Daily Comment (December 6, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! Financial markets remain choppy this morning. U.S. equity futures are generally higher, as is oil. Meanwhile, moderate temperatures in the U.S. are sending natural gas prices plunging, with nearest futures off nearly 10%. Inflation data is out later this week, and a reading over 7% is pos60sible. The Biden administration is expected to announce a diplomatic boycott of the Winter Olympics this week, which will send a signal to Beijing but allow athletes to compete.

Our coverage begins with the crypto markets, which had a rough weekend. Economics and policy come next, with an interesting chart on the labor markets. We also note that Q4 GDP is looking surprisingly strong. International news follows, with comments on Russia’s troop buildup and Iran/U.S. nuclear talks. China news is next. The PBOC cut reserve requirements this morning. We close with our usual pandemic update; indicators are that the Omicron variant spreads easily but may be less lethal.

Crypto: Major cryptocurrencies had a tough weekend, with prices falling more than 20% at one point. It isn’t clear why the selloff occurred, although we note that comments from the Chinese real estate market (see below) coincided with the selling. That may be a coincidence, but it could be that these real estate firms hold crypto and are selling to boost liquidity. Crypto is a 24/7/365 market, but that doesn’t necessarily mean that all periods have the same level of liquidity. Some of the drop may be due to selling into a thin market. However, the overall reason for the decline appears tied to concerns about policy tightening. We view crypto as a debasement asset, and a Fed pivoting to tightening isn’t positive for this asset class.

- Researchers warn quantum computers will probably be able to corrupt the blockchain and hack cryptocurrencies.

Economics and policy: We comment on the employment report and the economy.

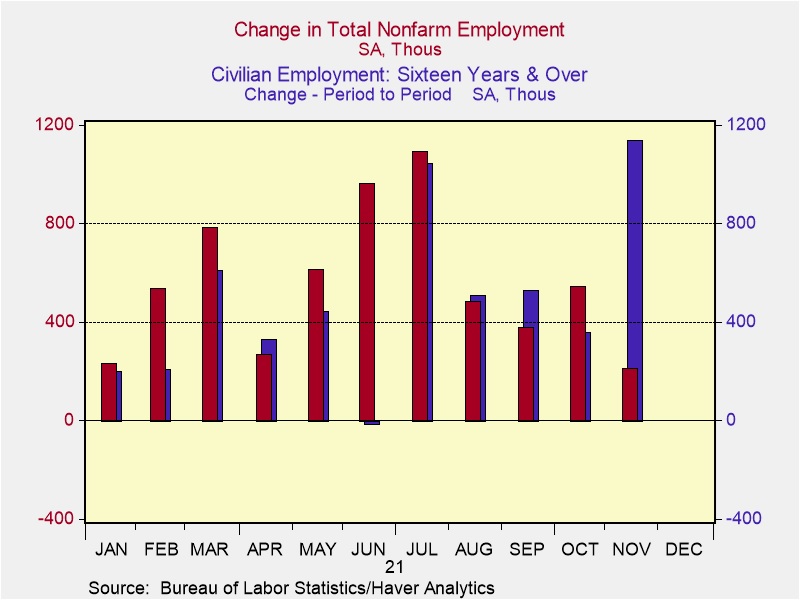

- Here are a couple of notable charts. First, the headline report of weak payroll data overshadowed remarkably strong household survey data.

This difference of 926,000 is rare. In the 886 months of data, a difference of this level or more has occurred only six times. We suspect the payroll data will be revised higher, but it is also possible that the household survey is picking up anecdotal reports of a surge in entrepreneurship. The establishment survey, where the payroll data comes from, won’t pick up workers starting their own businesses.

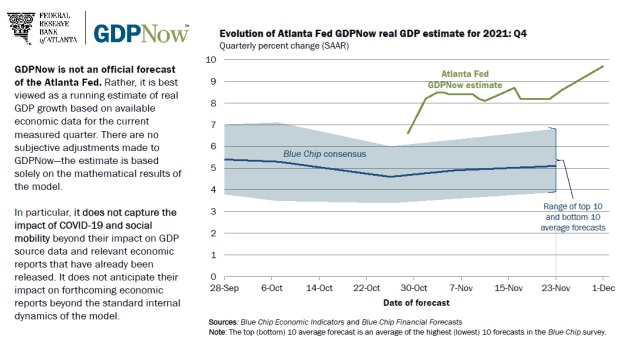

Second, the Atlanta FRB’s GDPNow report is currently calling for a 9.7% GDP number for Q4.

This level of growth is likely prompting the Fed to shift away from policy accommodation.

- Congress is trying to pass a series of bills before year end, including the debt ceiling.

International roundup: The Russian troop buildup continues to raise concerns, and talks with Iran are not going well.

- The U.S. is increasingly sounding the alarm over Russia’s troop buildup on the Ukraine frontier. By sharing intelligence with EU nations, Washington has made some headway in convincing even the rather Moscow-leaning European nations that the Russian threat is elevated, arguing that Russia could invade Ukraine in early 2022. Presidents Biden and Putin are scheduled to have a call tomorrow. It remains unclear to us just how serious Russia is about an invasion. Clearly, the buildup of troops would suggest that something is up. We have little doubt that (a) if Russia is serious, it can successfully invade Ukraine, and (b) the West won’t do much about it other than impose sanctions. However, sanctions are not a completely idle threat. If the West denied Russia access to the S.W.I.F.T. network, for example, it may prevent Moscow from selling oil to anyone other than China. And, if Iran’s experience is any guide, Russia would be forced to sell oil at a deep discount. Of course, this also would affect natural gas exports, so the EU would likely be cautious about such a step. It should also be noted that invading is one thing, controlling is another. Russia currently controls the Russian-leaning areas of Ukraine. Taking the rest would mean it would govern an anti-Russian majority, meaning that the costs of control would be high. We expect that Russia’s buildup is a bluff, but the alarm being raised by U.S. intelligence agencies means we are watching this issue closely.

- The negotiations with Iran to return to the JCPOA are not going well at all. Iran’s position is that the U.S. needs to lift sanctions as a precondition to talks, and the Biden administration needs to bind future administrations to whatever agreement is made. The latter point is impossible, as even treaties can be rescinded. EU negotiators warn that if Iran holds these positions, talks are doomed. If the talks fail, the U.S. will likely take steps to add additional sanctions and may need to consider military action to slow Iran’s nuclear weapons development.

- The EU is moving to create a trade retaliation structure that will be controlled by the EU Commission, allowing it to levy trade sanctions without the approval of individual nations. This change would give the EU much greater power in trade, although we struggle to see how the commission would move against the wishes of France and Germany.

- U.K. officials are in the U.S. to encourage America to make a free trade deal. Although, until the row between the EU and Northern Ireland is resolved, we doubt there will be much progress.

- It is now becoming clear that Assad will remain in power in Syria. However, his government is desperate for money to rebuild, is “shaking down” companies for money, and is engaging in drug trafficking.

- In Myanmar, the junta has sentenced Aung San Suu Kyi to four years in prison.

- There was a large volcanic eruption in Indonesia on the island of Java. Volcanic eruptions can spew ash into the upper atmosphere and may reduce temperatures.

China news: Reserve requirements were cut this morning.

- The PBOC cut reserve requirements by 0.5%; although regulators hope this will spur lending, the move isn’t big enough to boost lending significantly and could be used by banks to expand margins.

- Regulators in the U.S. and China continue to move toward delisting. Didi (DIDI, USD, 6.07) is moving to delist, but without a deal regarding U.S. disclosure requirements, the chances that many Chinese firms will delist is rising.

- Although Russia’s actions in Ukraine (see below) are making headlines, U.S. military leaders warn that Chinese aggression toward Taiwan remains elevated. Meanwhile, U.S. trade with Taiwan is booming, and an escalation in tensions could be an economic disruption.

- Chinese real estate woes continue. Evergrande (EGRNF, USD, 0.28) indicated it intends to include all of its offshore bonds in the expected restructuring. In addition, Sunshine 100 China Holdings (2608, HKD, 0.34) defaulted on a $170 million bond.

- China is facing some serious long-term issues. First, China has always had water management issues. From flooding to desertification, leaders have tried to manage water through dams and other actions. But, one underappreciated fact is that manufacturing uses a lot of water, and as shortages grow, China may struggle to meet production goals. Second, China’s demographics are deteriorating rapidly, which threatens future growth.

- China is in talks with Equatorial Guinea to build its first Atlantic military base.

- China is merging the assets of several SOEs involved in rare earth mining to create one large “champion.”

COVID-19: The number of reported cases is 265,990,136, with 5,258,654 fatalities. In the U.S., there are 49,086,840 confirmed cases with 788,364 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 580,417,105 doses of the vaccine have been distributed, with 470,297,846 doses injected. The number receiving at least one dose is 235,698,738, while the number receiving second doses, which would grant the highest level of immunity, is 198,962,520. For the population older than 18, 71.5% of the population has been fully vaccinated, with 59.9% of the entire population fully vaccinated. The FT has a page on global vaccine distribution.

- There is growing evidence that the Omicron variant is highly contagious. It appears this variant has adopted some of the characteristics of a related coronavirus, the common cold, which is helping its spread. Case reporting shows a rapid rise in cases in Europe. So far, the rise of cases in the U.S. has been less dramatic but is expected to increase soon. On the plus side, there is also evidence from South Africa that this variant may be less virulent compared to earlier strains. If so, the milder strain would be a positive development.

- The U.S. plans to fast-track new vaccines for Omicron, but widespread lockdowns appear unlikely.

- In Europe, there is rising opposition to lockdowns and vaccine mandates.