Daily Comment (February 24, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s report will focus primarily on the Russian invasion of Ukraine. On this day of global crisis, we at Confluence express our gratitude to the members of the U.S. military and intelligence community who are standing by to serve and protect their fellow citizens.

Russia-Ukraine: Russian President Vladimir Putin declared a “special military operation” into Ukraine but stated that he has no plans to occupy the region. In justifying his actions, Putin blamed NATO’s expansion into Eastern Europe and his position has been supported by China and Iran. Putin has demanded that Ukraine accept Russian sovereignty over Crimea and renounce its ambition to join NATO. So far, Ukraine forces have been able to hold up against the attack, but it isn’t clear how long they can last. Ukraine President Volodymyr Zelensky has announced that his country will fight and has started to arm civilians. Reports suggest that both sides have seen casualties. The attack did not come as a surprise; hours before the attack, three Russian-guided missile cruisers made their way into the Black Sea and the Mediterranean Sea. Here are our initial thoughts surrounding the invasion of Ukraine.

- When we titled our 2022 Outlook: The Year of Fat Tails, we expected a year of outlier events. Russian belligerence was expected (the #2 risk in our 2022 Geopolitical Outlook), but this action is far out on the risk curve. Here’s why:

- NATO has been deeply fractured. French President Macron declared it “brain dead.” Given enough time, it is possible that NATO would have imploded. Invading Ukraine makes little strategic sense.

- Now, the treaty organization has a renewed reason for existing, and states that have been historically neutral (Sweden and Finland) will almost certainly coordinate with NATO and may petition to join. The organization that Putin opposes now will likely enlarge and strengthen.

- The actual nightmare for Russia isn’t just a renewed American interest in Europe but the remilitarization of Germany. Given the behavior of the U.S. over the past decade, it would not surprise us to see Berlin conclude that it needs to protect itself.

- We have little doubt the Russian military can defeat Ukraine’s forces, but this action could very well mean winning the battle but losing the war. Opposition to Russia will almost certainly solidify.

- Poland and other central European nations have invoked Article 4, which triggers internal meetings of NATO if a member sees an external threat to their “territorial integrity, political independence or security.”

- In addition, as the U.S. discovered in Afghanistan and Iraq, invading is one thing but controlling is something quite different. We would expect Russia to face a persistent insurgency. Moscow may overcome opposition, but it won’t be costless.

- Part of the invasion was a series of cyberattacks on Ukraine. The problem with such tools is that they can be hard to contain once released. Senator Warner (D-VA) warns that if one of these weapons “gets loose” and ends up harming a NATO member, it might trigger an Article 5[1]

- We expect the U.S. and Western reactions to center on sanctions in the short run. Most likely, the focus will be on denying Russia technology. But we also expect a surge in defense spending to fortify the region. Poland will become the new line of demarcation.

- There are reports that Russia may use cryptocurrencies to evade Western sanctions. However, given the selloff we have seen in crypto, this might not be a good option. In addition, if crypto is suspected to be used to avoid sanctions, the full regulatory and cyber powers of the U.S. might be levied against the product.

- One of the key components of this conflict is timing. Putin needs the invasion to be quick as the longer it takes to control Ukraine the more pain the Russian population is likely to feel because of the sanctions. The Russian population’s willingness to support the conflict may fade in the face of damaging sanctions. Thus, this invasion could potentially backfire on Putin in a major way if not ended soon. As a result, Russia has warned media outlets to not use sources not approved by the Kremlin.

- Market reaction has been about as expected. Treasury yields fell, the dollar, yen, and Swiss franc rallied, gold lifted, and oil prices jumped. On the other hand, risk assets fell. The behavior of cryptocurrencies should end talk of them being “paper gold.” Bitcoin and other currencies fell hard.

Other Russia and Ukraine-related news:

- As tensions escalate over Ukraine, the U.S. and its allies are now feeling the pressure to expand their military capabilities. We have mentioned in previous reports that China has been sympathetic to Russia over its security concerns and may be watching the Ukraine situation to see how the West might respond if it were to use similar measures to annex Taiwan. As news broke of the Russian incursion into Ukraine, China urged all sides to show restraint and pledged to resume trade with Russia.

- China’s decision to side with Russia has led many to speculate about its next moves. Taiwanese President Tsai Ing-wen called for the island to strengthen its military capabilities. Meanwhile, Admiral Mike Gilday called for increasing the U.S. fleet of ships to 500 by 2,040 to counter China if it decides to invade Taiwan. Thus, this invasion appears to be causing the U.S. to question whether it would like to forego its hegemonic role.

- Before the invasion, the European Union ratcheted up its sanctions against 23 high-ranking individuals on Wednesday as it tried to deter Russia from invading Ukraine. The list targeted banking executives, military chiefs, media officials, and a top Kremlin official. Following recent actions by Russia, the European Union will probably hit Russia with its harshest sanctions. So, neither the U.S. nor the EU is expected to cut off Russia from the SWIFT global interbank payment system, but this could potentially change.

Central Banks

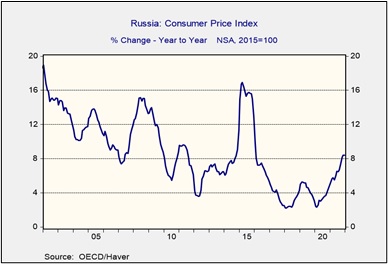

- The Bank of Russia has stated that it plans to intervene to prevent a financial crisis as it prepares for a robust response from the West. The central bank has ordered brokers to stop allowing traders to short Russian stocks. Additionally, the bank announced it would intervene in the foreign-exchange market after the ruble plunged to a record-low following the invasion. A declining ruble will likely hurt Russian households as it will make imports more expensive. At 8%, annual inflation is high by U.S. standards, but it is still much lower than the level it reached following its invasion into Georgia in 2008 and Crimea in 2014.

- Ukraine’s central bank has also taken measures to limit the damage the invasion will have on its financial system. It has suspended currency markets, limited cash withdrawals, and banned the issuance of foreign currency.

- In Europe, the European Central Bank is mulling whether to push back its plans to end its bond-buying stimulus program and begin rate hikes. There are concerns that the invasion could dip Europe into recession, so keeping policy easy to prevent these financial conditions may be seen as preferable to containing inflation.

- So far, the FOMC has sent no signals that it is retreating from its plans to normalize interest rates. However, we note that financial stress is rising, and over the past 30 years, the Fed has tended to avoid tighter policy when financial conditions are weakening. At the same time, with energy prices soaring, inflation worries will likely keep the pressure on to remove stimulus. So far, the 2-year deferred 3-month Eurodollar futures are still projecting at least 100 bps of tightening over the next two years.

Non-Ukraine news:

- States export taxes? As states grapple with ways to secure fuel supplies, the state of Washington has advanced legislation that would tax fuel shipped out of state. Washington plans to impose a six-cent-per-gallon tax on gas exported to other states. Neighboring states such as Oregon, Alaska, and Idaho have all voiced displeasure with the bill and Alaska has threatened to retaliate with an export tax of its own. That being said, the new tax would be the first of its kind in the nation and will probably be challenged in court. Washington has one of the highest gasoline prices in the country; thus, the export could be a way for the state to secure energy resources. However, the dispute over the fuel export tax may show how desperate states are becoming to rein in gasoline prices.

COVID-19: The number of reported cases is 430,148,646, with 5,920,054 fatalities. In the U.S., there are 78,731,240 confirmed cases with 941,909 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 687,728,405 doses of the vaccine have been distributed with 551,372,287 doses injected. The number receiving at least one dose is 253,179,401, while the number of second doses is 215,129,430, and the number who have received the third dose, granting the highest level of immunity, is 93,428,100. The FT has a page on global vaccine distribution.

- A new vaccine developed by companies Sanofi (SNY, $52.52) and GlaxoSmithKline (GSK, $42.50) achieved 100% efficacy against severe disease and hospitalization. The shot could be an effective booster.

- South Korea has approved the Pfizer vaccine for 5- to 11-year-olds.

[1] “The Parties agree that an armed attack against one or more of them in Europe or North America shall be considered an attack against them all and consequently they agree that, if such an armed attack occurs, each of them, in exercise of the right of individual or collective self-defence recognised by Article 51 of the Charter of the United Nations, will assist the Party or Parties so attacked by taking forthwith, individually and in concert with the other Parties, such action as it deems necessary, including the use of armed force, to restore and maintain the security of the North Atlantic area.”