Business Cycle Report (February 25, 2022)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

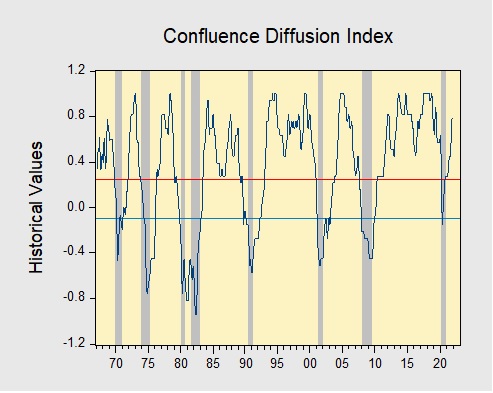

In January, the diffusion index rose further above the recession indicator, signaling that the economy remains in expansion. In financial markets, higher yields on Treasuries have weighed on equities. Meanwhile, manufacturing data suggests that supply chains are improving. Lastly, the labor market appears to be strong, with nonfarm payrolls surprising on the upside. That being said, ten out of the 11 indicators are in expansion territory. The diffusion index rose from +0.8182 to +0.84545, remaining well above the recession signal of +0.2500.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index currently provides about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures. A chart title listed in red indicates that the indicator is signaling recession.