Daily Comment (April 13, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including a discussion of the trend toward ever-greater U.S. and European sanctions, weapons shipments, and alliance building against Russia, which are likely to lead to greater risks over time. We next review a range of international and U.S. developments with the potential to affect the financial markets today and conclude with the latest news on the coronavirus pandemic.

Russia-Ukraine: Russian forces continue to regroup, reequip, and reposition for a concentrated effort to seize control of the Donbas region of eastern Ukraine and the country’s southern coast. The initial skirmishes in that effort are apparently already taking place, and it looks like Ukrainian forces in the besieged southeastern port city of Mariupol may not be able to hold out much longer, and the Russians’ main attack may still be a week or two away. In the meantime, the Russians continue to attack both military and civilian targets with artillery, missiles, and aerial bombardment. Separately, Ukrainian officials said they thwarted a planned Russian cyberattack against the country’s electric grid last Friday. That success not only illustrates the continued risk of cyberwarfare in the conflict but probably shows the effectiveness of U.S. and Western cyberdefense aid provided to the Ukrainians. Finally, in his first extended remarks on the war in several weeks, Russian President Putin said ceasefire negotiations with the Ukrainians are at a dead end. Consistent with the reports from various Western leaders who have met with Putin in recent months, Putin also signaled no intention to moderate Russia’s attacks or goals. He insisted his forces would achieve complete victory in the war.

- To cut Italy’s reliance on Russian energy, Prime Minister Draghi and Algerian President Tebboune have struck a deal under which Algeria will boost its natural gas exports to Italy by 40% in 2023 and 2024. Algeria would then displace Russia as Italy’s top source of gas, although significant investment will be needed to boost Algerian output to accommodate the increase.

- Finally, we think Putin’s unyielding position on the war and insistence on pressing forward will force the U.S. and its NATO allies to continue ratcheting up their economic sanctions, weapons transfers, and other involvement in the conflict. It’s increasingly clear that Putin is now fully committed to the goal of recreating a vast, powerful new Russian Empire and will only back down if he is confronted with undeniable defeat or driven from power. The U.S. and its allies will likely increase pressure on him gradually, in a process that will require taking ever-greater risks—probably up to the same level of risks taken during the Cuban Missile Crisis in 1962.

- First, we suspect the West will focus on ratcheting up its economic sanctions, ultimately to the point of banning at least some imports of Russian oil and gas. The momentum is moving in that direction even though a major study released today suggests that a full EU embargo on Russian energy would trigger a major recession in Germany, sending output down 2.2% next year and wiping out more than 400,000 jobs.

- Second, we believe the continuing bloodshed, Russian atrocities, and Russian aggressiveness will spur ever-greater risks in terms of the weaponry provided to Ukraine. We note that a new military aid package that President Biden is expected to unveil today will reportedly include Soviet-era Mi-17 helicopters and sea drones. Ultimately, the tanks, artillery, and fighter jets that have been so controversial up to now will probably be provided to the Ukrainians as well.

- Third, we think President Putin’s intransigence in prosecuting the war in Ukraine could be taken as a signal of what the rest of Europe can expect as long as he’s in power, and that will probably drive more front-line countries to join NATO. For instance, Finnish Prime Minister Marin today said her country would decide whether to apply for NATO membership within weeks, despite Russian threats to retaliate against any such move.

- To understand the fourth and last level of allied commitment, it’s only necessary to ask what happens if economic sanctions, weapons shipments, and a bigger NATO all fail to stop the Russians, especially in the event that Russian war crimes intensify to include chemical attacks or the use of tactical nuclear weapons. As it becomes clearer that the Russian military is under-resourced, logistically incompetent, poorly led, and morally bankrupt, more observers will argue that while Russia can inflict severe damage on unarmed civilians, it is militarily little more than a paper tiger, and the U.S. and its allies should intervene to put a stop to the carnage. Such an intervention could well extend to the allies deploying their own airpower or even their own troops on the ground. The risk is that Putin might then be convinced that he is backed into a corner, at which point he might be tempted to use the most powerful weapons in his arsenal. In other words, despite the ebb and flow of conventional warfare that will likely play out in the coming weeks and months, the war will continue to present enormous risks to the global polity, economy, and financial markets for as long as President Putin is in power.

U.S. Monetary Policy: The last 24 hours have included a range of developments related to the Federal Reserve. The first development to report is simply that former Treasury Department official Michael Barr has emerged as the Biden administration’s top choice to be the Fed vice chairman for regulation, following the withdrawal of former nominee Sarah Bloom Raskin in the face of Congressional opposition. However, the other developments relate more specifically to Fed monetary policy:

- Federal Governor Brainard, an inflation dove who recently rattled the bond market with her hawkish statements on upcoming rate hikes, offered a benign view of policy going forward. While reiterating that consumer prices are still rising too fast and that bringing down inflation is still the Fed’s most important task, Brainard said the ongoing moderation in federal fiscal stimulus and the Fed’s tightening of monetary policy would help reduce demand and bring down inflation over the course of the year. Most optimistically of all, Brainard said the momentum in the economy would keep those factors from causing an outright recession.

-

- Coupled with the big slowdown in the March “core” consumer price index (CPI) reported yesterday, Brainard’s argument for a soft landing in the economy gave a boost to both stocks and bonds.

- Even though overall CPI inflation accelerated to 8.5%, the highest rate since 1981, bond buying strengthened enough to drive the yield on the 10-year Treasury note down to 2.748%. The yield on the 2-year Treasury note fell to 2.426%.

- In contrast with Brainard’s view, St. Louis FRB President Bullard said in an interview with the Financial Times that the Fed needs to be more aggressive in its fight against inflation. Arguing that it’s a “fantasy” to think the central bank can bring inflation down sufficiently without raising interest rates to a level where they constrain the economy, Bullard called for rates to rise to a point where they actively curtail growth.

- Bullard’s hawkishness is well known to the market, which may explain why his comments don’t seem to have had much impact on bond yields yet.

- However, fear of meaningfully tight monetary policy and the risk of the Fed going too far have contributed to concerns that the Fed could help spark a sharp economic slowdown or even recession in the coming months or quarters.

New Zealand: In its battle against high inflation, the Reserve Bank of New Zealand today hiked its benchmark short-term interest rate by 50 basis points to 1.5% and signaled more rate hikes are likely to follow. The rate increase today was the institution’s biggest in 22 years.

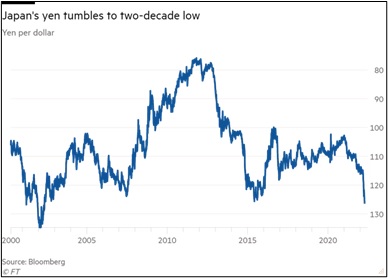

Japan: As the Bank of Japan continues to stand by its policy of yield curve control, including a commitment to buy unlimited amounts of Japanese government bonds to cap 10-year yields at 0%, traders continue to sell down the yen. Earlier today, the currency broke through ¥126 per dollar to trade at its weakest level in 20 years. The yen is now approximately 9% lower than at the end of 2021.

South Korea: A member of President-elect Yoon Suk-yeol’s transition committee said the new administration would reverse the country’s nuclear phaseout plan, which had been criticized for intensifying the east Asian country’s dependence on fossil fuels. The statement underscores how nuclear energy has gotten a second look amid rising prices and supply disruptions for fossil fuels. We believe the trend is bullish for uranium and other aspects of the nuclear industry.

United States-Mexico: Texas Governor Abbott is facing growing calls to abandon a two-week-old vehicle inspection program that has led to blockades and long queues at border crossings from Mexico into Texas.

- To protest the new security checks, Mexican truck drivers have blockaded the border crossings since Monday.

- Crossing times for commercial freight have slowed to 10, 20, or even 30 hours in some cases, threatening billions of dollars in trade and the lifeblood of many Texas businesses at a time when supply chains are already under strain.

United Kingdom: The London Police Department has fined Prime Minister Johnson and Treasury Secretary Sunak for a series of Downing Street parties that broke the government’s own pandemic rules. The fines, among 50 imposed on a range of officials, will revive a scandal that threatened to unseat Johnson early this year. Given the prime minister’s leading role in responding to the Russia-Ukraine war, he is now much more likely to survive the scandal.

Global Oil Market: In its April update, the International Energy Agency said it now expects that global oil demand in 2022 will rise to just 99.4 million barrels per day (mbpd) versus its March forecast of 99.7 mbpd. The agency ascribed its lower forecast primarily to the big, new coronavirus wave sweeping across China and the government’s aggressive economic lockdown to combat it. However, it also suggested that high energy prices are starting to curtail demand in the U.S. and other developed countries.

- Despite the modest drop in the IEA’s demand forecast, we continue to believe that factors like rising demand, high financial liquidity, geopolitical fracturing, and other supply disruptions will keep buoying oil prices for the foreseeable future.

- More broadly, we think those factors will continue to boost prices for a broad range of commodities going forward.

Global Industrial Metals Market: As record-high energy prices curtail industrial production in Europe and the war in Ukraine crimps output from Russia, inventories of some of the world’s most important industrial metals have dropped to critically low levels. Stockpiles of aluminum, copper, nickel, and zinc—four of the major contracts on the London Metal Exchange — have plunged by as much as 70% over the past year as traders and big consumers have tapped warehouses for material. The trend supports our view that conditions remain bullish for commodity prices.

COVID-19: Official data show confirmed cases have risen to 500,939,776 worldwide, with 6,185,579 deaths. In the U.S., confirmed cases rose to 80,478,089, with 986,408 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 218,521,227, equal to 65.8% of the total population.

- In the U.S., the seven-day average of people hospitalized with confirmed or suspected COVID-19 came in at 14,870 yesterday, down 15% from two weeks earlier.

- Amidst the big new Omicron BA.2 wave in China, people looking with dismay at the draconian lockdowns and food shortages in Shanghai are stockpiling food and emptying store shelves of staples like toilet paper and instant noodles. At the same time, ever more factories around Shanghai are closing down as government restrictions on transportation make it impossible to get supplies delivered. The behavior highlights just how socially and economically disruptive the government’s “zero-COVID” policy is.