Daily Comment (April 18, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where it appears the southeastern city of Mariupol is about to fall to the Russians. We next review a range of international and U.S. developments with the potential to affect the financial markets today. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: The military situation in Ukraine remained largely unchanged over the holiday weekend. Russian forces continue to regroup, reequip, and reposition for a concentrated effort to seize control of the Donbas region of eastern Ukraine and the country’s southern coast. The initial skirmishes in that effort are already taking place, and the Ukrainian forces in the besieged southeastern port city of Mariupol may not be able to hold out much longer, although the Russians’ main attack may still be a week or two away. In the meantime, the Russians continue to attack primarily military targets throughout the country with artillery, missiles, and aerial bombardment.

- An eighth Russian general has reportedly been killed in combat in Ukraine. State media in Russia reports that Major General Vladimir Frolov, deputy commander of the 8th Army, was buried Saturday. Meanwhile, reports circulating on the internet state the commander of Russia’s Black Sea Fleet, Igor Osipov, has been arrested following the sinking of the fleet’s flagship Moskva late last week.

- As intriguing evidence of just how creative and flexible the Ukrainian forces are, reports indicate the Ukrainians first distracted the Moskva with at least one, and possibly a swarm, of Turkish-made Bayraktar TB2 drones. With the Moskva and its crew distracted by the threat from the drones, the Ukrainians were able to slip two Neptune anti-ship cruise missiles through the cruiser’s defenses.

France: With just one week to go before the final round of France’s presidential election on April 24, President Macron has tried to blunt far-right challenger Marine Le Pen’s populist attacks by calling for an EU-wide cap on corporate executives’ pay. Macron is also making a play for France’s left-wing voters by emphasizing his support for renewable energy sources. The latest polls suggest Macron will win the election with 54% of the vote, compared with 44% for Le Pen, but the president clearly isn’t leaving anything to chance.

- Given her past calls for France to leave the EU and her current calls to wrest powers from Brussels back to Paris, a Le Pen win would likely cast the future of the EU into doubt and be very negative for European markets.

- Last week, Le Pen also reiterated her call for France to pull out of NATO’s military command and suggested the alliance make a “strategic rapprochement” with Russia. It illustrates that a Le Pen win would also have significant geopolitical implications that could undermine European stock values.

China: While U.S. markets were closed on Friday, the People’s Bank of China announced it would cut its reserve requirement ratio for major banks to 8.10% from 8.35%. To counter the Chinese economy’s slowdown in response to new pandemic lockdowns, high inflation, and the government’s regulatory crackdown on key industries, the central bank’s move is expected to spur an additional $80 billion in bank lending throughout the country.

- Notably, the central bank made no change to its benchmark interest rate. The rate on its one-year medium lending facility remained unchanged at 2.85%. The minimalist approach to monetary loosening shows how China’s high debt levels constrain the government’s ability to boost economic growth by making credit cheaper.

- The slow pace of monetary loosening will likely cap Chinese economic growth this year, which, in turn, will limit global economic growth and weigh on financial markets. As shown in the data tables below, China’s first-quarter GDP was up 4.8% year-over-year, beating expectations and accelerating from the 4.0% rise in the year ended in the fourth quarter of 2021. However, weak figures for March industrial production and retail sales added to the evidence that growth in full-year 2022 will fall short of the government’s goal of about 5.5%.

Israel: Palestinian-Israeli violence continued to boil over the weekend, with clashes in the area around Jerusalem’s Al-Aqsa Mosque, Islam’s third-holiest site. At the same time, Prime Minister Bennett is struggling to adjust to the defection of one of his party’s parliament members, which has deprived him of his one-seat majority.

U.S. Economy: Amid mixed signals regarding just how pessimistic U.S. consumers are about the economy, earnings releases by major banks show credit-card spending is rising briskly. Higher card spending and continued consumer optimism would suggest that the economy can keep growing in the near term. Yet, we continue to think that factors like high inflation and rising interest rates are creating a significant risk for a recession in perhaps 12-18 months.

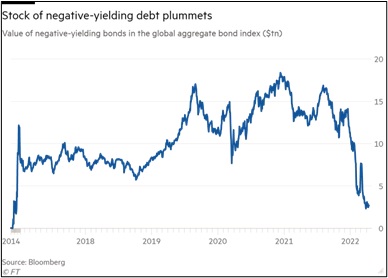

Global Bond Markets: With inflation surging and central banks around the world hiking interest rates, new data shows the value of global bonds offering a negative yield has fallen to $2.7 trillion from $14.0 trillion as recently as mid-December. In the U.S., the 10-year Treasury note is currently yielding 2.830%, its highest level since late 2018.

Latin American Agriculture: As we’ve noted before, food supply disruptions arising from the Russia-Ukraine war have further boosted global food prices. One region that seems well placed to take advantage of that is Latin America, where farmers are looking to help fill the gap for wheat, corn, soybeans, and other products that are no longer available from Russia and Ukraine. Because of the expected economic boost from stronger prices for food products, minerals, and other commodities, we think Latin American equities are now more intriguing than they have been in a long time.

Mexico: President Andrés Manuel López Obrador has failed to push through Congress a controversial reform of the country’s energy industry that would have favored state-owned electricity utility CFE over private generators.

- The proposal, which also included canceling power generation permits and prioritizing CFE power over private renewables on the grid, had raised further fears about private property rights in Mexico.

- Failure of the measure in Congress is therefore positive news for private businesses and investors. However, the Mexican’s heavy-handed regulatory approach remains a major constraint on the country’s economy and financial markets.

COVID-19: Official data show confirmed cases have risen to 504,598,742 worldwide, with 6,198,694 deaths. In the U.S., confirmed cases rose to 80,632,301, with 988,618 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 218,907,165, equal to 65.9% of the total population.

Virology

- In the U.S., the Omicron BA.2 variant continues to spread, but it is still causing relatively few serious illnesses or hospitalizations. The seven-day average of people hospitalized with confirmed or suspected COVID-19 came in at 14,936 yesterday, down 6% from two weeks earlier. Because of the low level of hospitalizations and general fatigue with the pandemic, the new outbreak is generating few new policy responses.

- In China, where the Omicron BA.2 wave has kept parts of Shanghai under lockdown for weeks, small protests have now broken out against the government’s stringent measures, including its decision to requisition citizens’ apartments for quarantine facilities.

- Shanghai’s health authorities said three COVID-19 patients have died, marking the first pandemic-related deaths to be reported in the city since the outbreak started last month. Despite the announcement, however, many observers still accuse the government of underreporting the death toll from the outbreak and associated lockdowns.

Economic and Financial Market Impacts

- As noted above and shown in the data tables below, the new pandemic lockdowns in Shanghai have already begun to weigh on Chinese economic data. China’s March industrial production was up just 5.0% year-over-year, slowing from a rise of 7.5% in the first two months of the year. Retail sales were down 3.5% year-over-year.