Daily Comment (October 14, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. Bank earnings reports are giving a bullish tone to the equity markets this morning. Our coverage begins with the Federal Reserve; the FOMC released its minutes yesterday. Economics and policy come next. Inflation worries are rising. Crypto news follows. Our overseas coverage begins with a China update and the international roundup. We close with pandemic news.

Federal Reserve: The minutes of the September 22 FOMC meeting were released yesterday. There were two critical points from the report. First, the members agreed that tapering will begin before the year’s end and will likely end by mid-2022. Second, the committee took great pains to note that balance sheet management and interest rate policy are separate. There was a concern raised about inflation, and the members seemed to lean mostly toward price increases remaining elevated for a longer period. The financial markets are well prepared for tapering, and the minutes had little effect on financial markets yesterday.

- Vice-Chair Quarles is no longer in charge of the Fed’s bank supervision committee, as his term ended yesterday. For now, no one has been selected to take the position. Quarles has suggested he would like to stay on as a governor (his term ends 10 years from now), although tradition dictates he step down. We would expect pressure to be brought on him to resign.

- Governor Bowman said yesterday that she sees risks of more persistent inflation. She is the governor representing community banks, and historically, this governor has been a reliable vote for the Chair. Her comments may signal a shift in sentiment among the governors, which could lead to growing pressure to raise rates.

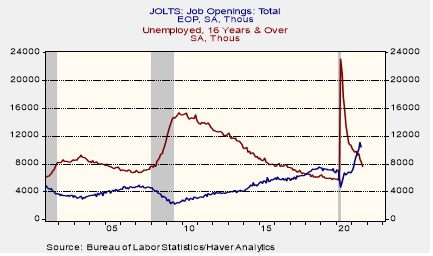

- The JOLTS report released earlier this week showed a couple of points worth noticing. First, even though openings fell, they remain well above the level of unemployed, meaning there are more jobs available than those currently out of work and looking to be hired.

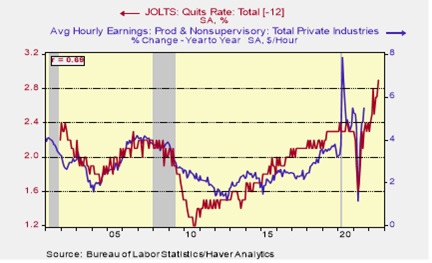

Second, the quits rate suggests wage growth will be robust in the coming year.

This chart overlays the quits rate, advanced 12 months, to the yearly change in hourly earnings for non-supervisory workers. The relationship would support wage growth in excess of 5% to 6% next year.

Economics and policy: Inflation worries dominate.

- Yesterday, the White House held a meeting to address the bottlenecks at U.S. ports. There is a push to have the ports operate “24/7.” Although we appreciate the sentiment, if the mere order to work longer hours was enough, it is likely it would have been done a long time ago. The problems at U.S. ports are complicated; merely dictating hours won’t make truck drivers materialize. The White House clearly wants Americans to know it is aware of the problem. What it can do to get it fixed is unclear. Earlier administrations have made similar proclamations with little effect.

- The president is also asking the oil industry to take steps to lower energy prices. Of course, the irony is that the administration has not been supportive of the energy industry, so it isn’t obvious how much support the White House will get from companies.

- Labor tensions continue to rise, prompting former Labor Secretary Robert Reich to speculate that we are seeing something a bit like a general strike. And, with a hat tip to Johnny Paycheck, are some headlines:

- Southwest Airlines (LUV, USD, 51.25) has suffered through what looks like a work stoppage. Although anger over vaccine mandates plays a role, understaffing and excessive overtime also appear to be contributing factors.

- Hollywood crews are threatening to strike, which could shut down television and movie production.

- Around 10 thousand unionized workers at John Deere (DE, USD, 329.00) went on strike this morning. A recent company proposal failed by 90%.

- Kellogg’s (K, USD, 61.69) is facing strikes at four facilities affecting 1,400 workers.

- Shortages of truck drivers are not just an issue in the U.S. and U.K. Europe is also dealing with a lack of drivers. Low pay and poor working conditions are making it difficult to attract people to the industry.

- For the past four decades, there has been a push to meet customer demands. However, as labor gains power, we are seeing a pushback against what is perceived to be unruly clients. This is a social shift of potential significance.

- We are closely monitoring the path of tax policy in the current congressional negotiations. We noted recently that Ireland agreed to a minimum corporate tax of 15%, setting the stage for a global minimum corporate tax. Tech firms have expressed support, most likely because in the negotiations, the digital services tax was tabled.

- So far, evictions haven’t jumped as feared when pandemic rules suspended them. It appears state and local governments are finally distributing the Federal support designed to make up for lost rent.

- There is some good news—shipping costs between the U.S. and China are finally starting to decline.

Crypto: The long-awaited ETPs for cryptocurrencies may be coming soon. The bad news is that they won’t be grantor trusts, like precious metals, but futures-based, similar to most of the commodity ETPs. ETFs based on futures usually trigger a K-1 for tax accounting. Anticipation of approval is lifting volume in crypto futures trading.

China news: China’s PPI jumps.

- China’s September PPI hit a record on a yearly basis, rising 10.7%. It’s the fastest increase in prices since 1995. Almost all the rise is due to higher coal prices.

Fortunately, CPI was quite tame, rising only 0.3% from last year. Over the past decade, the correlation between CPI and PPI in China is a mere 19%; from 1997 to 2010, it was 76%.

- Home sales reported by China’s real estate firms are showing declines of 20% to 30% in what is usually a strong month for sales. Given the role that residential real estate plays in China’s economy, if these declines are sustained, it will probably lead to a sharp drop in growth.

- The crackdown on digital currencies in China continues. Official media reports that law enforcement is expanding its crackdown on crypto trading. Binance, a large crypto exchange, said yesterday that it would no longer trade crypto and CNY. As China ousted bitcoin mining, miners have set up shop in the U.S.

- About half of the world’s distressed dollar bonds are now represented by China’s real estate sector. The issuance of dollar bonds from the Chinese real estate sector has essentially stopped.

- The Xi government is expanding its regulation of the media industry, including those who operate on social media.

- General Secretary Xi bid farewell to Chancellor Merkel, calling the German leader an “old friend,” a designation usually only offered to groundbreaking leaders like President Nixon. Germany has maintained close ties to Beijing, a position that is often at odds with Washington.

- Earlier this year, China arrested numerous actors and celebrities and, in some cases, tried to remove any trace of their social media existence. In what has to be one of the more unusual actions, China is supporting the creation of virtual entertainers. Essentially, these are virtual bands whose “members” have fans who follow them. For Beijing, virtual celebrities are much easier to control than human ones.

International roundup: Brexit returns to Northern Ireland.

- The EU is easing border restrictions on the Ireland/Northern Ireland frontier. The plan relaxes border controls significantly but still may not be enough for Westminster. A major sticking point is that the EU insists that the European Court of Justice adjudicate claims, which is a problem for the Johnson administration. If these actions don’t lead to a satisfactory outcome, there is the potential for a hard border to return, likely ending the Good Friday Agreement.

- French officials say that the U.S. and France continue to have notable differences on several issues. Divisions between the U.S. and EU nations are a further indication of a fraying relationship.

- Although the most common image of migrants trying to cross into the U.S. is that of desperately poor people making the attempt, there are reports that better-off migrants from South America are flying to Mexico and attempting to cross the border. This news may suggest conditions in South America may be deteriorating.

- Poland is fortifying its border with Belarus, as the latter has become a conduit for refugees from the Middle East. Warsaw is worried that Belarus is weaponizing immigrant flows in a bid to force the EU to relax its sanctions on Minsk.

- Japan is considering a major increase in defense spending to levels that would suggest it is ending its pacifist stance. Threats from China, especially against Taiwan, are likely triggering the decision.

- Chile has declared a state of emergency in its southern regions due to civil unrest. Indigenous groups are pushing for greater autonomy.

- Reflecting George Steinbrenner’s management of the Yankees, President Erdogan of Turkey has fired two deputy governors of the Bank of Turkey; one was the only dissent of last month’s surprise rate cut. The lira is down 1% today.

- On October 1, Venezuela introduced a new currency, known as the “digital bolivar,” which was similar to the previous currency, except it has six fewer zeros in the denomination. It appears the new currency is struggling to hold its value as well, as the central bank has been injecting around $40 million per week to prop up its value. The economy is unofficially dollarized, meaning that about the only things citizens use the bolivar for are gasoline (which is heavily subsidized) and public transportation.

COVID-19: The number of reported cases is 239,258,937, with 4,876,197 fatalities. In the U.S., there are 44,684,338 confirmed cases with 719,546 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 489,254,145 doses of the vaccine have been distributed with 404,371,247 doses injected. The number receiving at least one dose is 217,627,490, while the number receiving second doses, which would grant the highest level of immunity, is 187,937,559. For the population older than 18, 68.0% of the population has been vaccinated. The FT has a page on global vaccine distribution. The Axios map continues to show improvement in COVID-19 cases, especially in the south. It appears that the real risk of infection is tied to being indoors. If so, as the weather cools, we will likely see cases rise across the northern states.

- The WHO has created a new 26-member scientific panel to restart the study of the pandemic’s origins. We doubt this new panel will have any better reception from Beijing.

- New studies suggest that mixing the mRNA vaccines for boosters may be more effective. The FDA continues to consider guidelines on booster authorization.

- China has begun to administer boosters to high-risk patients and the elderly.