Daily Comment (May 18, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment opens with an update on the Russia-Ukraine war, where Russian President Putin appears to be facing increasing popular discontent with the war. We also provide a detailed discussion of the implications now that Sweden and Finland have formally applied for membership in NATO. We next review a range of international and U.S. developments with the potential to affect the financial markets today. We close with the latest news on the coronavirus pandemic.

Russia-Ukraine: It appears that another of President Putin’s decisions has backfired on him. With Russian military bloggers and pundits now openly criticizing the country’s poor performance in the war, the conditional surrender offered by Russia to the Ukrainian defenders at Mariupol’s Azovstal Steel Works has generated even broader shock and anger. After months of government propaganda promising quick victory and the complete destruction of Ukrainian “nationalists,” many Russians can’t understand why their government (i.e., Putin, who almost certainly made the final decision) would let the Azovstal defenders live, perhaps to be sent home in a future prisoner exchange. At the same time, Russian forces continue to make only minimal territorial gains in eastern and southeastern Ukraine, while the Ukrainian forces continue to mount successful counterattacks. Now we know what that “Z” insignia on Russian vehicles really means, as shown in the cartoon below.

Source: Financial Times

- Throughout the war, we have seen unverified reports of mounting opposition to President Putin within Russian leadership circles, but this week’s open criticism in the media and public expressions of anger among politicians seem much more concrete. We’ve thought all along that a failed war would likely drive Putin from power. Now that anger at the war is becoming more noticeable, we’ll be watching closely for any sign that Putin is losing his grip on power and, if so, who might take his place.

- In another example of how Putin’s war has backfired, EU leaders continue working toward a ban on Russian oil imports. As the EU leaders work to find a way to overcome Hungary’s resistance, U.S. Secretary of State Yellen has thrown her weight behind a proposal to impose a price cap or tariffs against Russian petroleum products.

- Separately, Italian energy firm Eni (E, $29.20) said it would open a ruble account at Russian bank Gazprombank to make an upcoming payment for Russian gas, but EU officials are warning the move would violate existing EU sanctions.

- The various sanctions against Russian energy continue to buoy global oil and gas prices. At this writing, Brent crude is trading at $113.93, up 1.8% so far today.

- Meanwhile, Sweden and Finland formally applied for membership in NATO today, in a move that will transform Europe’s security situation. Considering the countries’ previous doctrine of independence and not antagonizing Russia, their application to join NATO is the best example of how Putin’s invasion of Ukraine has backfired on him.

- Sweden and Finland now must complete a multistep process before they officially enter NATO. The first step will be a series of meetings with NATO experts in Brussels to ensure the preconditions for membership have been met.

- Then, all member states must ratify accession protocols permitting the countries to join the Washington Treaty, which forms the legal basis for NATO.

- Most countries require parliamentary approval to ratify the protocols. Even though many nations have said they quickly want to accept Sweden and Finland as members, political circumstances in individual countries could slow the process down.

- Notably, Turkish President Erdogan continues to express his resistance. In fact, Turkey today has already blocked a vote by NATO ambassadors to accept the membership applications from Sweden and Finland. However, Erdogan’s resistance is widely seen as an effort to milk the situation for his own benefit. It would be no surprise if he is eventually bought off with security or economic sweeteners from the other NATO countries.

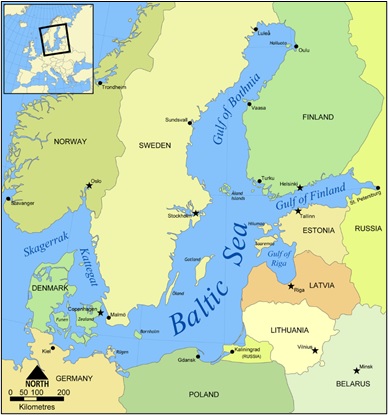

- The accession of Sweden and Finland into NATO should make the alliance stronger generally, but especially in Northern Europe. Reflecting that, the commander of Estonia’s armed forces, Lt. Gen. Martin Herem, said adding Sweden and Finland to NATO would profoundly improve the Baltic countries’ security, in part by transforming the Baltic Sea into something approaching a NATO lake (see map below) and improve operational awareness of the skies over the region.

- Just as important, Herem suggested that if Russia ever attacked the Baltic states, the new NATO could blockade St. Petersburg and force Russia to relieve its exclave of Kaliningrad on the ground through the Suwalki Gap.

- The statement about blockading St. Petersburg illustrates just how aggressive and energetic the Eastern European members of NATO are. Countries like Poland, the Czech Republic, and the Baltics may take a lead role in the revitalized NATO in the coming years, ensuring that it remains vigilant against Russia.

Source: Wikipedia

China: To help boost birth rates, the government of Jiangsu province has promised to reimburse firms for 50% to 80% of maternity leave costs for employees having their second or third child. The move illustrates how China still has not been able to boost its birth rates to address its looming demographic crisis, even after abandoning its controversial one-child policy.

Sri Lanka: The country is expected to formally default on its foreign debt today as the grace period for recent missed payments expires, and the country has essentially run out of foreign reserves. Sri Lanka’s total foreign debt is reportedly about $50 billion.

U.S. Monetary Policy: At a conference yesterday, Federal Reserve Chair Powell used his toughest language yet to underscore his commitment to fighting inflation even if it means a slower economy and higher unemployment. According to Powell, “Restoring price stability is a nonnegotiable need. It is something we have to do . . . There could be some pain involved.”

- Powell signaled policymakers would hike the benchmark fed funds rate by 50 basis points again in both June and July.

- In a sign that he would be willing to tolerate a recession and significantly higher joblessness to bring inflation down, Powell also said the unemployment rate consistent with stable inflation “is probably well above 3.6%,” the current level.

- In response to the tough talk, bond yields rebounded, with the yield on the 10-year Treasury note jumping to a one-week high of 2.988% and the yield on the 2-year yield rising to 2.699%.

U.S. Stock Market: For a second straight day, a major retailer issued a significant earnings miss attributable largely to surging costs. After a big miss yesterday by Walmart (WMT, $131.35), today Target (TGT, $215.28) posted lower quarterly earnings and said it would absorb higher costs this year rather than raise its prices. The company’s management said fuel and freight costs would be $1 billion higher this year than expected, with little sign of their easing throughout 2022. After Walmart’s stock fell over 11% yesterday, pre-market trading suggests Target’s stock will fall more than 20% today.

COVID-19: Official data show confirmed cases have risen to 524,767,762 worldwide, with 6,281,461 deaths. The countries currently reporting the highest rates of new infections include the UK, Germany, the U.S., and France. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) In the U.S., confirmed cases rose to 82,727,079, with 1,000,205 deaths. In data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 220,682,023, equal to 66.5% of the total population.

Virology

- As yet another wave of infections seems to be hitting the U.S., newly reported cases are on the rise again. The seven-day average of newly reported cases has now reached 100,732, up 61% from two weeks ago. However, hospitalization and death rates are still rising much more slowly. The seven-day average of people hospitalized with confirmed or suspected COVID-19 in the U.S. came in at 22,642 yesterday, up 27% from two weeks earlier. New COVID-19 deaths are averaging just 318 per day, down 7% from two weeks earlier.

Economic and Financial Market Impacts

- The U.S. Chamber of Commerce in China has warned that the country’s draconian pandemic lockdowns since 2020 will lead to lower foreign investment in China in the next three, four, or five years. Although the Chamber hasn’t seen a mass exodus of companies away from China, it warned that Chinese travel restrictions have prevented the due diligence and negotiating visits that would have led to new foreign investment in the coming years.

- As shown in the data tables below, Japan’s pandemic lockdowns early this year contributed to a decline in economic activity. Reflecting the lockdowns and surging commodity prices, the country’s first-quarter gross domestic product (GDP) fell at an annualized rate of 1.0%.