Asset Allocation Weekly (June 3, 2016)

by Asset Allocation Committee

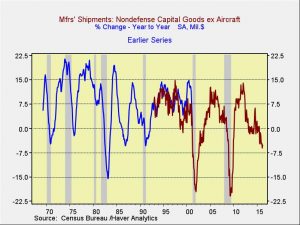

The prolonged weakness seen in capital spending is a concern for the economy and equity markets.

This chart shows the yearly change in the three-month smoothed non-defense capital goods orders excluding aircraft. The Census Bureau changed how it calculates this series in 1992; we have overlapped the yearly change in the earlier series. In general, a negative reading is a concern. It isn’t a certain signal of recession, and in some downturns it becomes weak late in the cycle, but, in any case, a persistent negative reading does suggest economic weakness. The only other time the yearly change in this number was this negative without being associated with a recession was in 1987.

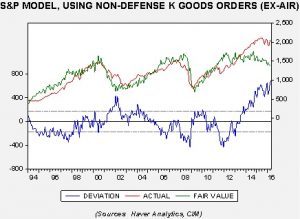

Taking this data from 1992 and regressing it against the S&P 500 suggests an overvalued equity market.

This chart shows the results of regressing non-defense capital goods orders, excluding aircraft, against the S&P 500. The orders data closely fit this equity index until around 2012. Based on this study, fair value is around 1383.

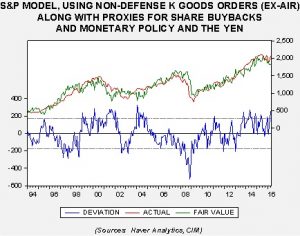

So, what is causing this divergence? We suspect monetary policy, the dollar and corporate behavior are affecting the equity market. Adding a proxy for buybacks and monetary policy, along with the yen’s exchange rate, reduces the degree of overvaluation.

Adding these proxies increases fair value to 1811, significantly reducing the degree of overvaluation. This is still well below the current market, but it does show how equity markets have become dependent on accommodative monetary policy, dollar strength and share buybacks. Without stronger corporate economic growth—which will boost the demand for investment goods—monetary policy tightening, regulation to reduce buybacks or a stronger yen could put pressure on equity markets. We remain supportive of equity markets, although we are only looking for single-digit gains, at best, due to current valuation levels.