Daily Comment (January 18, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we open with a few remarks on the downdraft this morning in most global financial markets. We next provide an update on Russia’s military buildup along its Ukraine border. We then cover a range of other international news developments. We wrap up with the latest news on the coronavirus pandemic.

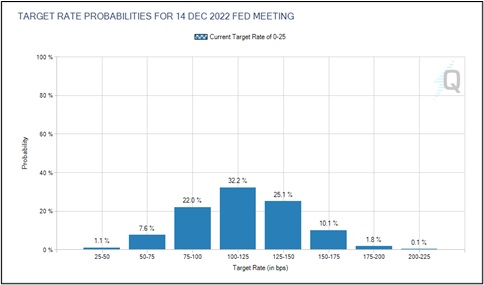

Global Financial Markets: As U.S. investors return to the markets after yesterday’s holiday, expectations for Fed rate hikes have worsened, apparently in response to stray comments by financial executives last week that the monetary policymakers might hike their benchmark fed funds rate a half dozen or more times this year. Adding to the interest-rate concerns, the Bank of Japan today lifted its inflation projections for the first time since 2014, conjuring up images of a potential rate hike by the BOJ. Futures markets today suggest investors expect “only” four Fed rate hikes by December (see CME chart below), but that is still uncomfortable enough to drive down bond and stock values.

- The yield on the two-year Treasury note today has jumped to approximately 1.025%, surpassing 1% for the first time since early 2020.

- The yield on the ten-year Treasury obligation has risen a bit more moderately to 1.825% or so, leaving the yield curve slightly flatter and adding to evidence that bond investors fear a policy mistake in which the Fed will hike rates too far and slow the economy.

- We continue to think the Fed will have to pull its punches before it hikes rates as far as the market currently believes. We think tighter policy could quickly expose financial fragilities somewhere in the economy or start to weigh on real economic activity, even as today’s high inflation rates begin to moderate because of more favorable “base effects” and some supply disruptions get resolved. Besides, high financial market volatility, with the VIX over 20 (as it is today), has typically scared off the Fed from further policy tightening. Nevertheless, investors today are in a panic about sharply rising interest rates, and it’s unclear how long the markets will remain volatile.

Source: CME

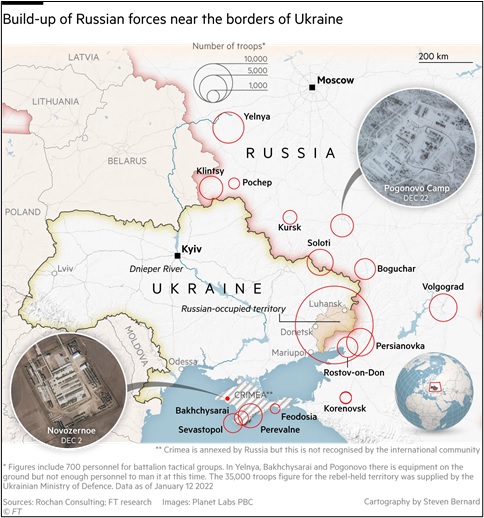

Russia-Ukraine: At least as of this writing, President Putin still hasn’t launched an attack on Ukraine, even though 100,000 or so Russian troops and enough military equipment for many more than that remain poised along Ukraine’s northern, eastern, and southern borders. U.S. officials also say Russia has secretly deployed saboteurs to Ukraine so they could be ready to launch a “false flag” attack on Russian interests there, in case the Kremlin needs justification for an attack. Russia has also been evacuating its diplomats from its embassy in Kyiv, in another potential sign of impending conflict.

- Russian officials have expressed frustration with last week’s diplomatic talks between Russia and the U.S., its NATO allies, and a broader group of European countries. In those talks, the U.S. and its partners refused Russia’s demand for security guarantees, including a prohibition on any other former Soviet republics joining NATO and a rollback of NATO’s presence in the republics that have already joined. Russian officials have given the U.S. and its allies one week to meet Russian demands.

- In addition to holding a gun to Ukraine’s head in the form of its massive military buildup on Ukraine’s borders, a cyberattack against Ukraine in recent days adds to the threats that Russia hopes will convince the West to meet its demands.

- As of right now, the U.S. and its allies are generally closing ranks and presenting a united front against Russia’s demand for what would be a sphere of influence in Eastern Europe. For example, British Defense Minister Wallace yesterday told parliament that the U.K. is sending “light anti-armor, defensive weapon systems” to Ukraine, and he is inviting Russian Defense Minister Shoigu to London for talks in the coming weeks to help defuse the crisis. However, some cracks among the allies have been noticed, including some European discomfort over the Biden administration’s approach and some countries, such as Germany, expressing concern over the economic impact of rising tensions.

- In any case, tensions remain high, and if they continue to escalate, they could start to have a real impact on global financial markets. Obviously, a major shooting war would do the same. Less obvious is how the markets would react to a more limited action by the Kremlin, such as an incursion focused on the ethnically Russian-dominated provinces of Donbas and Luhansk in eastern Ukraine, where separatists have been fighting the central government for seven years. Limited airstrikes or cyberattacks could also help get Putin’s point across and present challenges for the markets.

China: Amid signs of significant economic slowing ahead of the Communist Party’s 20th National Congress later this year, the People’s Bank of China cut two of its key interest rates over the weekend. The modest rate cuts suggest the government is increasingly anxious to keep up economic growth ahead of the Congress, where President Xi will seek approval for a third term in office. Indeed, PBOC Vice-Chair Liu today promised that the central bank would introduce further moves to stabilize the economy and prevent a “collapse” of credit.

- Meanwhile, the National Bureau of Statistics yesterday said China’s population grew just 0.034% in 2020, to 1.413 billion. Births fell to a modern low of 10.62 million, barely ahead of the country’s 10.14 million deaths. Importantly, China’s declining birth rate means fewer young people are entering the labor force each year, meaning the government doesn’t have to worry quite as much about creating new entry-level jobs. That’s probably one reason President Xi has been willing to launch his recent clampdown on powerful, fast-growing high-technology firms.

- Slowing economic growth in China, reflecting factors ranging from the government’s crackdown on property investment and technology firms to the rapidly spreading Omicron mutation of the coronavirus, would have a noticeable negative impact on global economic growth. Investors are therefore likely to be encouraged by Beijing’s steps to loosen monetary policy and lighten up a bit on its regulatory drive.

United States-China: The FBI and a U.S. investment-screening panel are investigating a Chinese government-backed investment company’s purchase of a 47% stake in a California manufacturer of small recreational, amphibious planes.

- A group of U.S. shareholders has accused the Chinese firm of hollowing out the company and moving its technology to China. The technology apparently has potential military applications.

- The U.S. move is only the latest in a series of initiatives that underscore the threat to U.S.-China capital flows. As we have argued previously, the clampdown on such flows is an increasing risk for investors.

United Kingdom: Prime Minister Johnson continues to face mounting pressure to resign because of last week’s news that he attended a “bring your own booze” party in the garden of Downing Street against his government’s social-distancing rules early in the pandemic.

- Former chief advisor Dominic Cummings yesterday accused Johnson of lying to Parliament about the incident.

- Tory Members of Parliament reportedly faced blistering criticism from constituents over the weekend, with many now openly calling for Johnson’s head.

- Adding to the troubles, the latest polling puts the Tories 13 percentage points behind the opposition Labor Party.

- Johnson’s fate will depend highly on an investigation conducted by a senior civil servant. Her report could come out as early as this week, depending on its conclusions and how it casts the incident.

Yemen-United Arab Emirates: Yemen’s Houthi rebels said they were behind yesterday’s drone and missile attacks on the United Arab Emirates, which killed three people. The Houthis, who are backed by Iran, said they had targeted Abu Dhabi in retaliation for the UAE’s recent escalation of its support for the Yemeni government in a Saudi-led coalition. The attack has sparked fears of wider violence in the region, adding to today’s jump in energy prices.

Emerging Market Debt: The World Bank issued a report saying a group of 74 less-developed countries will have to pay some $35 billion to official bilateral and private lenders in 2022, up about 45% from their required payments in 2020 (the last year for which figures are available).

- The jump in debt costs reflects both the resumption of payments after some countries took advantage of a moratorium early in the coronavirus pandemic and a big increase in borrowings by some countries trying to cushion the blow from the pandemic.

- For countries with dollar-denominated debt, the strength of the greenback will make it especially challenging to meet their debt service. The risk of an emerging-market debt crisis remains elevated.

COVID-19: Official data show confirmed cases have risen to 331,166,002 worldwide, with 5,547,903 deaths. In the U.S., confirmed cases rose to 66,456,516, with 851,730 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 248,707,43. The data show that 74.9% of the U.S. population has now received at least one dose of a vaccine, and 62.9% of the population is fully vaccinated.

Virology

- With the Omicron mutation continuing to spread rapidly, the seven-day average of new U.S. cases topped 800,000 for the first time over the weekend. More important, the seven-day average of confirmed and suspected COVID-19 hospitalizations topped 155,000 for the first time, putting high stress on the healthcare system. Fortunately, however, falling rates of new infections in Europe and some parts of the U.S. suggest there may be a light at the end of the tunnel.

- Data from Europe and the U.S. show there are more child admissions to hospitals in recent days than at any other time during the pandemic. However, severe cases have remained rare in the youngest age groups, and Omicron infections generally look similar to other common respiratory illnesses.

- In Japan, the government today reported over 30,000 new cases of COVID-19, marking a new record high for the pandemic. The government is now preparing to put Tokyo and other prefectures under quasi-emergency measures to combat the Omicron variant.

- In China, authorities again warned citizens that the coronavirus could be spread via mail and frozen foods after they were unable to pinpoint the origin of Beijing’s first case of the Omicron variant.

- According to a Beijing municipal official, contact tracing of more than 16,000 of the patient’s contacts turned up no infections, but investigators found the virus on letters mailed to the patient from Toronto, Canada.

- The World Health Organization says it is possible for people to become infected after touching contaminated surfaces or objects, but researchers generally believe that risk is very low.

- As Chinese citizens tire of the government’s “zero COVID” policy, the suggestion that the Beijing case came from overseas will likely spark new concerns that China is trying to shift blame for the pandemic and make foreigners the scapegoats for the crisis. If so, that would further poison the relationship between China and other major countries.

- In Hong Kong, officials launched a probe into hamsters imported from the Netherlands after a fully vaccinated pet store employee tested positive for COVID-19. Several hamsters and a shopper also tested positive. The city government said more than 1,000 hamsters would be culled, and about 150 pet store visitors would be sent to government quarantine facilities.

- Responding to the new case in Beijing, the government announced that most Chinese citizens would not be allowed to attend the Winter Olympic Games to be held in the city starting in early February. China had already barred foreign spectators from attending.

- A new study shows vaccination “certificates” or “COVID passes” introduced in France, Germany, and Italy increased the vaccination rate in those countries by 13.0, 6.2, and 9.7 percentage points, respectively. The effect was especially large among older population groups.

Economic and Financial Market Impacts

- New data shows that Texas, Arizona, Utah, and Idaho have now recovered all the jobs they lost at the start of the pandemic, leading to a trend that is expected to include another dozen states by the middle of this year.