Weekly Energy Update (January 27, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Since troughing in early December, oil prices have been steadily rising due to tightening supplies. We are approaching the highs set in November.

(Source: Barchart.com)

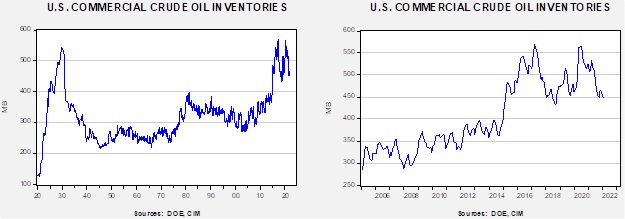

Crude oil inventories unexpectedly rose 2.4 mb compared to a 1.0 mb build forecast. The SPR declined 1.3 mb, meaning the net build was 1.1 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 11.6 mbpd. Exports rose 0.2 mbpd while imports fell 0.5 mbpd. Refining activity fell 0.4%.

(Sources: DOE, CIM)

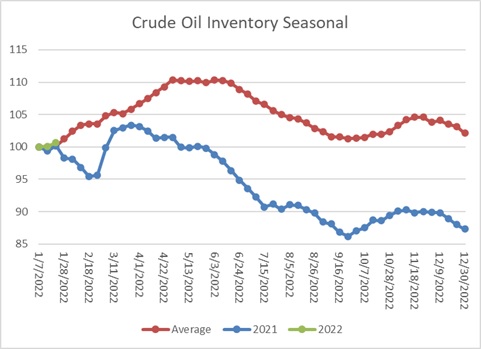

This chart shows the seasonal pattern for crude oil inventories. This week’s report shows a pattern consistent with average and last year. Next week has a clear divergence between average and last year. We had a massive cold snap last year, so it is more likely we will see inventories follow the average instead of last year.

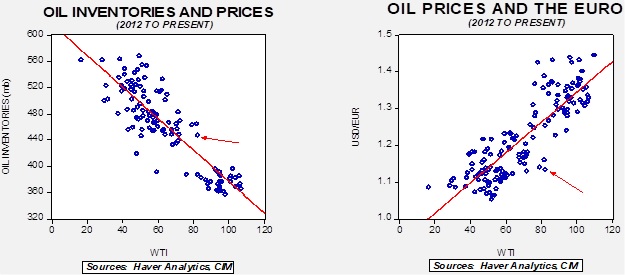

Based on our oil inventory/price model, fair value is $70.04; using the euro/price model, fair value is $53.89. The combined model, a broader analysis of the oil price, generates a fair value of $69.30. Current prices exceed our model projections, but price momentum is likely to push prices higher.

Market news:

- Despite promises to increase output, OPEC+ is running almost 0.8 mbpd below target. The shortfall does not appear to be driven by deliberate actions to reduce output, but by production problems among some smaller member producers. In addition, as we note below, both the UAE and the KSA have been suffering from missile and drone attacks, which may affect output as well.

- Bitcoin mining consumes massive amounts of power. Miners get the right to verify transactions by cracking complicated puzzles and are rewarded with bitcoin for their efforts. To solve these puzzles, tremendous computing power is required. The rating agency Fitch (HTV, USD, 108.35) warns that as mining activity rises in the U.S., utilities could struggle to meet the demand for power.

Geopolitical news:

- Last week, we reported on the Houthis drone attacks on the UAE. This group, based in Yemen and aligned with Iran, released new attacks this week on the UAE, but the missiles were intercepted by the U.S. military. The KSA and UAE are encouraging the U.S. to blacklist the Houthis due to the recent missile strikes. The Biden administration had removed the Houthis from the terrorist blacklist in February 2021 but is apparently considering putting them back on the list because of the recent attacks.

- Although Iran supports the Houthis, Tehran is trying to distance itself from recent missile attacks, especially against the UAE, which with Iran has positive relations.

- In light of rising tensions in Ukraine, there are increasing worries that a military incursion will lead to a disruption of natural gas supplies into Europe. Concerns about supply problems could make EU nations reluctant to enforce punitive sanctions or take other steps. The U.S. is trying to address these worries by securing natural gas supplies outside of Russia. In particular, the U.S. is working with Qatar to be a source of supply. One problem, however, is that more than 80% of Qatari gas is currently tied up in contracts with Asian states. Although contracts can be broken, there are usually costs involved, and making this gas available might relieve shortages in Europe but create supply problems in Asia. Higher prices may be unavoidable.

- Russia has proposed an interim agreement regarding the JCPOA, where Iran would scale back some of its nuclear activities in return for a partial withdrawal of sanctions. We don’t think the U.S. would agree to such an arrangement, but Iran has clearly stated it rejects the idea. Nevertheless, Iran has opened the door to direct talks with the U.S.

- The U.S. has indicated it won’t make a deal with Iran without the return of four Americans held by Iran. Iran has shown no sign it will release the four hostages.

- Kazakhstan, Uzbekistan, and Kyrgyzstan suffered major power outages this week. It is not clear what caused the outages, but given recent unrest in Kazakhstan, there are worries they may be tied to recent disturbances.

- After recent meetings, Iran’s hardliners are suddenly supportive of Moscow.

Alternative energy/policy news:

- The fossil fuel industry is facing an increasingly hostile investment and regulatory environment. However, it is important to note that the industry is not without allies, and a pushback against the aforementioned trend is developing. For example, the state treasurer of West Virginia is ceasing its use of a Blackrock (BLK, USD, 813.34) investment fund for banking transactions. Blackrock has been vocal about reducing investment in fossil fuels, which triggered the action by West Virginia. And, the state is not alone; 15 other states are joining the effort to oppose curtailing investment in the industry.

- Although the action by the states may slow the regulatory and investment measures to reduce fossil fuel consumption and production, generationally, the industry is likely fighting a losing battle. The young in the developed world oppose the industry and will become more powerful over time.

- Nuclear power remains a controversial issue. While Germany continues its phaseout of nuclear power, there is increasing investment elsewhere.

- At the same time, we are seeing roadblocks developing for solar power. Rooftop or distributed solar power usually relies on subsidies and, in some cases, generous programs to purchase excess power from homeowners. A coalition of utilities and labor unions is looking to curtail these incentives in California. Without careful structuring of incentives to benefit utilities and their workers, these elements of the industry are natural enemies against distributed power.

- Other issues are adversely affecting solar power, including tariffs (most panels come from China) and rising costs of installation.

- An unsung area that can reduce carbon emissions is improved consumption efficiency. Although building emissions are not the largest source of carbon, it is an important area and one that has not shown appreciable improvement. The administration is drafting new rules to incentivize improved efficiency in heating, lighting, and cooling commercial buildings.

- General Motors (GM, USD, 53.52) announced it will make a $7 billion investment in Michigan for battery production for EVs.

- Hydrogen is an old alternative to fossil fuels. To some extent, it has been the “fuel of the future and always will be.” In other words, it has been difficult to create and actually build out a hydrogen-based economy. Hydrogen has some attractive features; fuel cells, which use the fuel, are highly efficient. The gas can, in theory, be distributed through the existing fulling station network. Unfortunately, at present, most hydrogen is produced from using fossil fuels, making this a less attractive option. Notably, both Canada and China apparently are considering the development of hydrogen as an alternative fuel.

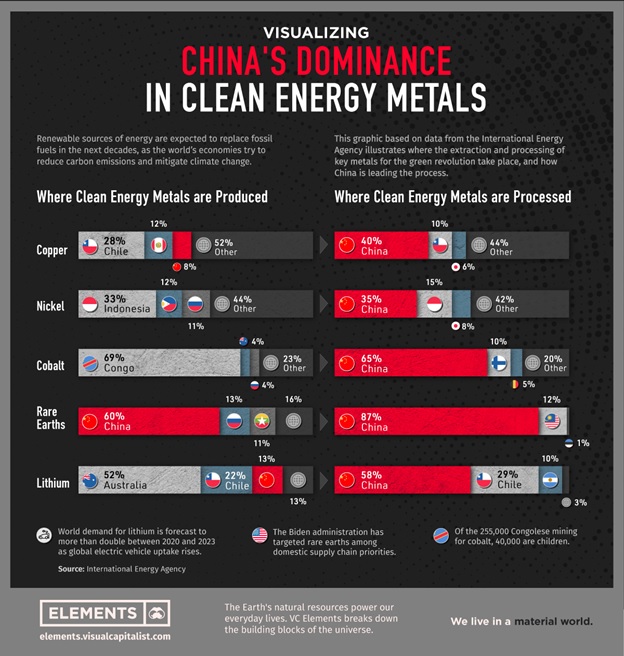

- Although China is a major source of key metals used in clean energy, it dominates the processing.

(Source: Visual Capitalist)

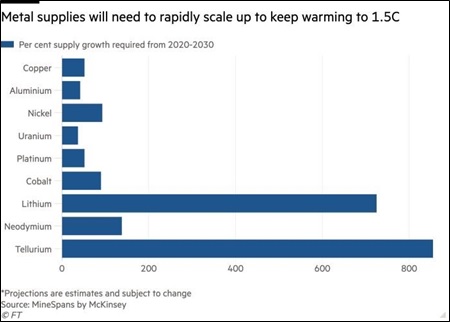

The chart below shows that demand for these metals will likely be robust, meaning that without strong investment, China will continue to dominate metals processing. It should be noted that processing these metals can be environmentally “dirty.” It may be difficult to process these metals in developed economies.

(Source: FT)

- Lithium prices have been extraordinarily strong due to rising demand and tight supplies.