Daily Comment (December 16, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Note to readers: The Daily Comment will go on holiday after Friday’s comment and return on January 3, 2022. From all of us at Confluence Investment Management, have a Merry Christmas and Happy New Year!

Good morning! So far this morning, financial markets are in risk-on mode. However, we warn there is a torrent of news this morning that could change sentiment. We start with a quick run of headlines before we dive into the FOMC’s decision yesterday.

- The BOE surprised the market this morning, becoming the first G-7 nation to raise policy rates; the bank lifted rates by 25 bps. Market expectations called for no change in rates. Gilt yields rose, and the GBP rallied.

- The ECB announced it has started to taper…slowly. Rates were left unchanged. The EUR rallied on the news.

- Taking a familiar opposite tack, the central bank of Turkey cut rates by 100 bps to 14%, and the government announced a 50% increase in the minimum wage. The TRY has plunged to a new record low. As we have noted before, Turkey appears to be heading toward hyperinflation.

Our coverage begins with a recap of the FOMC decision. Our regular reporting starts with China news. The update on economics and policy comes next; it looks like Build Back Better won’t be passed this year. The international roundup follows, and we close with pandemic news.

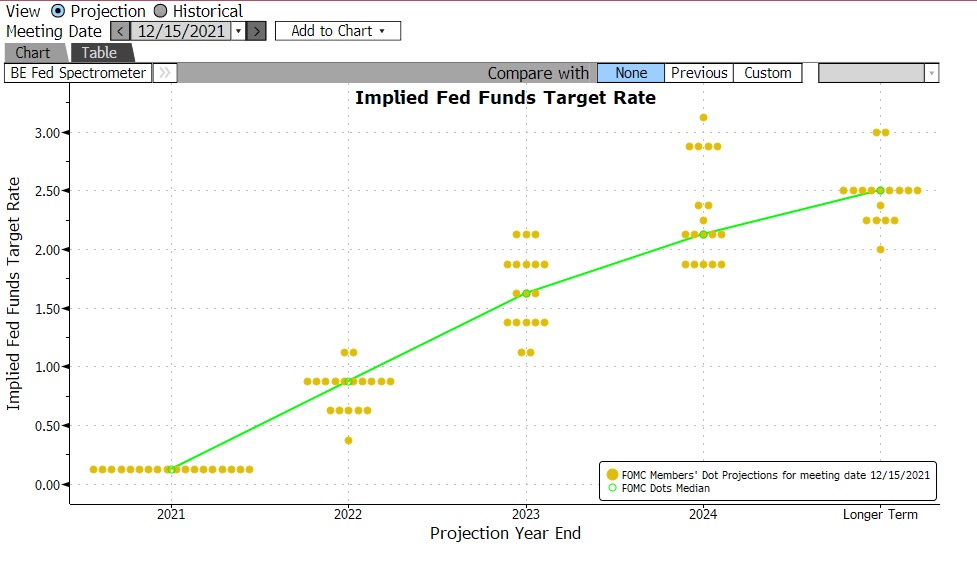

The FOMC: The Fed issued a hawkish statement yesterday, doubling the pace of its taper and signaling, through the dots plot, rate hikes next year. Here is a snapshot of the dots.

First, yesterday’s meeting:

(Source: Bloomberg)

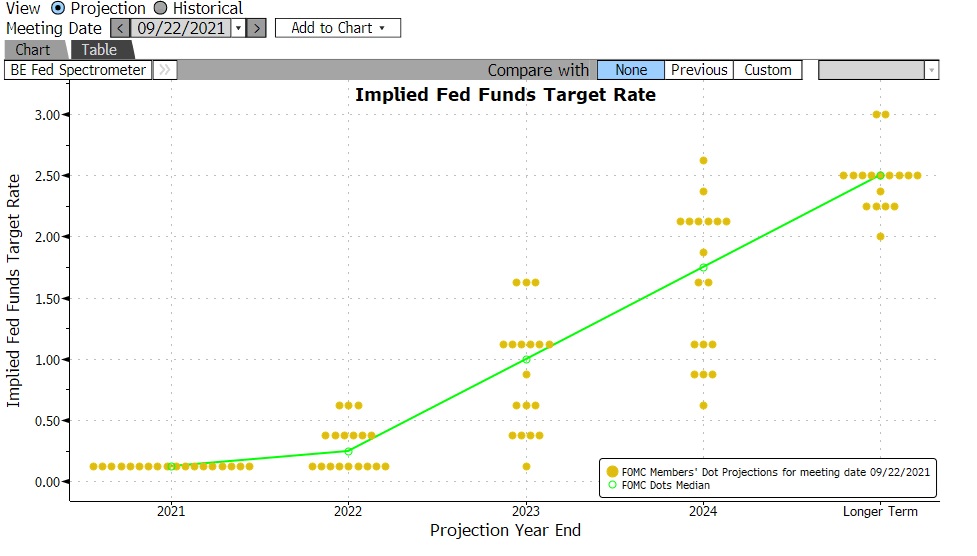

And, the September meeting.

(Source: Bloomberg)

The difference is that at the September meeting, there was one rate hike projected by a small majority. Most of the tightening was projected for 2023. That has clearly changed. The majority is projecting a 0.875% fed funds target by year’s end, which is three rate hikes. Fifteen of 18 members project two to three rate hikes, and no member signaled no change in rates. Even the most dovish (Kashkari, Minneapolis FRB most likely) has moved to one rate hike. The expansion of the balance sheet is set to end by March.

In the economic projections, members are expecting inflation to fall; the core PCE forecast is for 2.7%, up from 2.3% in September. GDP is also expected to rise to 4.0% from 3.8% in September. In Powell’s comments, he suggests we are near full employment. There is evidence that confirms that position, although other evidence suggests otherwise. In a sense, the decision suggests the Fed has concluded that the pandemic has changed the labor markets, and using the pre-pandemic levels as a benchmark is no longer appropriate. This means the Fed can declare victory on the labor front and move to confront inflation directly.

Here are our thoughts:

- Every Fed chair puts his stamp on the FOMC. Some dominate, like Volcker or Greenspan. Others sway by the strength of the intellect, like Bernanke or Yellen. Powell is probably best characterized by the term “pivot.” He is not an economist and seems to bear no allegiance to a particular school of thought within economics. Because he lacks a core position, he tends to sway with the situation. Thus, in 2018, he seemed on a path to tightening regardless of the outcome…until, of course, equities cratered, and he rapidly reversed course. He aggressively moved to support the economy as the pandemic hit, engaging in novel measures to directly backstop various markets usually not supported by the Fed. Now, after assuring markets that tightening is far off, he suggests it’s coming soon. To some extent, Chair Powell seems to adhere to the ideas of one of the 21st century’s great thinkers, Groucho Marx, who famously noted, “I have my principals…if you don’t like them, I have others.”

- Financial markets are used to Fed chairs with ideological leanings. When a course of policy is decided upon, there is a tendency for that policy to be held until some goal is met. That isn’t the case with Powell. A course of action decided today may not last if conditions change. In some respects, this stance isn’t necessarily a problem. It can allow a chair to move quickly and boldly without the restraints of ideology. For market participants, it’s a bit like batting against Ebby LaLoosh. At any point, the bull could be hit. The financial markets have already built in expectations of rate hikes. The Fed essentially confirmed that today. Just be careful “digging in.” If inflation falls by midyear and there is any cooling of the economy, these expectations could vaporize rapidly.

- The other thing to remember is that two voters will be gone by the end of January. The president could select doves for three open governor positions and change the stance of the FOMC. On the other hand, the roster of regional bank presidents voting next year is hawkish. For now, the path of tightening will be generally supported by the committee. However, by midyear, it could become less clear. Of course, as we have noted, the White House has become increasingly deliberative over time, so it may be a while before governor replacements are nominated.

- Clearly, so far, financial markets are pleased with the tightening decision. There were growing worries that the Fed would ignore signs of inflation. In the end, the Fed has pivoted yet again to now fight inflation. It’s only bullish for risk assets if the Fed engineers a soft landing. Although such outcomes are rare, if any chair can pull one-off, it’s probably this one because he is so flexible.

China news: The U.S. continues to restrict trade with China.

- Washington continues to tighten regulations on China trade. The House has passed a bill that bans all imports from the Xinjiang region due to worries over the use of forced labor. In addition, the U.S. has expanded its blacklist of Chinese firms in the technology surveillance area. Beijing’s actions to limit U.S. listings are worrying U.S. financial firms.

- On the real estate front, the government is getting deeper into managing the Evergrande (EGRNF, USD, 0.19) restructuring. Regulators have conducted an audit and indicated there would not be a rapid liquidation of assets. As regulators deal with Evergrande, stress is spreading to other firms, as well. At the same time, vulture investors are showing interest in buying distressed assets of these companies.

- The government is starting to encourage the construction of affordable housing.

- The U.S. formula for hegemony has had two components. The first has been to provide security in conflict zones (Japan/China, Europe, Middle East) to “freeze” these potential conflicts. The second is to act as the global importer of last resort, freely running current account deficits to provide necessary dollar funding to the world. The reason we believe U.S. hegemony will come to an end is that there is no domestic political consensus to maintain these policies. Americans are done with security wars[1] or operations. In addition, the distortions triggered by trade on jobs and the economy have become intolerable. Consequently, SoS Blinken’s trip to the Far East, cut short by COVID-19, was likely doomed to disappointment. What these nations want is access to the U.S. market through free trade deals. Those are now politically untenable in the U.S. Thus, Washington can no longer provide the trade support these countries desire, opening the door for China to deepen economic relations.

- Russia and China are not natural allies. In fact, the “Nixon to China” event was mostly due to the fact that China and the Soviet Union were close to war. Hostility toward the U.S. has created conditions of mutual benefit for China and Russia. This benefit was seen by a recent set of video conferences between the two leaders. Although both characterized the meetings as warm, we note the two nations have not made a formal alliance. Russia worries that its steadily falling population will encourage China to encroach on its Siberian regions, which are rich in natural resources.

- China’s economy is slowing; recent data has shown weaker spending and investment. In the past, such data would trigger fiscal and monetary stimulus. However, in Xi’s bid to bring debt under control, policymakers may not come to the rescue this time.

- Lithuania has recalled its diplomats from China. The Baltic state is in a quarrel with Beijing over relations with Taiwan.

Economics and policy: Build Back Better won’t get passed this year, and new money market regulations may be coming.

- The Build Back Better program is in trouble, as the White House and Congressional leadership can’t seem to sway Senator Manchin (D-WV) to support the measure. It now looks like the bill will not be passed this year, and while we expect something to pass, it will be smaller than the current proposal.

- Flexport has developed a set of shipping indicators that measures the average time for cargo to move from the exporter shipping dock to when it is ready to go on the water to its destination. Two key areas, the Far East Westbound and the Transpacific Eastbound, show this process takes over 100 days; pre-pandemic, this trip averaged between 50 to 60 days. These indicators suggest there has been little improvement in supply chains.

- The SEC is proposing new rules for money market funds (MMK) that are designed to reduce the likelihood of runs. The proposals have not been taken well by the industry. One proposal would allow for “swing pricing,” which would give MMK the ability to price their NAV by a calculation of the value of the entire portfolio. Under current rules, MMK will meet redemptions by selling the most liquid elements of their portfolios first; it tends to give an advantage to customers who liquidate the quickest. The swing price is designed to take away this advantage. Another proposal would require that at least 25% of the portfolio be either cash or assets that are one day from maturity. The current rule allowing MMK to suspend redemptions would be rescinded. We would not expect MMK firms to support these measures, but MMK remains a worry because they typically become unstable during periods of financial stress.

- Natural gas prices continue to soar in Europe. The weather is turning colder, and tensions with Ukraine are the culprits. One fallout from the rise in natural gas prices is soaring fertilizer prices, which some farms use as a feedstock. We will be watching to see if higher fertilizer costs reduce planting or skew the crop away from corn (which needs fertilizer) to soybeans.

- California is seeing a net migration out of the state; high living costs and taxes are likely leading people to leave.

- Thinking about being a trucker? The White House wants to help.

- The EU has been taking the lead on tech policy. Europe’s tech industry is smaller than in the U.S., so the industry has been less effective in lobbying in Brussels. The rules in Europe are guiding U.S. policy.

International roundup: Iran installs cameras and Germany expels Russian diplomats.

- Iran has agreed to re-install video cameras on some nuclear facilities. Although this represents progress, we remain doubtful that a deal will be reached to restore the 2015 nuclear deal.

- Germany has expelled two Russian diplomats in retaliation for a court decision that sentenced Vadim Krasikov to life in prison for executing Zelimkhan Khangoshvili, a Georgian citizen of Chechen ethnicity who lived as a refugee in Germany. We would expect Russia to retaliate in kind.

- Brazil will hold presidential elections next year in October. Polls suggest Lula, the former president, holds a comfortable lead.

COVID-19: The number of reported cases is 272,336,362, with 5,332,813 fatalities. In the U.S., there are 50,374,554 confirmed cases with 802,511 deaths. Data show that infection rates are rising rapidly, but so far, fatalities have not, raising hope that the highly infectious Omicron variant may not be as deadly as the earlier version. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 599,876,215 doses of the vaccine have been distributed with 488,296,089 doses injected. The number receiving at least one dose is 239,975,167, while the number receiving second doses, which would grant the highest level of immunity, is 202,845,886. For the population older than 18, 72.2% of the population has been fully vaccinated, with 61.1% of the entire population fully vaccinated. The FT has a page on global vaccine distribution. The Axios map shows increasing cases across most of the East and Midwest. The mountain states and high plains are seeing falling cases.

- The Omicron variant is triggering a wave of infections. The U.K. hit a new record for daily infections yesterday. Although cases are rising in the U.S., the outlook is likely for a surge of cases in the coming weeks.

- Even though we don’t expect widespread lockdowns to occur, we are seeing restrictions and other measures emerge. Several colleges in the U.S., well into finals week, are telling students to go remote into the semester’s end. Broadway is starting to cancel shows. Italy is requiring EU visitors to have a negative COVID-19 test before entering.

- China, which continues to use aggressive isolation measures when outbreaks occur, is starting to see these measures adversely affect its economy.

- Given how rapidly the Omicron variant is spreading, even if it is less virulent, the increased number of infections will likely lead to more deaths and hospitalizations, even if the per capita data remains steady. This is because there will probably be more infections. The good news is that each infection survived (to quote Nietzsche, “what doesn’t kill me makes me stronger”) increases immunity and moves us along the path of making COVID-19 a seasonal scourge like influenza.

- A recent state-by-state study confirms what one would expect; states that had stricter shutdowns suffered fewer fatalities but had weaker economic growth. States with looser guidelines had a better economy but more deaths.

[1] Small wars or operations to stabilize areas, such as Vietnam, Iraq, Afghanistan, or the heavy commitment to NATO.