Daily Comment (March 14, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine War. Concerns about a Russian missile strike close to NATO member Poland are being partially offset by positive signs for a diplomatic compromise. We next review a range of U.S. and international developments that could affect the financial markets today. We close with the latest news on the coronavirus pandemic.

Russia-Ukraine: Even as Russian forces continue regrouping for an expected new assault on the capital city of Kyiv, the key development over the weekend was a large Russian missile strike on a Ukrainian military training base just 10 miles from the Polish border. Illustrating the risk of escalation in the conflict, the U.S. responded with a stern warning that NATO would respond to even the slightest attack on any of its territory. In fact, even before the missile attack, Russian Deputy Foreign Minister Ryabkov warned that NATO’s arms shipments to Ukraine would be considered a valid target.

- At the same time, diplomatic efforts to end the conflict continue. In a long phone call Saturday, German Chancellor Scholz and French President Macron tried to persuade Russian President Putin to agree to an immediate ceasefire and seek a negotiated solution, but to no avail.

- On a more positive note, the lower-level Russian and Ukrainian officials who have met several times to discuss a ceasefire have begun to sound more conciliatory. Ukrainian negotiator and presidential adviser Mykhailo Podolyak said in a video posted online, “I think that we will achieve some results literally in a matter of days,” and the RIA news agency quoted a Russian delegate, Leonid Slutsky, saying the latest talks had made substantial progress.

- Neither side indicated what scope any near-term agreement might have. However, Ukrainian President Zelensky today said the negotiators are discussing a possible meeting between him and Putin.

- Separately, U.S. Deputy Secretary of State Wendy Sherman said Russia showed signs of willingness to engage in substantive negotiations about ending.

- The Russian and Ukrainian delegates are due to have another round of talks today, but this time by video conference.

- Perhaps even more important, we are seeing signs that the Chinese leadership has recognized the danger it’s in by aligning too closely with Russia. For example, a high-level Chinese foreign policy researcher has been allowed to publish an analysis arguing that President Putin is bound to lose the war, which will strengthen the U.S. and the Western liberal democracies that, in China’s view, had been in decline. The researcher argues that China, therefore, must cut its ties to Putin and help bring about a negotiated settlement so it won’t be isolated from the newly strengthened West in the future.

- Amid reports Russia has asked China for military equipment and other assistance in its war against Ukraine, U.S. National Security Advisor Sullivan will discuss the situation today in Rome with top Chinese foreign affairs official Yang Jiechi.

- Sullivan is expected to warn China against trying to bail out Russia and impress upon Yang the reputational damage China is suffering by standing by Russia.

- We continue to see a high risk that the war could broaden and escalate. Without a doubt, the economic and financial repercussions already set in motion will continue, from skyrocketing prices for energy and other commodities to a long-term risk that the U.S. dollar might lose its attractiveness as a global reserve currency (although it’s important to note that some countries, including major commodity suppliers like Canada and Australia, are benefitting). Those factors point to a high possibility of a near-term recession or stagflation, consistent with the market action we’ve recently seen in equities, bonds, commodities, and currencies to date.

- All the same, the reinvigoration of the U.S. and NATO plus the rising geopolitical costs for Russia and China (not to mention the horrible direct costs for Ukraine) suggests that a sudden, unexpected diplomatic breakthrough can’t be dismissed out of hand.

- In particular, if China’s leaders change their minds about supporting Russia and pivot toward active peacemaking, there may be some chance for a quicker and more positive end to the war than now seems possible. It’s still too early to predict such an outcome, but investors should keep in mind that it is a possibility. Indeed, the relatively more optimistic comments coming from the Russian and Ukrainian negotiators have already given a modest boost to stock markets today and are helping push down oil prices.

United States-Venezuela: Faced with a massive political backlash, the Biden administration has backed off its outreach to Venezuela for additional oil supplies that could help bring down fuel prices. For now, it suggests Venezuela will remain isolated internationally and will have little ability to rejuvenate its oil industry or its oil exports to the U.S.

United States-Iran: The U.S. has turned down a Russian demand for sanctions relief before it would help push a revived Iran nuclear deal over the goal line. For at least the time being, that has put a pause on the deal, keeping Iranian crude oil largely unavailable to world markets and helping keep energy prices high.

Taiwan: For the second time this year and the seventh time since the start of 2020, the island’s military said one of its jet fighters has crashed into the sea. The pilot, who ejected and was rescued, said a mechanical problem brought the plane down.

- The incident buttresses concern about the high operating tempos forced on the Taiwanese air force as it responds to Chinese planes’ frequent challenges to the island’s airspace.

- The Chinese intrusions into Taiwan’s aircraft identification zone probably aim in part to wear down the island’s military forces and probe for its weaknesses. If successful, those intrusions could eventually encourage China to try to take control of Taiwan, likely setting off a major international crisis that would drive asset prices lower.

Colombia: As anticipated, ex-Marxist guerilla Gustavo Petro won yesterday’s left-wing primary election, confirming he is the man to beat in the May 29 presidential vote. In addition, Petro’s coalition did well in legislative elections and will be one of the biggest blocs in the next parliament.

- Petro’s performance confirms that political winds in Latin America continue to blow to the left, threatening the region’s free-market, private-property-oriented economic policies.

- The continued leftward trend threatens to undermine Latin American asset values going forward.

United States: With apartment rents rising rapidly, legislators across the U.S. are again looking to enact rent control, reviving measures largely shunned in recent years. These proposals, which would generally allow landlords to boost monthly rents by no more than 2% to 10%, are on the legislative agenda in more than a dozen states.

COVID-19: Official data show confirmed cases have risen to 456,908,767 worldwide, with 6,041,077 deaths. In the U.S., confirmed cases rose to 79,517,492, with 967,552 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 216,647,869, equal to 65.3% of the total population.

- In the U.S., the seven-day average of people hospitalized with a confirmed or suspected COVID-19 fell to 29,177 yesterday, down 43% from two weeks earlier.

- In China, new locally transmitted cases tripled to more than 3,100 over the weekend, marking the country’s worst outbreak in two years. In response, authorities in the southern metropolis of Shenzhen imposed a new set of restrictions. For example, bus and subway services will be suspended beginning on Monday, and residents will be urged to work from home and step out only to buy daily necessities.

- Just as important, the Shenzhen shutdown will force a number of manufacturing facilities to shut down for a week or more.

- Since that portends potentially broader negative effects for the Chinese economy, the news contributes to today’s downdraft in energy prices. The burgeoning infection rates are also driving Chinese equities down sharply today.

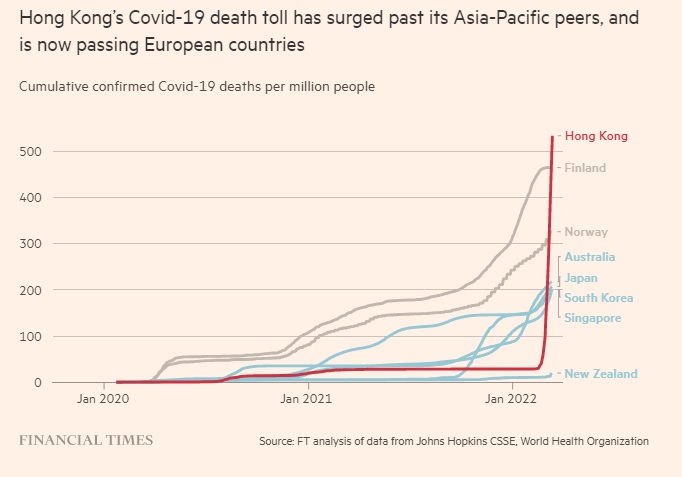

- Outside the mainland, Hong Kong is facing even greater infections, in large part because many of its elderly residents still aren’t vaccinated. The city’s death toll per million people has now surpassed that of the worst-hit European countries and all of its main peers in the Asia-Pacific region (see graph below).