Daily Comment (April 6, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where little has changed militarily over the last day, but geopolitical and economic pressures on Russia continue to mount. We next review a range of international and U.S. developments with the potential to affect the financial markets today. We wrap up with our pandemic coverage.

Russia-Ukraine: Militarily, reports continue to indicate that the Russian invasion forces in western Ukraine around the capital city of Kyiv are being pulled back, apparently for reequipping and regrouping before being redeployed to Kharkiv, the Donbas region of eastern Ukraine, and the country’s southeast coast. Other fresh units based in Russia proper are also reportedly being prepared for action in eastern Ukraine. In the meantime, the Russians continue to attack civilian areas throughout the country with artillery, missiles, and aerial bombs. Simultaneously, Ukrainian officials continue to unearth evidence of apparent war crimes in areas previously occupied by the Russians.

- In his virtual speech to the UN Security Council yesterday, Ukrainian President Zelensky warned that evidence of even more horrendous atrocities was likely to be uncovered. In frustration that the UN probably can’t take action because of Russia’s permanent seat on the Security Council, Zelensky called for it to be reformed or dissolved.

- Indeed, the UN is probably a major loser because of the war. Since Russia has a veto over Security Council decisions by virtue of its seat in the group, it has been able to thwart UN efforts to stop the war. The crisis has shown the UN to be powerless in disciplining permanent Security Council members and their allies.

- Although the UN continues to enjoy public support for many of its initiatives, from food aid to helping set trade standards, its ineffectiveness in stopping the war will likely fuel calls for it to be reformed or dissolved, just as Zelensky demands. As the world fractures into at least a U.S.-led bloc and a rival Chinese/Russian-led bloc with diametrically opposed values and policy aims, having all three of those lead countries on the Security Council will probably be a recipe for permanent stalemate.

- Dismantling the UN system may not seem like a direct threat to investors, but it would probably be quite important.

- Without a common and accepted forum for addressing global political disputes, the evolving blocs would be more likely to operate under a “might makes right” ethos in which destructive wars would be harder to avoid.

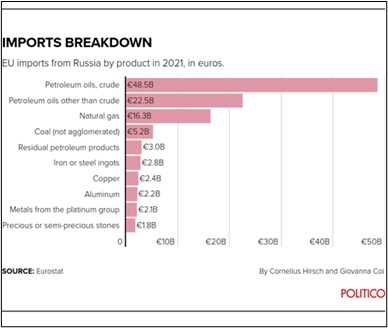

- Meanwhile, the U.S. and its Western allies continue to impose new sanctions on Russia. The U.S. today will reportedly announce a new package of sanctions that would include a ban on all new investments in Russia. Looking ahead, several senior, centrist European officials are now even calling for a ban on Russian oil and gas imports (for a breakdown of Europe’s major imports from Russia, see graph below). Press reports indicate the previously announced sanctions are already having an impact within Russia.

- Just days after the U.S. Treasury Department blocked U.S. banks from handling dollar payments from Russia, halting $649 million of interest and principal payments on a Russian dollar bond, the Russian government said it would try to make the payment today in rubles.

- According to the Russian government, payments will instead be deposited into ruble-denominated accounts in Russia; the proceeds can be converted into dollars following the “restoration of the Russian Federation’s access to foreign currency accounts.”

- While the Russian action illustrates the government’s effort to avoid an international bond default, the tough stance by the U.S. Treasury Department underscores how divergent the two sides are operating in the midst of the war.

- In other economic fallout from the war, it turns out that crude oil isn’t the only type of oil being affected. The war has also sparked a global shortage of sunflower oil, which has, in turn, pushed prices of other edible oils to record highs, hitting food makers and consumers already grappling with inflation. Separately, the International Committee of the Red Cross yesterday warned a quarter of Africa’s population is facing a food-security crisis driven by severe drought, raging wars, and a rise in world food prices caused by Russia’s invasion of Ukraine,

Hungary: Just days after Prime Minister Orban, a right-wing nationalist and Russia sympathizer, scored reelection by a landslide, the European Union has launched a process that could allow it to impose financial penalties on Hungary for corruption and rule-of-law abuses. Use of the “conditionality mechanism” could jeopardize some of the €24 billion that Budapest is due to receive up to 2027.

Sri Lanka: The country is facing a foreign exchange crisis as its government grapples with looming debt payments, widespread protests, and an economic emergency. After President Rajapaksa yesterday was forced to end emergency rule imposed just days earlier, the Sri Lankan rupee is hovering near 300 per dollar. It is down 32% year-to-date and lagging even Russia’s ruble.

- The crisis stems in part from rising commodity prices following the outbreak of the Ukraine war, as well as rising interest rates around the world.

- The crisis, therefore, illustrates how emerging markets around the world are facing growing economic, social, and financial risks.

U.S. Monetary Policy: Federal Reserve Governor Brainerd, who has ordinarily been considered a dove on inflation, yesterday said “it is of paramount importance” for the central bank to start reducing today’s fast price increases, both by hiking interest rates and selling down its portfolio.

- Brainerd’s statement sparked a sharp sell-off in longer-maturity bonds, with the yield on the 10-year Treasury note jumping to 2.600% from 2.409% on Monday.

- With the jump in longer-term yields, the yield curve inversion that began last week was erased—just barely. By day’s end, the yield on the 2-year Treasury note stood slightly below the 10-year yield at 2.580%.

- Fed policymakers are clearly in a panic over inflation and currently plan to tighten policy aggressively to fight it. We should learn more about their plans later today when they release the minutes from their March meeting. Nevertheless, we continue to doubt that the policymakers will be able to hike rates as fast or as far as they intend without exposing financial fragilities or unduly slowing the economy.

U.S. Agriculture: Amid the search for hedges against galloping inflation, investors are reportedly ramping up their purchases of U.S. farmland and driving up prices. Land values in the Midwest grain belt have gained 25-30% in just the past year, and auctions draw intense bidding for available ground. Real estate investment trusts (REITs) focused on farmland, such as Farmland Partners (FPI, 13.83), have also been strongly appreciating.

COVID-19: Official data show confirmed cases have risen to 493,765,532 worldwide, with 6,159,580 deaths. In the U.S., confirmed cases rose to 80,209,061, with 982,585 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who are considered fully vaccinated now totals 217,955,850, equal to 65.6% of the total population.

Virology

- In the U.S., the seven-day average of people hospitalized with a confirmed or suspected COVID-19 came in at 15,383 yesterday, down 27% from two weeks earlier.

- Even though new cases and hospitalizations remain low in the U.S., the Omicron BA.2 variant that has been sweeping through parts of Europe and Asia is starting to boost cases in the northeast U.S. The mixed signals are prompting officials to warn that BA.2 will likely lead to a more viral transmission. There is hope among public-health experts that warming weather and built-up immunity in the population are muting the variant’s impact.

- In China, the authorities recorded more than 16,400 new local cases on Monday, the highest daily tally in mainland China in more than two years. Over 80% of the latest daily cases were in Shanghai.

Economic and Financial Market Impacts

- Also in China, new data shows the government’s strict lockdowns have had a devastating effect on the country’s service sector. As shown in the data tables below, the March Caixin services PMI dropped all the way to 42.0 from 50.2 in February. Like all major PMIs, the Caixin services PMI is designed so that readings below 50 point to contracting activity.

- Separately, the lockdowns are also exacerbating serious shortages of fertilizer, labor, and seeds, just as many of the country’s biggest agricultural provinces prepare for their crucial spring planting season. According to official data, as many as a third of farmers in northeastern Jilin, Liaoning, and Heilongjiang provinces have insufficient inputs after authorities sealed off villages to fight the pandemic.

U.S. Policy Responses

- As early as today, the Biden administration will announce plans to extend until the end of August a pause on federal student-loan payments.