Weekly Energy Update (December 16, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(The Weekly Energy Update will go on hiatus until January 6, 2022. To all our readers, Merry Christmas and Happy New Year.)

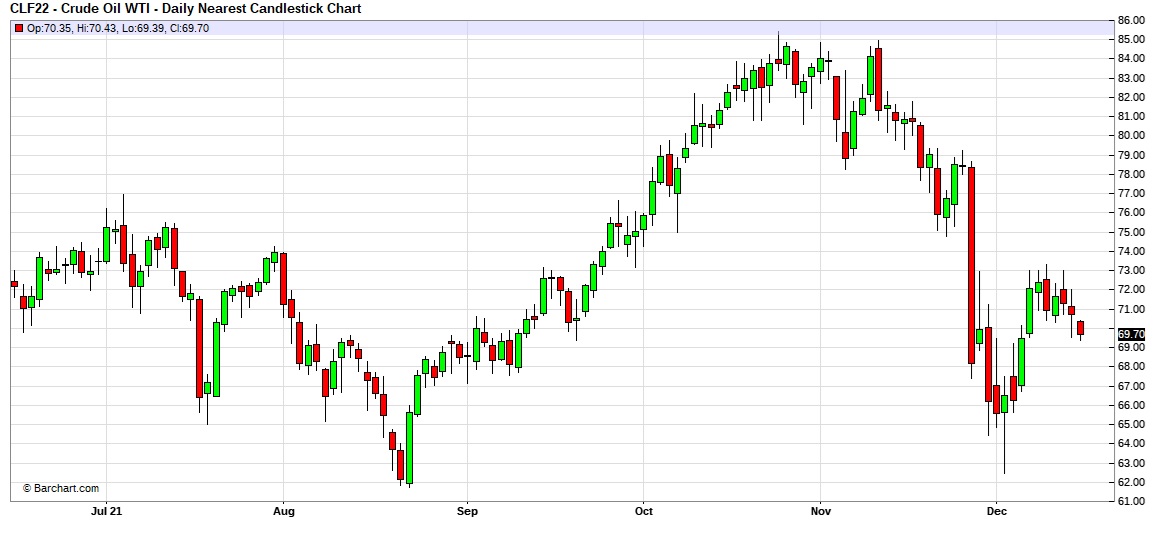

After recovering last week, oil prices have started to drift lower. Worries about rising production and weakening demand due to the Omicron variant, in addition to monetary policy tightening, are pressuring prices.

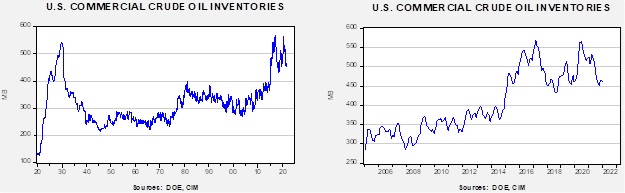

Crude oil inventories fell 4.6 mb compared to a 2.3 mb draw forecast. The SPR declined 2.0 mb, meaning the net draw was 6.5 mb (difference due to rounding).

In the details, U.S. crude oil production rose 0.1 mbpd to 11.7 mbpd. Exports rose 1.4 mbpd, while imports were unchanged. Refining activity was steady.

(Sources: DOE, CIM)

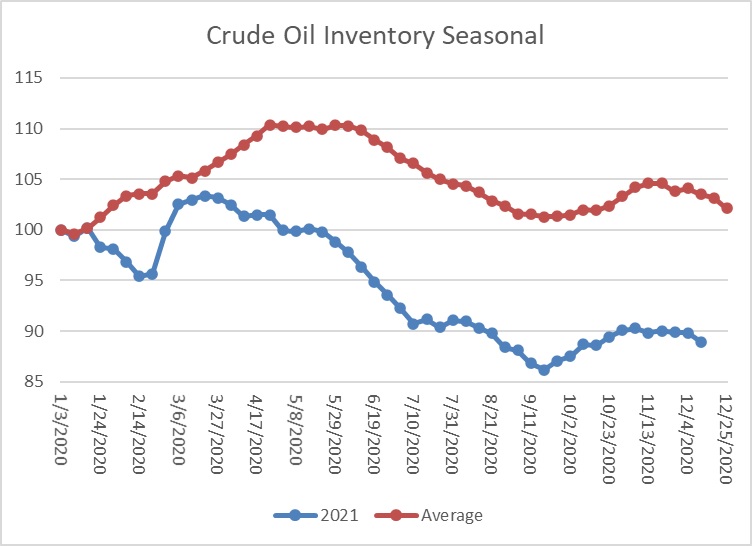

This chart shows the seasonal pattern for crude oil inventories. Inventories usually decline in December, so last week’s draw was normal. Note that stocks are significantly below the usual seasonal trough. Our seasonal deficit is 75.3 mb.

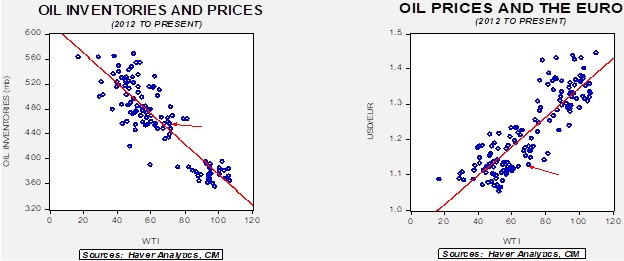

Based on our oil inventory/price model, fair value is $65.32; using the euro/price model, fair value is $52.49. The combined model, a broader analysis of the oil price, generates a fair value of $58.50. The recent decline in oil prices has brought the market closer to fair value. Dollar strength remains a bearish factor, and the SPR release has eased the bullish pressure from falling stockpiles. Fears of future supply tightness remain a bullish factor.

Market news:

- We have been watching the financing situation in energy. Increasingly, fossil fuel firms are seeing hurdles develop to acquire funding for projects. The White House has ordered the government to stop financing carbon-intense projects abroad, which will affect coal mining. Several states have either ordered government pensions to divest fossil fuel investment in portfolios, or there are bills pending. These states include Maine, New York, New Jersey, Hawaii, Massachusetts, and California and are said to control $82 billion of fossil fuel investments. Therefore, the divestment could adversely affect equity values and complicate funding.

- European natural gas prices soared this week on worries over tensions with Ukraine. Germany’s new foreign minister raised doubts about opening Nord Stream 2, which also lifted prices.

- Although the Biden administration has tried to be union-friendly, Biden’s climate change policy is running headlong into opposition from the United Mine Workers. Using less coal is going to reduce the number of union miners.

- For the OPEC+ nations, pricing policy in a flat to declining demand environment will create a challenge. On one hand, the goal of avoiding stranded assets could encourage higher production. On the other, a nation could try to maximize revenue in the face of falling oil investment. For the state oil companies, the latter policy seems to be winning out. The KSA is projecting a budget surplus in 2022 because of high oil prices.

- A recent report tries to ascertain the county-level impact of climate change policy. In other words, to determine who will be harmed by reducing fossil fuel investment and who will cope with the changes.

Geopolitical news:

- Western media is clearly signaling that the Iran nuclear talks are failing, and the U.S. and allies are considering a response, even perhaps a military one. Regional countries are also in talks, possibly preparing for a conflict. However, media comments from Iran indicate just the opposite. Iran is talking about increasing its negotiating staff and suggests that talks are making progress. We tend to think the talks are doomed, which increases the odds of a regional conflict.

- At the same time, nations in the region are steadily preparing for reduced U.S. involvement. The national security advisor from the UAE visited Iran last week, despite the fact that the emirates have normalized relations with Israel.

- The Grand Ayatollah Khamenei has warned against efforts that encourage educated Iranians to emigrate. Slow economic growth and the lack of opportunity are likely the drivers of the brain drain.

- Meanwhile, Iran has been deporting Afghans fleeing the Taliban-led government.

- The U.S. has ended combat operations in Iraq.

Alternative energy/policy news:

- Congo is seeing a flurry of foreign investment as developed nations attempt to secure key raw materials necessary to transition from fossil fuels.

- The Danish company Seaborg (closely held, non-public) claims to have made a breakthrough in energy storage using molten salt.

- Lithium prices are soaring due to strong demand and tight supplies.

- Several projects are underway to determine whether the world’s oceans can absorb carbon.