Daily Comment (June 22, 2016)

by Bill O’Grady and Kaisa Stucke

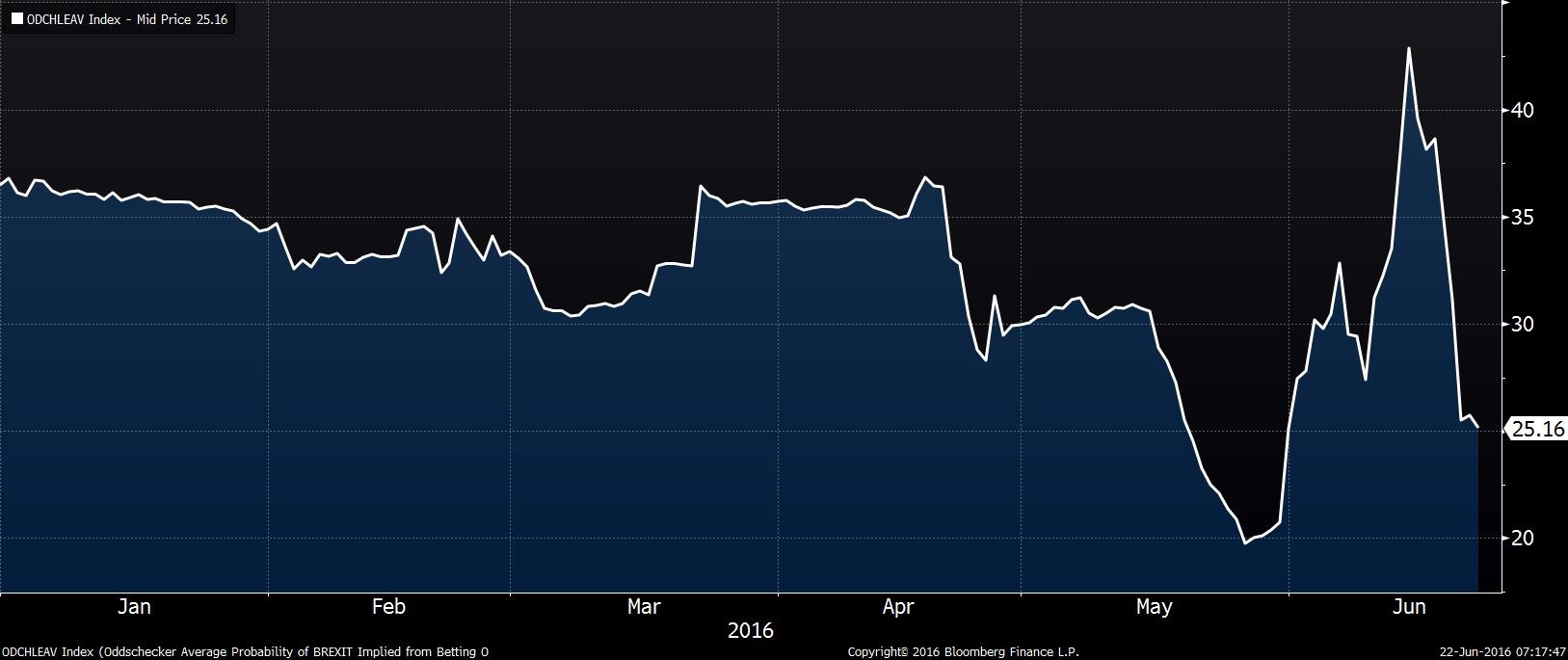

[Posted: 9:30 AM EDT] On the eve of the vote in the U.K., polling suggests that the Brexit vote will be close. However, the message coming from the betting pools maintains the leave camp at roughly 25%.

This chart shows the leave bets, which peaked around 45% but have fallen precipitously to the 25% level. Our experience has been that betting pools are more reliable than polling. We believe this has been the case for three reasons. First, polling questions can vary slightly from poll to poll; a bet is the same throughout the run-up to the event. Second, money is involved. It’s easy to offer an opinion, but once cash is in play participants tend to take it more seriously. Third, betting is anonymous whereas most polls require giving an opinion to someone and, in the case where a candidate or position may be seen as being favored by a “lesser” class, there can be an incentive for the questioned person to lie. Being able to make a wage in private eliminates that issue. It is possible to manipulate a betting pool; amounts are not usually that large and a few well-heeled bettors can swamp a pool. But, like in a horse betting situation, driving down the odds on a horse only works if one can distort the bet to the point where an arbitrage can be made. It isn’t obvious how one could do this in a binary bet. However, that being said, Bloomberg has reported that the odds makers are noting a large number of small bets being placed for exit while fewer, but larger, bets are being made for remain. Thus, the pools could be getting distorted, although it is hard to see how this benefits a remain voter because it lowers the payout even if one is correct and raises the risk of being wrong if these bets have distorted the markets. In any case, somewhere around midnight to one o’clock on Friday we will know how the vote played out.

In general, it does appear that the markets have mostly discounted remain and we suspect that will be the outcome. If the U.K. does remain, look for a strong risk-on trade that fades as the day wears on.

Chairwoman Yellen will face the second round of her semi-annual “grilling” from Congress today. Nothing new was revealed yesterday and we expect the Fed to remain dovish. We note that the fed funds futures have only a 10% chance of a hike in July and don’t even crack 50% by the meeting on February 2, 2017. Simply put, the Fed is probably on hold for the rest of the year.