Weekly Energy Update (April 7, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices remain volatile, moving on war news. The SPR release will likely be bearish for prices. Technically, the oil chart appears to have a descending triangle, which is often a bearish pattern.

(Source: Barchart.com)

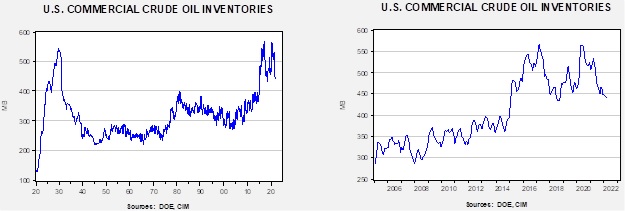

Crude oil inventories rose 2.4 mb compared to a 2.9 mb draw forecast. The SPR declined 3.7 mb, meaning the net draw was 1.3 mb.

In the details, U.S. crude oil production rose again this week by 0.1 mbpd to 11.8 mbpd. Exports rose 0.7 mbpd, while imports were unchanged. Refining activity rose 0.4% and is now 92.5% of capacity.

(Sources: DOE, CIM)

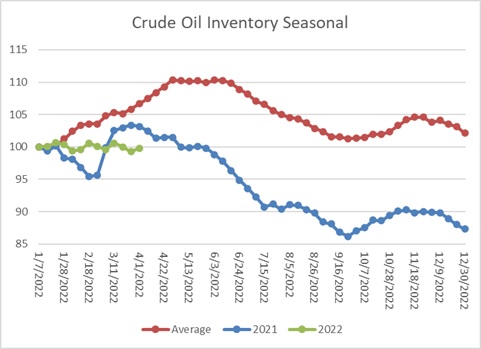

This chart shows the seasonal pattern for crude oil inventories. Last year, oil stocks peaked in early April and fell steadily into September. With the announcement of the SPR release (see below for details), we should see rising commercial stocks in the coming weeks. However, the actual pattern will depend on the logistics of the sale.

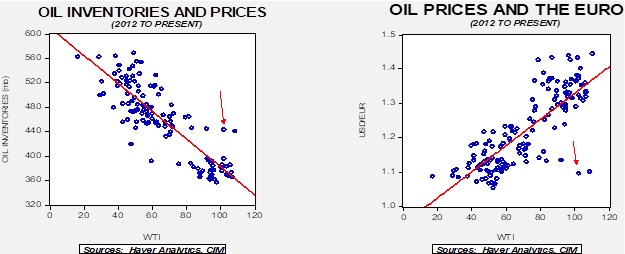

With so many crosscurrents in the oil markets, we see some degree of normalization. For the time being, we would expect oil to fluctuate between $105 to $90 per barrel, with a bias to the downside in the short term. However, we doubt the SPR release will be a long-term bearish factor, and if the war drags on, there is a growing likelihood the price will rise and return to recent highs.

The SPR Release

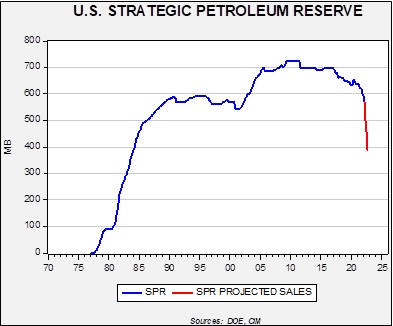

Last week, the administration announced the largest sale from the Strategic Petroleum Reserve in its history. The plan is to release 1.0 mbpd for 180 days. The chart below shows the projected sale’s effect on the SPR.

The IEA announced other nations would join in the sale, although amounts were unspecified. There are a number of reasons and features for the sale. Here are the points we found interesting:

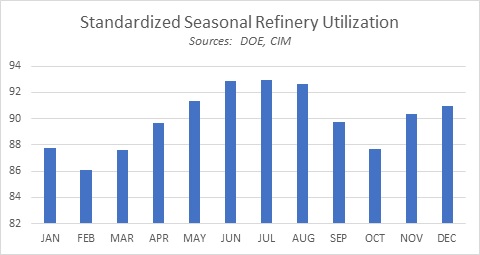

- The White House made it clear that the goal of the release was to lower gasoline prices. To a great extent, the success of that outcome will be dependent on several variables. For example, this week’s refinery utilization report shows that 92% of capacity is currently in use. That is elevated relative to seasonal norms.

This chart shows standardized seasonal refinery utilization. As the chart shows, refineries engage in maintenance in the winter and autumn. Our current reading for utilization is 92.5%, which is near the usual peaks seen in summer. Although run rates in excess of 95% are not unprecedented, they only occur about 9.4% of the time. The bottom line is this: although increasing the availability of crude oil will help reduce gasoline prices, gasoline supplies depend on refining. With capacity approaching levels we consider constrained (any reading above 95%), the impact of the additional oil will likely be lessened by the lack of excess refining capacity.

- Policymakers of all stripes tend to miss second-order effects. Often, they don’t anticipate the reactions of consumers and producers that can thwart the goals of a policy action. In this case, the unknown is how oil producers will react to the announced SPR release. In a nutshell, it would make sense for producers to reduce output and investment in the face of the release. Essentially, the administration wants oil producers to increase output while the SPR policy is designed to lower prices. Economic theory would suggest this isn’t likely.

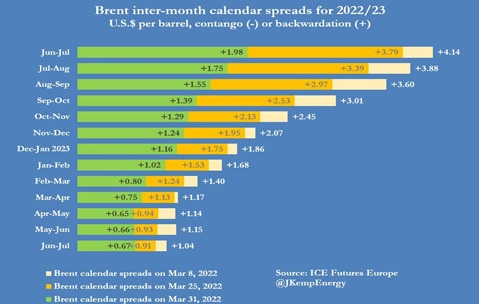

- The administration is promising the oil sold will be replaced at some point in the future. That assertion has led calendar spreads to narrow; deferred contract prices rose in anticipation of government buying to replenish the SPR.

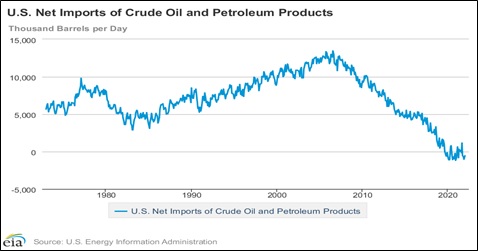

We harbor serious doubts this oil will ever be replenished. As the SPR chart above shows, with the exception of a modest rebuilding in mid-2020, stocks have been drawn down since peaking in 2011. Buying oil requires a budget decision, and there is always something else that a government would rather spend money on. In addition, given that the U.S., on balance, is a small net exporter, it isn’t obvious why an SPR exists. After all, the IEA requires OECD nations to hold 90 days of net oil exports. The U.S., by this measure, is over reserved.

Perhaps a more important issue is that the goal of climate change policy (see below for recent reports on the topic) is to reduce fossil fuel consumption dramatically. If it is successful, the SPR could become a stranded asset. Thus, refilling it seems like an exercise in futility.

- Finally, although the SPR system is designed to move 4.4 mbpd out of storage, and the current withdrawal is less than a quarter of that maximum, there could be logistical issues. The SPR has never been drawn down at this level before. The pipeline system has changed over time, and the pipelines connected to the salt caverns in Texas and Louisiana also move shale oil. It is possible that the SPR oil will displace shale, leading to declines in production or other snags. We do expect that after a few weeks, the kinks will be worked out. But market participants should not be surprised if there are problems initially, so it may take more time than our chart above suggests.

Market news:

- The FDIC has released risk management guidelines on climate change issues. The financial services industry has been facing increasing scrutiny on lending to and investing in the energy industry, and these guidelines will likely lead to further restrictions against financial support.

- By all accounts, there is consistent evidence that oil producers are being cautious about expanding output. As we reported last week, the Dallas FRB noted investors are demanding capital discipline, and this is the most important factor in restraining production increases. The SPR release isn’t likely to ease capital discipline.

- The KSA has announced price increases for its Asian customers.

- Falling water levels at Lake Powell could reduce hydroelectric power in the summer.

Geopolitical news:

- As the Russian withdrawal from the areas around Kyiv reveals atrocities, European nations are facing increasing pressure to embargo Russian fossil fuels. The EU appears ready to ban Russian coal. Lithuania announced it has cut off Russian natural gas imports. Germany has been reluctant to embargo Russian oil and gas, but recent research suggests the impact may not be as negative as feared. However, Britain has continued imports of Russian diesel; Russia supplies about 20% of the U.K.’s diesel fuel.

- As sanctions encourage disinvestment, we are starting to see foreign asset seizures. Germany announced it was taking control of Gazprom’s (GAZP.MM, RUB, 252.90) Germania, a storage, transmission, and trading firm that operates in Germany.

- Russia has a problem. It can sell natural gas and oil to Europe and, under its contractual arrangements, receives euros. However, due to financial sanctions, there is little Russia can do with these funds. Essentially, Russia is selling fossil fuels to Europe for nothing. In response, Russia is demanding “hostile nations” pay for energy in rubles. In theory, this change isn’t all that important, because a buyer like Germany, for example, could go to the bank, buy rubles, and pay for the gas. But Russia doesn’t necessarily want rubles as much as it wants Western goods (e.g., semiconductors, aircraft parts, etc.) Putin could force Europeans to sell such items to Russia to obtain rubles that could be used to buy fossil fuels. The EU is balking. Russia’s plan has led the German government to lay out emergency measures to deal with a shortage of natural gas.

- Although negotiations seem eternal, there are reports that the U.S. and Iran are near a deal on reviving the 2015 nuclear deal.

- The Brazilian state oil company Petrobras (PBR, USD, 14.91) remains without a CEO after the most recent appointee, Adriano Pires, turned down the job. Rising fuel prices have led Brazilian President Bolsonaro to fire the last two heads of the company. Pires, an energy consultant, concluded he would have conflicts of interest if he took the position.

Alternative energy/policy news:

- The U.N. released its update on mitigating climate change. Overall, the report suggests that nations are not moving fast enough to contain emissions that contribute to climate change; thus, risks are rising. There are reports that the S. and China pushed to delay the release of the report, concerned about recommendations that would adversely affect economic growth.

- In light of these warnings, there is growing interest in direct carbon capture from the atmosphere.

- Australia is seeking to replace Russian natural gas with exports of green hydrogen to Europe.

- The Biden administration is using the Defense Production Act to secure key minerals for EV batteries. The act can force companies to give priority to government contracts and allow the government to provide loans and grants to build capacity. Rising EV production reveals that the supply chains for key metals are vulnerable. The rising price of battery materials is already causing problems for automakers.

- Solar energy firms are becoming increasingly critical of U.S. trade policy.