A Good IDEA for the Long Run: The Benefits of Increasing Dividends (December 2021)

A Report from the Value Equities Investment Committee | PDF

In this report, we examine the long-term outperformance of stocks with growing dividends; why certain dividend growers outperform and their attributes; how those attributes correspond to our approach when selecting businesses for the IDEA portfolio; and the impact of inflation on dividend stocks.

Why Dividends? A Bird in the Hand

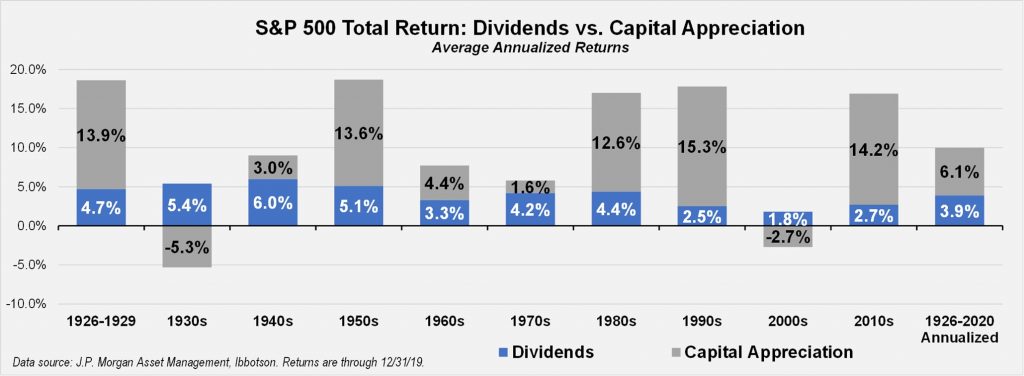

It is a common maxim in investing that dividends make up a good portion of the long-term total return in the market. This chart demonstrates how significant that contribution has been over the past century. As the saying goes, “a bird in the hand is worth two in the bush”; the same can be said for the predictability of dividends relative to capital appreciation.

An Established History

At Confluence Investment Management, our value equity investment philosophy was initiated at our predecessor firm and continues to be implemented more than 25 years later. Accordingly, the members of the Value Equities Investment Committee have a long history of managing dividend-oriented investment strategies. With a dedicated team of research analysts conducting proprietary research, the fundamental approach is focused on understanding and valuing individual businesses with an emphasis on owning competitively advantaged businesses. This approach is the foundation of all six domestic value equity strategies at Confluence, including the Increasing Dividend Equity Account (IDEA) strategy.