Daily Comment (November 30, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

In today’s Comment, we open with highlights from the U.S. labor market, U.S. relations with China and Russia, and a small number of other international developments. However, the bulk of our report deals with the new Omicron variant of the coronavirus, which today has again sparked sharp volatility in the world’s financial markets.

U.S. Labor Market: Against the backdrop of a nationwide labor shortage that is driving up wages and encouraging labor action, an official with the National Labor Relations Board ruled that Amazon (AMZN, 3,561.57) improperly impeded an April unionization vote that ultimately failed and ordered that the vote be held again. The company will have the right to appeal the ruling to the full NLRB, but the body could schedule the re-vote before that happens.

United States-China: Vice Admiral Karl Thomas, commander of the U.S. Seventh Fleet, called for as many as eight U.S. and allied aircraft carriers to be deployed to Asia-Pacific waters in order to deter China and Russia from making aggressive geopolitical moves in the region. That would mark a huge increase in allied carrier deployments in the region, underscoring the seriousness with which at least some U.S. military leaders see the challenge from China and Russia in the coming years.

China: In a sign that the government’s crackdown on big, powerful technology companies has not yet ended, six different regulatory agencies today announced a raft of new rules to rein in the country’s ride-hailing industry. Among other things, the new rules will limit the fees companies can earn from each ride they dispatch, incentivize them to make some drivers formal employees, and urge them to provide benefits such as insurance for their drivers.

NATO-Russia-Ukraine: Foreign ministers from the NATO countries are meeting in Latvia today to forge a response to Russia’s troop buildup around Ukraine, which U.S. intelligence officials have warned could point to a Russian invasion in the coming months. The ministers will need to strike a difficult balancing act between sending a tough warning to Moscow while not over-committing to the defense of Kiev.

Iran Nuclear Deal: At the latest round of talks to re-implement the 2015 deal limiting Iran’s nuclear program, Iranian negotiators yesterday doubled down on the tough demands they would require before agreeing to a renewed deal. For example, the Iranians continued to refuse to talk directly with the U.S. side, and they demanded that any resumption of the deal would require the U.S. to first dismantle all sanctions imposed since it walked away from the agreement in 2018. Prospects for a renewed deal appear slim, raising the prospect of future destabilizing moves ranging from an Iranian break-out to a nuclear weapon or an Israeli-led attack to prevent that from happening.

Barbados-United Kingdom: Barbados officially became a republic today, nearly 400 years after the English first set foot on the Caribbean island. As a result, Queen Elizabeth II is now head of state for just 15 realms, including the United Kingdom, Australia, Canada, and Jamaica.

COVID-19: Official data show confirmed cases have risen to 262,312,703 worldwide, with 5,211,147 deaths. In the U.S., confirmed cases rose to 48,440,107, with 778,653 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 232,792,508. The data show that 70.1% of the U.S. population has now received at least one dose of a vaccine, and 59.3% of the population is fully vaccinated.

Virology

- In today’s key virology news, CEO of Moderna (MRNA, 368.51) Stéphane Bancel predicted in an interview with the Financial Times that existing vaccines will be much less effective at tackling the new Omicron variant than earlier strains of coronavirus. Just as unsettling, he warned that it would take months before pharmaceutical companies could manufacture new variant-specific jabs at scale.

- According to Bancel, “I think [the change in effectiveness] is going to be a material drop. I just don’t know how much because we need to wait for the data. But all the scientists I’ve talked to…are like, ‘This is not going to be good’.”

- With drug firms warning that the current vaccines might have to be modified to retain control over the pandemic, economic prospects and returns on risk assets are once again in question. As we mentioned in our Comment yesterday, early indications are that Omicron may be more transmissible but less lethal than previous variants, which at some level could be a positive outcome. Scientists probably still need at least a couple of weeks of study to get a decent feel for how Omicron behaves. All the same, Bancel’s comments underscore that the situation remains fluid, and a more negative assessment of Omicron might evolve. As shown by today’s market declines in Europe and Asia, that could leave markets volatile in the coming weeks.

- Similarly, Regeneron Pharmaceuticals (REGN, 654.40) said preliminary tests indicated that its antibody drug cocktail to treat COVID-19 lost effectiveness against the Omicron variant. Outside scientists said an antibody treatment from Eli Lilly (LLY, 254.83) also appeared to lose effectiveness against the mutation. Both findings are preliminary, but they have contributed to today’s market angst regarding Omicron.

- In light of the threat from the new Omicron variant, the CDC yesterday recommended that everyone 18 and older get an additional shot after completing their first course of vaccination. That marked a step up from the agency’s stance earlier this month, when it merely encouraged boosters for those 50 and above and said people ages 18 and above could get an additional dose. Indeed, some experts believe that having a booster may soon become a requirement to be considered “fully vaccinated.”

- Reports indicate that the FDA, as early as next week, may approve use of the vaccine from Pfizer (PFE, 52.40) and BioNTECH (BNTX, 362.52) as a booster in youths aged 16 and 17. As of now, the vaccine is approved as a booster only for those 18 and older.

Economic and Financial Market Impacts

- In testimony prepared for the Senate Banking Committee this morning, Fed Chair Powell says the new Omicron variant could intensify the supply-chain disruptions that have fueled this year’s surge in inflation. The testimony highlights how the new variant could put the Fed in a difficult position in the coming months if it exacerbates inflation, while also holding more workers back from seeking employment, which could lead wages to continue accelerating.

- In an address to the nation regarding the new Omicron variant, President Biden yesterday said the mutation is “a cause for concern, not a cause for panic.” He also said he would unveil a plan on Thursday for tackling the virus this winter “not with shutdowns and lockdowns, but with more widespread vaccinations, boosters, testing, and more.”

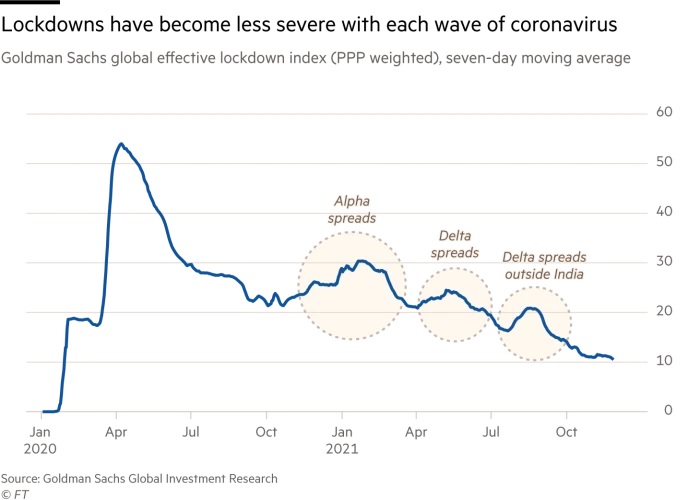

- The commitment to not focus on new economic lockdowns underscores the fact that many world leaders will be politically constrained from using such an approach to battle the Omicron mutation, at least unless it proves to be much more lethal than now known. Not only has the long battle against COVID-19 spawned intense popular backlash against lockdowns, but the rollout of vaccination programs has probably also made lockdowns less necessary.

- New lockdowns could be imposed in some places, as they already have been in some European nations, but for now it looks like we won’t see the widespread, nationwide lockdowns seen earlier in the pandemic. Indeed, global lockdowns have continued to trend downward throughout the period since the pandemic first began, as shown in the chart below.