Weekly Energy Update (March 3, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices are moving sharply higher as sanctions expand against Russia.

(Source: Barchart.com)

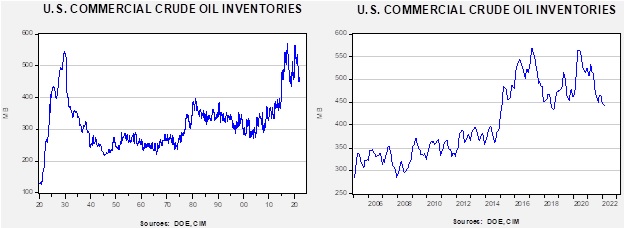

Crude oil inventories unexpectedly fell 2.6 mb compared to a 2.5 mb draw forecast. The SPR declined 2.4 mb, meaning the net build was 5.0 mb.

In the details, U.S. crude oil production was unchanged at 11.6 mbpd. Exports rose 1.1 mbpd, while imports dropped by the same amount. Refining activity rose 0.3%.

(Sources: DOE, CIM)

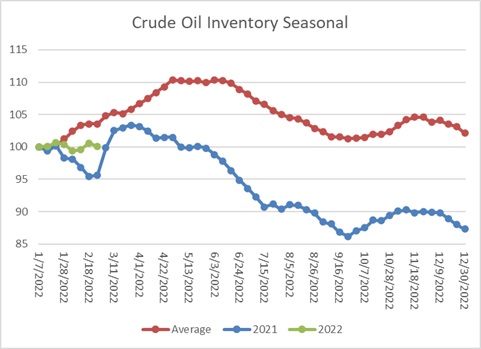

This chart shows the seasonal pattern for crude oil inventories. This week’s report shows we are “splitting the difference” between last year’s plunge and the usual rise seen in the 5-year average. Given all the turmoil in markets, it is more likely that inventories hold steady in the coming weeks until refineries begin to ramp up for summer driving.

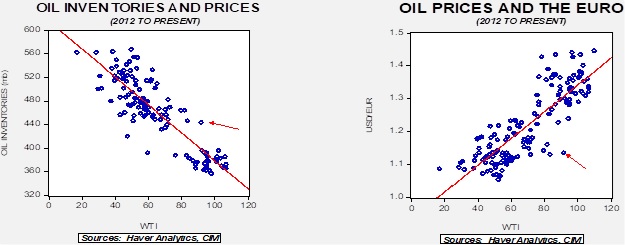

Based on our oil inventory/price model, fair value is $70.37; using the euro/price model, fair value is $54.44. The combined model, a broader analysis of the oil price, generates a fair value of $63.09. Current prices are being driven by ESG and geopolitics, so the usual impact of inventory and the dollar has been overwhelmed. However, the analysis shows that any sort of normalization will likely lead to lower oil prices; presumably, “normalization” may not return any time soon.

Market news:

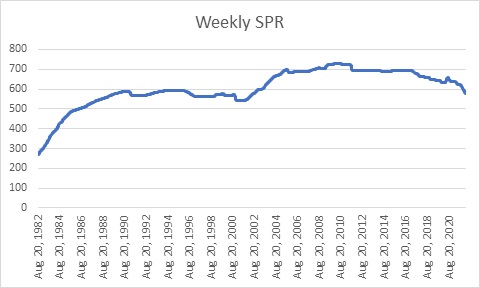

- As part of the war response, the U.S. and other nations announced a 60 mb oil release from SPRs. We are not sure this action will have much of a positive impact (it hasn’t thus far). As we noted last week, we expect the correlation between price and inventory to flip to positive in the coming weeks as consumers scramble to secure supply. One of the primary reasons for creating SPRs was to discourage hoarding. If consumers believe the SPRs can provide oil in a shortfall, they should be confident enough to avoid hoarding. Unfortunately, the U.S. has been steadily releasing oil from the U.S. SPR, so the psychological impact of the news has dampened.

- China’s decision to ADD to its SPR suggests that hoarding is likely starting to spread.

(Sources: DOE, CIM)

- This chart shows the weekly level of the SPR since August 1982. The current level, at 580 mb, is the lowest in nearly 20 years.

- Divestment efforts from fossil fuels continue, which will tend to reduce funds available for investment.

Geopolitical news:

- Needless to say, the war in Ukraine is currently the most important geopolitical event. The present situation is very fluid, and we recommend readers monitor our Daily Comment for daily updates. The war in Ukraine and the subsequent sanctions are earth-shattering, disrupting energy flows from a major oil producer. Although sanctions have purposely attempted to carve out energy flows, self-sanctioning activity by firms is leading to an unexpected disruption of the energy trade. Simply put, companies involved in the energy trade, from shipping companies, pipelines, commercial consumers, and banks that facilitate the energy trade, are worried about future sanctions and thus are shying away from handling Russian energy. The spread between Urals crude oil and Brent has widened dramatically as there is less of a market for Russian oil.

- The U.S. imports around 600 kbpd of oil and products from Russia; we expect these sales to be cut off soon. Our best guess is that Canadian oil will replace the lost Russian oil…at a higher price, of course.

- Supermajor oil firms that have had direct investment into the Russian oil industry are beginning the process of selling these assets. Losing access to Western drilling technology could hamstring Russia’s future oil production.

- The nuclear deal negotiations with Iran are in the background of the Ukraine War. Although we have been skeptical that a deal will be struck, the jump in oil prices creates a strong incentive for the U.S. to reach some sort of arrangement in a bid to bring oil prices down. A new snag has developed in the negotiations. Iran is blocking IAEA inspectors, who are key to establishing Iran’s compliance with any pact. Although successful talks will probably lead to a decline in oil prices, we doubt the drop will be sustained.

- Iran and Qatar have agreed to 14 different issues in recent talks as Tehran attempts to improve its standing in the world.

- Further evidence that the Middle East is preparing for a post-U.S. world emerged recently as Turkey and the UAE, who have been at odds in recent years, took steps to improve relations.

Alternative energy/policy news:

- It is not uncommon for environmental efforts to be reduced when oil prices rise. A recent report from the U.N. suggests that the impact of climate change is rapidly growing and could endanger about half the world’s population.

- Despite the potential for high oil and gas prices to undermine wind, solar, and nuclear energy, we note that wind power companies recently bid aggressively for ocean waters off the coast of New York.

- It is often said that the U.S. government’s regulatory bodies represent a fourth branch of government. This is because Congress often gives these agencies wide discretion in executing policy, perhaps more than legislators intended. Justice Gorsuch has been critical of this “4th branch” and is expected to curtail its power in cases brought to the Supreme Court. The court is considering whether to limit the EPA’s mandate on climate change and force Congress to draw up legislation to address the matter. If the court decides to limit regulators, it could slow the expansion of climate regulation.

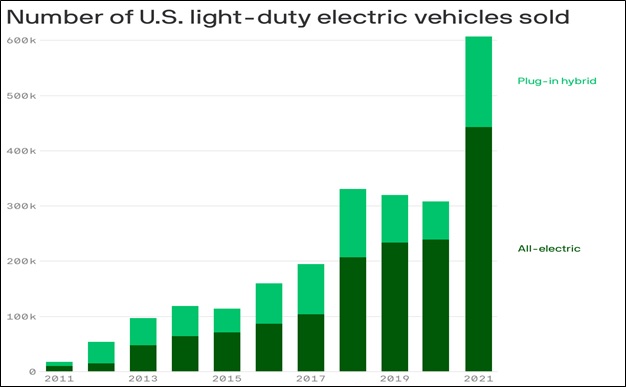

- Ford (F, USD, 18.19) announced it was splitting its business into EV and legacy units to focus on the energy transition and eventually wind down the internal combustion engine business. EV sales have been rising in recent years, and car companies expect higher sales in the future.

(Source: Axios)