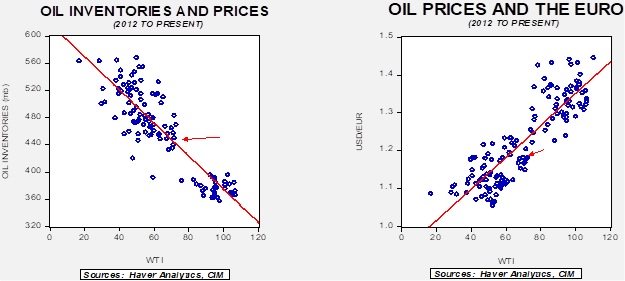

Based on our oil inventory/price model, fair value is $68.13; using the euro/price model, fair value is $62.10. The combined model, a broader analysis of the oil price, generates a fair value of $65.07. Continued dollar strength is weighing on oil prices. The decline in inventory, on the other hand, is a bullish factor.

Ida

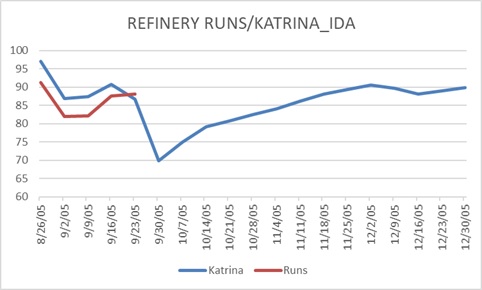

Hurricane Ida followed a path similar to Hurricane Katrina. For the next few weeks, we will track the impact of Ida on the oil and gas market, using Katrina as a baseline comparison.

(Source: DOE, CIM)

This chart compares refinery runs during the two periods following the hurricanes. This week, refinery operations recovered modestly. In 2005, Katrina was soon followed by Hurricane Rita. Barring a repeat, we would assume refineries will continue to rise to around 90% of capacity, and then stabilize.

Market news:

- Both Europe and Asia are facing an energy crisis.

- In the U.K., the supply chain for energy is showing signs of deep disruption. Gasoline lines and service station closures due to lack of supply have caused severe problems. Part of the issue is panic buying by drivers. Complicating the situation is a lack of truck drivers, a consequence of Brexit. In leaving the EU, European drivers felt unwelcomed and returned home, leading to a lack of shipping capacity.

- In Europe, tight supplies for natural gas are causing a supply crunch for electricity, sending prices soaring. Europe is producing less natural gas, partly because of environmental regulations. Russia has curtailed shipments, likely to “encourage” Germany to rush the approval of Nord Stream 2. Although LNG could help ease this supply shortage, Asia, so far, has been outbidding the EU.

- The EU’s environmental rules have also played a role. Carbon prices, part of the EU’s cap-and-trade system, are rising, leading to higher gas prices as well. Paradoxically, the shortage of natural gas is leading to supply problems for industrial carbon dioxide. Natural gas is a feedstock for fertilizer, and making that product creates CO2 as a byproduct. High natural gas prices have curtailed fertilizer manufacturing (something to watch for farmers in the coming months) and consequently CO2.

- While the EU is struggling with natural gas and oil product supplies, China is forcing electric generators to curtail output to address severe pollution problems. These regulations, coupled with rising natural gas and coal prices, are making utilities reduce the electricity supply, leading to falling industrial output. These actions will exacerbate current global supply chain problems and will reduce China’s economic growth.

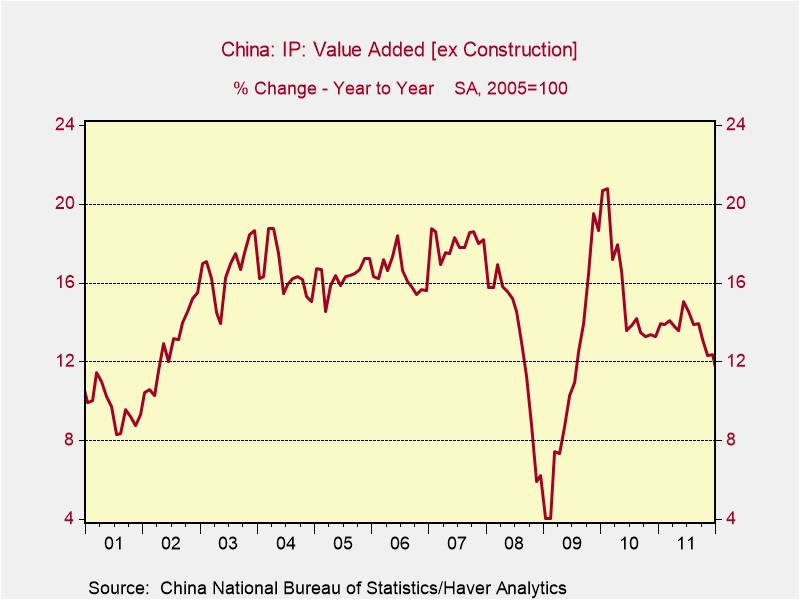

- China has made regulatory reductions before. There was a falloff in industrial output before the 2008 Summer Olympics.

Of course, the total decline in industrial production cannot be attributed to the games (a global recession was also part of that); the earlier ones were temporary. The current reductions appear to be longer-lasting, perhaps leading to less global productive capacity.

- As winter approaches, nations are scrambling to secure natural gas supplies. China is buying LNG aggressively, sending prices higher.

- There are fears that the current supply problems in China will worsen this winter.

- S. regulators are pushing for stricter power plant standards to avoid a repeat of the Texas experience last winter.

- A key element to the recent rise in prices is the impact of environmental policy. Although the current policy doesn’t necessarily preclude oil and gas development, regulators have made it clear that the industry will struggle to acquire financing, and the risk of stranded oil and gas is high. In addition, environmentalists have prevented the expansion of pipelines, leading to supply bottlenecks. So, higher commodity prices are almost unavoidable. In fact, to encourage the transition away from fossil fuels, high prices are likely required.

- The Biden administration is considering cuts to biofuel mandates, which tend to reduce oil prices and undercut grain prices.

- The lack of non-OPEC exploration activity will probably increase market power for OPEC.

Geopolitical news:

- As the U.S. withdrawals from the region, local powers are working to restructure relations. Arab Gulf states are making informal steps to improve cooperation and resolve differences with Qatar. Iran and the KSA are continuing to talk as well.

- The U.S. Treasury has applied sanctions to entities in the region that support Hezbollah.

- National Security Advisor Sullivan is scheduled to visit the Middle East next week.

- In light of the U.S. withdrawal from Afghanistan, Iran is increasing its pressure on groups in Iraq and elsewhere in the region supporting the U.S.

Alternative energy/policy news:

- Given the energy crisis in the U.K., policymakers are considering increasing their commitment to nuclear power.

- Ford (F, USD, 14.36) announced a major effort to expand electric car and light truck production. As we noted last week, Ford plans to recycle exhausted batteries, turning their cars into a closed loop. This week, the company not only announced new vehicle production facilities but also announced a strong move into battery production.