Weekly Energy Update (January 13, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Since troughing in early December, oil prices have been steadily rising due to tightening supplies. We are approaching the highs set in November.

(Source: Barchart.com)

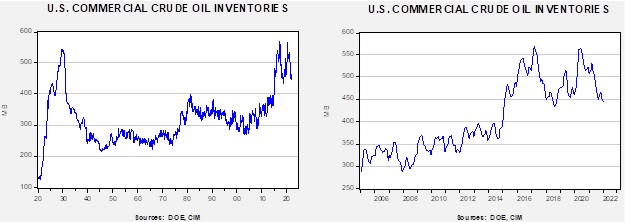

Crude oil inventories fell 4.6 mb compared to a 1.7 mb draw forecast. The SPR declined 0.3 mb, meaning the net draw was 4.9 mb.

In the details, U.S. crude oil production declined 0.1 mbpd at 11.7 mbpd. Exports fell 0.6 mbpd, while imports rose 0.2 mbpd. Refining activity unexpectedly fell 1.4%.

(Sources: DOE, CIM)

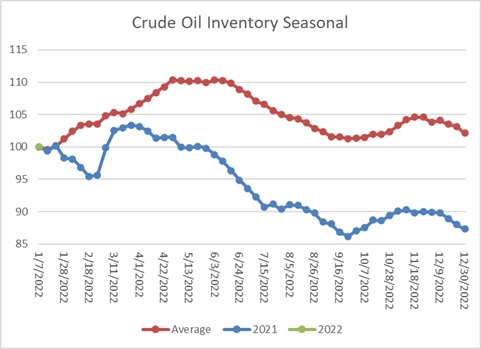

This chart shows the seasonal pattern for crude oil inventories. This week, we reset the chart for 2022, adding 2021 as a reference. The key element to watch is to determine whether inventories follow the usual seasonal pattern, repeat last year’s path.

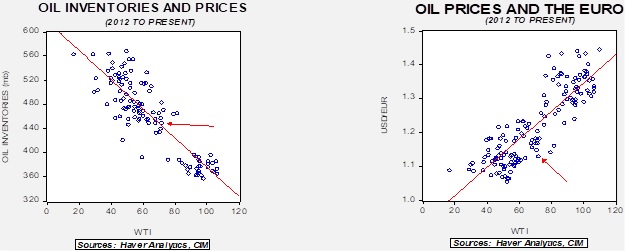

Based on our oil inventory/price model, fair value is $70.20; using the euro/price model, fair value is $53.68. The combined model, a broader analysis of the oil price, generates a fair value of $62.18. Current prices exceed our model projections, but price momentum is likely to push prices higher.

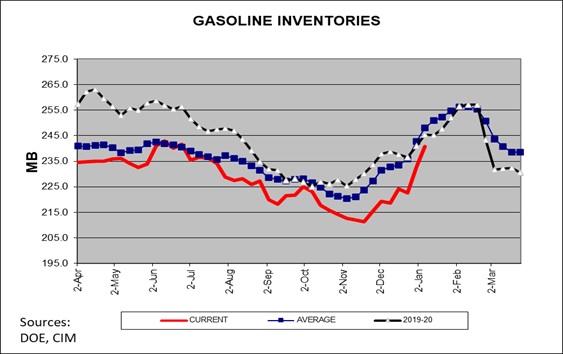

Although gasoline inventories have been rising rapidly, we note the rise is consistent with seasonal patterns.

We would expect gasoline stockpiles to rise another 12-15 mb by early February.

Market news:

- The U.S. is now the world’s top LNG exporter, edging out Qatar and Australia for the first time. In the late 1990s into the mid-2000s, the U.S. was aggressively building the infrastructure to import LNG. Remarkably, 15 years later, the U.S. is a leading source of LNG to the world.

- Higher natural gas prices led to a resurgence in coal consumption this year, leading to a rise in greenhouse gas emissions.

- Banks are coming under increasing scrutiny over lending to fossil fuel companies. As regulators restrict lending to the sector, financing will likely come either from internal cash flow or from the shadow banking system. The bottom line is that the lack of available financing will tend to make the oil supply less responsive to higher prices.

- Market forces are powerful. Using markets to price carbon could create an investment case for carbon removal.

- In the face of rapidly rising natural gas prices, a British energy supplier suggested homeowners should “cuddle their pets” to stay warm this winter. It has subsequently apologized for the comment. It reminds us of our youth and “Three Dog Night,” a band named after something our ancestors did to stay warm.

Geopolitical news:

- Kazakhstan’s president “invited” peacekeepers from various allied countries (mostly from Russia) as widespread unrest developed. We will discuss the situation there in more detail in a future Bi-Weekly Geopolitical Report, but it is important to note that the country is a major oil and gas producer and provides 40% of the world’s uranium supplies.

- Natural gas prices in Europe appear to be manipulated by Moscow to gain leverage over the EU. This situation will likely continue going forward.

- Showing brazen disregard for U.S. sanctions, China increased its purchases of oil from Iran and Venezuela.

Alternative energy/policy news:

- The transportation sector is working to boost fuel efficiency to control costs and reduce carbon emissions. One experiment is that ships are deploying kites to allow wind energy to reduce fuel consumption.

- EVs are becoming more popular; one reason is that automakers are beginning to electrify pickup trucks.

- A recent Deloitte report details that Japan and South Korea are leading the world in consumer attitudes in favor of EVs or other alternative vehicles.

- Germany has closed three of its six remaining nuclear power plants.

- One theme we have been watching is the oil to metals trend in electrifying the transportation sector. BHP (BHP, USD, 66.58) is making a major investment in Tanzania to secure nickel supplies.