Business Cycle Report (April 28, 2022)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

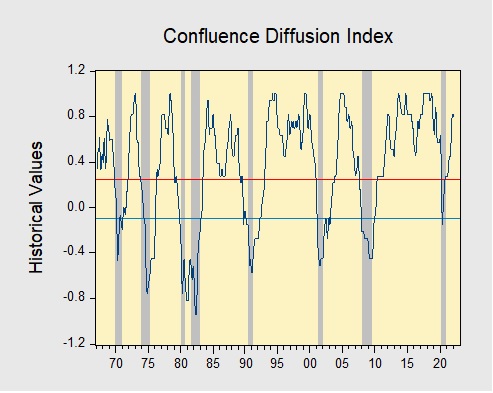

In March, the diffusion index rose further above the recession indicator, signaling that the economy remains in expansion. Higher yields on Treasuries and the Russian invasion have weighed heavily on equities. Meanwhile, manufacturing data suggests that supply chains are improving. Lastly, the labor market appears strong, with initial weekly claims falling to near historic lows. The latest report showed that all 11 indicators are in expansion territory. The diffusion index rose from +0.8182 to +0.8789, remaining well above the recession signal of +0.2500.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the indicator is signaling recession.