Weekly Energy Update (June 3, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices continue to grind higher despite reports of OPEC+ production increases and record SPR sales.

(Source: Barchart.com)

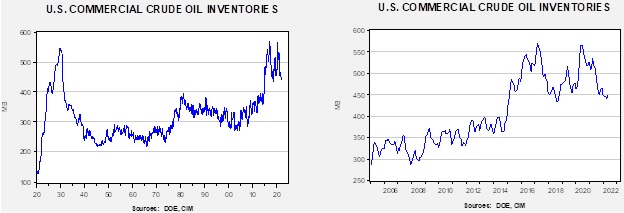

Crude oil inventories fell 5.1 mb compared to a 3.0 mb draw forecast. The SPR declined 5.4 mb, meaning the net draw was 10.5 mb.

In the details, U.S. crude oil production was unchanged at 11.9 mbpd. Exports fell 0.3 mbpd, while imports fell 0.4 mbpd. Refining activity declined 0.6% to 92.6% of capacity.

(Sources: DOE, CIM)

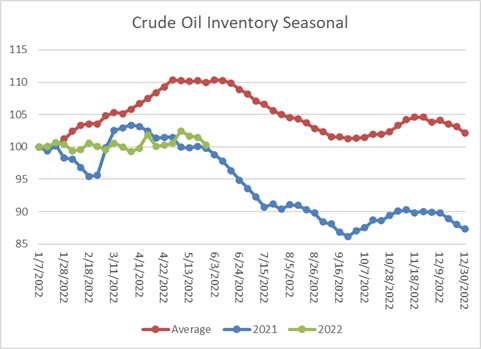

The above chart shows the seasonal pattern for crude oil inventories. This week’s report is consistent with last year’s pattern. If that becomes the path for the next six weeks, a 10% decline in commercial stockpiles is in the offing.

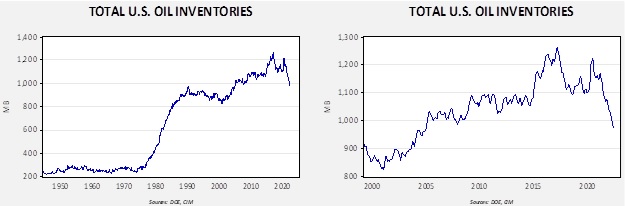

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in 2005. Using total stocks since 2015, fair value is $92.85.

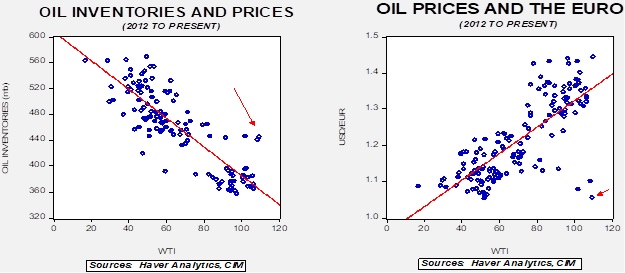

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

Market news:

- The biggest news this week was the announcement of a partial oil embargo by the EU, but the second runner-up is also critical (the OPEC+ news comes in second). The U.K. has announced a windfall profits tax on energy companies. The 25% tax is designed to offset the cost of subsidies to U.K. households. The argument for such taxes is that an unusual event has occurred, which will cause pain to the economy. Without adjustments, households will face the full burden of the event. A windfall profits tax attempts to split the burden of the event. However, economics teaches that prices are signals; a jump in prices signals consumers to conserve and producers to expand output. A windfall profits tax undermines the price effect, leading to more consumption and less supply than would occur without the measure.

- Although a change in power in Washington would likely improve the sentiment for the energy industry in the short run, it probably won’t change the long-term situation. One area of concern is that younger engineers are shunning the industry due to the stigma of contributing to climate change. If the industry can’t find workers, it will be tough to grow regardless of the pricing environment.

- We note that the House GOP has released a road map on energy. It’s mostly an “all of the above” plan, with the centerpiece being to streamline the permitting process for large infrastructure projects.

- Over the past year, we have seen several ESG actions taken against oil companies. We note that recently some of these measures have failed to be adopted. Environmental actions at the company level tend to be limited by the goal of supporting the company’s continuing operations.

- As the world attempts to reconfigure natural gas supply chains, LNG is becoming increasingly important. Funding for new projects in the U.S. is increasing. However, LNG growth is also affecting the usual seasonal patterns. U.S. inventories are low despite high prices as more gas is diverted to world markets.

- Despite the EU oil embargo (see below), German consumers are using either EUR or USD to make payments on Russian oil.

- India is increasing its purchases of Russian oil, enjoying a deep price discount.

- The EU and the U.S. have enacted stricter sanctions on insurance, which could make it much more difficult to insure oil shipments. If sanctions on marine insurance develop, Russia could find itself unable to find buyers.

- As noted in the data section, the U.S. continues to move oil out of the SPR. Part of the reason for the release was to reduce energy prices. Unfortunately, for most applications, crude oil isn’t directly used. It must be refined into a petroleum product first. Oil prices are high, but product prices, due to the lack of refining capacity, are even higher.

- The G-7 is pressing OPEC+ to lift production.

- Low water levels in the Western U.S. are threatening hydroelectric power.

- Natural gas demand is highest in winter during the home heating season. We have noted steadily rising summer demand as well. The EIA reports that 88% of households used air conditioning in 2020; during the summer, peak demand is often supplied by natural gas, and air conditioning is a key driver of demand.

- During the pandemic, there were state and local moratoria on utility shut-offs due to non-payment. It is estimated that 20 million households are behind on their utility bills, a collective arrears of $23 billion. Although we doubt all these households will suddenly have their utilities shut off, this situation is unprecedented. We may see a reduction in utility demand without some sort of workout plan.

Geopolitical news:

- At long last, the EU has managed to put together a partial Russian oil embargo. Hungary demanded an exemption and was granted one. Slovakia and the Czech Republic were also granted waivers. The embargo will be phased in over the next six to eight months. In the wake of the decision, Brent crude oil rose above $120 per barrel. Albeit less than perfect, the ban is notable; by year’s end, some 90% of EU imports of Russian crude oil will be cut off. It should also be noted that the nations exempted from the ban will likely face tariffs, which will discourage imports from Russia.

- Russia is said to be selling oil to China via ship-to-ship transfers on the high seas. The goal for both parties is to elude sanctions.

- As is typical of sanctions regimes, Russia is becoming adept at circumventing controls on its exports. Still, the “acid test” of the effectiveness of sanctions is the Urals/Brent spread, which continues to trade at a $35 per barrel discount compared to under $5 before the war.

- The most important impact of the sanctions and the partial import ban is that both are forcing a restructuring of trade and payment flows. Over time, Russia will sell more oil to China and India and less to the West. At this juncture, the pipeline infrastructure isn’t in place for a seamless adjustment, so supply issues are inevitable. It’s also important to note that refineries tend to tailor their facilities to specific types of crude oil. This factor will increase the supply problems and keep prices elevated.

- One interesting example of the impact of trade flows is that private Indian refiners are benefiting from cheap Russian crude, while state-owned refiners, locked into long-term contracts, are seeing their margins contract.

- The second-biggest story of the week is the OPEC+ announcement that it is increasing its monthly production targets to 65 mbpd from 0.40 mbpd. Although the news may improve the supply situation, the adjustment is rather modest. On the announcement, oil prices rose.

- However, we harbor doubts that the cartel producers can hit this number. Most members are already at capacity. Throughout OPEC’s history, the KSA has tended to fill the gaps created by member states that fail to fulfill their quotas. Our concern is that the Persian Gulf OPEC members have less spare capacity than advertised and thus may simply be unable to lift production meaningfully.

- The political optics are plain ugly. President Biden is said to be preparing for a trip to the KSA. During his campaign, he labeled the KSA a “pariah.” Now he is traveling, hat in hand, for increased oil supplies. The political opposition to meeting with the Saudi crown prince is growing. Going the Riyadh instead of Houston to support higher oil production is hard to explain.

- High levels of corruption in Iran are undermining trust in the regime. A recent building collapse is further evidence of deteriorating trust. There is also growing civil unrest due to rapidly rising food prices. Meanwhile, the odds that the U.S. will return to the JCPOA remain long. Iran is demanding the U.S. rescind its labeling of the Iran Revolutionary Guard Corps as a terrorist organization. That action would make little political sense. Reducing the likelihood further are U.N. findings that Iran has enriched enough nuclear material to make a nuclear weapon. Sanctions have become less effective over time. Their presence limits the number of buyers of Iranian crude oil, forcing a discounted price.

- One reason the Europeans keep working at talks is that they see Iran as a potential source of natural gas. Even with a deal, there is no guarantee that relations between the U.S. and Iran will improve in the future. Iran lacks the investment for boosting exports to the EU, and Europe may be reluctant to make those investments only to see them stranded by a change in U.S. policy.

- Iran seized two Greek tankers in the Persian Gulf in retaliation for the Greek seizure of an Iranian tanker at the behest of the U.S.

- Libya’s woes continue. A pipeline leak has reduced export flows. Rising food prices and the ongoing civil conflict will keep Libyan flows at risk. Since the fall of the Gaddafi regime, Libyan production and exports have been volatile. Unfortunately for Europe, the bulk of Libyan exports goes to the continent.

- The UAE and Israel have signed a free trade agreement, removing tariffs on 96% of traded goods. As the U.S. reduces its influence in the region, a coalition, which includes Israel, to isolate Iran has been developing.

- The KSA and Algeria are seeing improved relations. Although differences still exist, Riyadh’s outreach to Algeria could be part of a broader attempt to improve relations across North Africa.

Alternative energy/policy news:

- We expect nuclear power to become more important in the future, but currently, the West is heavily dependent on Russia for fuel. Russia provides about a third of enriched fuel globally.

- Japan is warming up to nuclear power, a major change since Fukushima.

- Japan is testing the generation of electricity through ocean currents. Ocean currents tend to be more stable than other unconventional energy sources and could become baseload if conditions are favorable.

- S. officials continue to squabble over solar tariffs.

- Volvo (VLVLY, USD, 17.81) announced it has built the first vehicle using fossil-fuel-free steel. There was no discussion of relative costs. Self-driving EV trucks are starting to show up at mining sites.

- EV sales are forecast to triple by 2025. A key to expanding sales is lowering prices, which is starting to occur.

- On the other hand, battery makers are complaining about higher input costs.

- Substituting hydrogen for fossil fuels in industrial applications is garnering attention, but the costs involved are daunting.

- If the world is going to shift away from fossil fuels, a massive expansion in mining investment is required. It isn’t happening yet.