Daily Comment (January 24, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

In today’s Comment, we open with the building of geopolitical tensions along the Russia-Ukraine border and in the waters off the coast of China. We next review various political and economic developments around the world, including a brief comment regarding this week’s Federal Reserve meeting on U.S. monetary policy. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: As Russia continues its menacing military buildup along the northern, eastern, and southern borders of Ukraine, the State Department instructed the families of U.S. diplomats in Ukraine to leave the country and authorized some embassy staff members to leave as well. The department also recommended that all U.S. citizens in Ukraine consider leaving now on the grounds that the U.S. Embassy won’t be in a position to help Americans depart if a Russian attack is underway.

- Separately, the New York Times reported that President Biden is considering deploying several thousand U.S. troops, as well as warships and aircraft, to NATO allies in the Baltics and Eastern Europe. If true, it would signal a major pivot after several months of relying only on diplomatic and economic pressure to warn off the Russians.

- The Financial Times reports other NATO allies are also reducing their embassy staff in Ukraine, putting their military forces on standby, and sending additional ships and fighter jets to bolster the defenses of its members in Eastern Europe.

- In other key news over the weekend, the British government announced it has uncovered a Russian plot to install a new, friendly government in Kyiv. According to the statement, an ex-Ukrainian politician is the Kremlin’s preferred leader, although the statement also cited Russian intelligence links with four other former senior officials who fled to Russia in 2014 and have reportedly been plotting to return to power in Kyiv ever since.

- The continuing Russian troop buildup, reports of Moscow-friendly officials waiting in the wings, and the U.S. order to draw down its embassy staff all have started to contribute to a war scare within Ukraine, with many citizens reportedly rushing to withdraw their funds from banks. The longer the standoff continues, the greater the risk it will sap Ukraine’s economy and therefore generally weaken the country more.

- The threat of military conflict and the potential for new Western sanctions have also begun to affect the Russian economy and financial markets. The Moscow stock market fell over 7.5% today; yields on Russia’s government debt hit their highest level in six years. The ruble lost 1.5% to trade at 78.9 to the dollar, a 14-month low.

Source: The Daily Mail

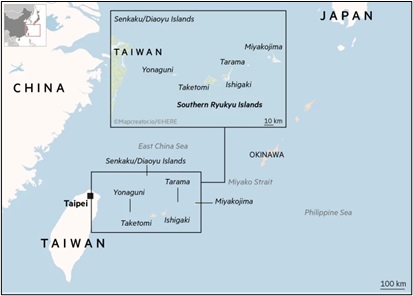

China-Taiwan-Japan: Although the Russia-Ukraine crisis has garnered the most attention recently, it’s important to remember that military tensions also continue to rise in the waters between China, Taiwan, and Japan. For at least the last six months, the Chinese navy has maintained the continual presence of at least one warship in the waters south and east of the southernmost Japanese islands. That marks China’s first consistent deployment of naval forces beyond the “first island chain” and demonstrates the military and economic threat it poses to Japan, especially if it were ever able to control Taiwan.

- Separately, China sent dozens of warplanes on threatening trajectories near Taiwan’s airspace over the last two days, in their biggest such show of force since October.

- The sorties were apparently meant to register Beijing’s anger over a joint U.S.-Japan naval exercise involving two U.S. aircraft carriers that concluded over the weekend.

Source: Financial Times

China: In a sign that President Xi continues to clamp down on powerful private businesses and what he sees as threats to China’s moral fabric, the government has launched an investigation into “disciplinary violations” by vaping tycoon Chu Lam You. In Hong Kong, news of the investigation sent her company, Huabao International Holdings (336 HK, HKD, 4.86), tumbling by over 65%.

Italy: Parliament members and other senior politicians today begin the process of voting for the country’s new president, with all eyes on whether they will keep Italy’s most celebrated technocrat, former ECB chief Mario Draghi, as prime minister, allowing him to forge ahead with an ambitious EU-funded reform program, or elevate him to head of state, potentially triggering a paralyzing crisis over a successor to head the government.

- As the voting gets started, media tycoon and four-time prime minister Silvio Berlusconi has given up on his long-shot bid for the presidency.

- Berlusconi, who was convicted of tax fraud in October 2012, said he decided to pull his name from consideration so lawmakers from across the political spectrum could choose a less divisive candidate.

Yemen-United Arab Emirates: The UAE intercepted two missiles launched by the Iran-allied Houthi rebels in Yemen, one week after a strike by the group killed three people in Abu Dhabi. The attack highlighted the growing threat from the Houthis, who have targeted neighboring Saudi Arabia with missile and drone strikes for years.

U.S. Monetary Policy: Fed officials begin their next two-day policy meeting tomorrow, after which Chair Powell is expected to confirm that the central bank’s asset purchase program will end by March and set the stage for a new round of interest-rate hikes. As if that isn’t unsettling enough for the financial markets, some policymakers’ statements have recently sounded almost panicky about inflation, creating uncertainty about how fast or how far they will hike rates.

COVID-19: Official data show confirmed cases have risen to 351,903,261 worldwide, with 5,598,042 deaths. In the U.S., confirmed cases rose to 70,700,678, with 866,540 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 250,763,600. The data show that 75.5% of the U.S. population has now received at least one dose of a vaccine, and 63.4% of the population is fully vaccinated.

Virology

- The seven-day average of people in U.S. hospitals with confirmed or suspected cases of COVID-19 declined for the third consecutive day, reaching 157,425 on Sunday. The number of new COVID-19 admissions to hospitals across the U.S. was also down.

- Even though the highly transmissible Omicron mutation is quickly subsiding in much of the country, a monthly poll by the U.S. Census Bureau indicated almost 8.8 million people were out of work in January because they were sick or caring for someone with COVID-19. That’s by far the highest such figure since the survey began in mid-2020, exceeding the 6.6 million recorded in January 2021 and three million from December’s survey.

- In addition, the number of people reporting they weren’t working due to concern about getting or spreading the disease rose to 3.2 million in the January survey from 2.6 million in December.

- Other recent studies suggest concern about COVID-19 is continuing to push people into retirement.

- The resulting business disruptions could be a key reason for the jump in initial jobless claims reported last week. Some economists fear “peak Omicron” could even lead to a decline in January nonfarm payrolls, although the momentum in the economy would probably quickly reverse any payroll decline.

Economic and Financial Market Impacts

- In the U.K., airlines still battling to get ridership up to pre-pandemic levels, have warned they will be forced to run half-empty and highly polluting “ghost flights.” New government rules compel carriers to fly more regularly to retain their lucrative take-off and landing slots at busy airports. The Department for Transport today said airlines would have to hand back airport slots if they were not used 70% of the time from March 27, up from the current threshold of 50%.