Daily Comment (April 11, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where both sides are preparing for a new phase in which Russia will focus on seizing only eastern and southern Ukraine. We next review a range of international and U.S. developments with the potential to affect the financial markets today. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: The military situation in the war remains in a relative lull, with Russian forces having pulled out of western Ukraine, including the region around the capital city of Kyiv, to regroup and reequip for an effort to seize control of the eastern Ukrainian region of Donbas and the country’s southern coastline. In the meantime, Russian forces continue to attack a range of military and civilian targets with artillery, missiles, and aerial bombs. Satellite imagery and other intelligence suggest Russian ground forces are already deploying into battle positions in eastern Ukraine, although some analysts think they will need several more weeks of preparation before launching major new assaults.

- In any case, the next phase of the war is likely to look much different from the first. Rather than the Ukrainians holding off the Russians with insurgency-style, hit-and-run attacks with small units, the next phase concentrating on Donbas will likely look much more like World War II, marked by prolonged, pitched battles between large formations of tanks, armored personnel carriers, artillery, and other equipment. Those characteristics will probably favor the Russians and their preponderance in equipment and personnel. Nevertheless, they are still likely to be hindered by poor morale and losses in the war to date. Reports indicate the Russians are calling up some 60,000 reservists to augment their forces for the coming battles.

- The Russians have also abandoned their disastrous decision to run the war from Moscow. Instead, President Putin has reportedly named Army Gen. Aleksandr Dvornikov to command the Russian attack on the ground in Ukraine. Dvornikov is famous for having led Russia’s successful intervention in Syria almost a decade ago, but it is important to remember that the highly motivated, professionalized, well-equipped Ukrainians are likely to be a much tougher adversary than Dvornikov faced in Syria.

- On the economic front, S&P late Friday downgraded Russia’s sovereign foreign debt to “selective default,” saying it didn’t expect that the rubles Moscow deposited in payment on debt due last week could ultimately be converted into dollars as required by the loan documents. Failure to pay under the terms of the documents would mark Moscow’s first default in more than 100 years.

- In other economic fallout from the war, Western Europe continues to struggle with the challenge of weaning itself off Russian energy. In Germany, the chief executive officer of major utility E.On (EONGY, $11.29) ruled out extending the life of its sole German nuclear power plant, which is due to go offline at the end of this year. According to the CEO, “There is no future for nuclear in Germany, period. It is too emotional. There will be no change in legislation and opinion.”

France: In the first round of presidential elections yesterday, centrist President Macron and the far-right firebrand Marine Le Pen came out on top, setting them up for a head-to-head matchup in the second and final round on April 24. With some 97% of the votes counted, the tallies currently show Macron winning 27.6% and Le Pen 23.4% of the first-round votes, ahead of the far-left candidate Jean-Luc Mélenchon with 22.0%. Le Pen benefited from a late surge that reflected widespread disaffection over inflation, security, and immigration.

- Two polls right after the vote indicated that Macron would narrowly beat Le Pen in the run-off. One poll found Macron would win the run-off by 52% to 48%, within the margin of error. The other poll showed he would win 54%-46%. Along with Macron’s slightly better-than-expected showing on Sunday, this has given a boost to both the euro and French stocks so far today.

- Le Pen has been skeptical of the EU, and she said she would withdraw from NATO’s military command structure. In addition, she has expressed admiration for Russian President Putin. As with nationalist populists in many countries, Le Pen performed best among the less educated, traditionalist, and rural electorate.

- A Le Pen win signals the continued power of right-wing populists in Europe.

- If she wins, it will also signal a potential fracturing of the EU and the acquiescence of a major European power in Russia’s invasion of Ukraine.

Pakistan: After Prime Minister Khan was ousted in a no-confidence vote over the weekend, parliament today is set to confirm opposition leader Shehbaz Sharif as the country’s new leader.

- The move will end weeks of political uncertainty that fueled a devaluation of the rupee, pushed down the stock market, and forced the central bank to raise interest rates.

- However, Sharif’s appointment as the new prime minister doesn’t necessarily imply good governance and bright economic prospects going forward.

- Sharif, the former chief minister of the country’s largest province, is the brother of a former prime minister who was jailed on corruption charges.

- Sharif will inherit a $6 billion IMF loan program, which has involved unpopular measures such as raising utility prices.

Mexico: President Andrés Manuel López Obrador was projected to win more than 90% of his referendum questioning whether he should serve out the second half of his six-year term. However, the turnout was below 20%, well short of the 40% needed for the result to be binding. Many critics and opponents of the president considered the poll a farce or mere grandstanding.

U.S. Labor Market: Evidence continues to suggest that more retirees may be returning to the labor market, which could potentially help relieve labor shortages and hold down wage rates. Perhaps driven by the steep rise in consumer price inflation, more than 480,000 aged 55 and over started working or looking for work in the past six months, compared with just 180,000 who entered the labor force in the six months before the pandemic struck.

U.S. Financial Market: The Federal Reserve continues to tighten monetary policy; state and local governments have responded by calling off bond issuances and spending down their federal stimulus cash. As a result, bond issuance by state and local governments dropped 8% in the first quarter from a year earlier. At the same time, data show that spooked investors yanked money from municipal-bond funds, which suffered their biggest quarterly outflows since 2013.

Global Electrical Vehicle Industry: The CEO of major Australian lithium producer Lake Resources (LLKKF, $1.38) warned that if Western governments and companies can’t find a way to break China’s dominance in raw material supply chains, battery manufacturers will continue to confront a severe lithium shortage, and the West’s electrical vehicle industry will be hampered.

COVID-19: Official data show confirmed cases have risen to 498,154,313 worldwide, with 6,176,420 deaths. In the U.S., confirmed cases rose to 80,399,474, with 985,482 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who are considered fully vaccinated now totals 218,377,792, equal to 65.8% of the total population.

Virology

- In the U.S., the seven-day average of people hospitalized with a confirmed or suspected COVID-19 came in at 15,058 yesterday, down 18% from two weeks earlier.

- Meanwhile, the big new wave of infections continues in China, South Korea, Vietnam, and some other Asian and European countries. In Shanghai, new infections hit another record for the 10th straight day. Fearful of the rapid spread in that city, the tech hub of Shenzhen has launched dramatic new testing and isolation protocols that will likely have major economic impacts.

Economic and Financial Market Impacts

- As China keeps responding to its vast new wave of infections by clamping down even harder on its economy, supply disruptions and shutdowns at key factories are raising concerns about an outright tailspin for the economy, driving Chinese stocks sharply lower today.

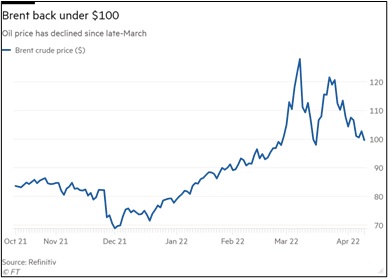

- More broadly, China’s draconian shutdowns are also prompting worries about a fall in global oil demand, which is weighing on global oil prices. So far today, Brent crude has fallen about 3.5% to $99.44 per barrel.