Daily Comment (July 14, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with a discussion about the latest CPI report and its impact on the Federal Reserve’s decision to raise rates. We then briefly review Biden’s trip to Israel. Next, we give an update on the latest development from Russia’s war in Ukraine. We end the report with an overview of other news stories that we believe will affect financial markets.

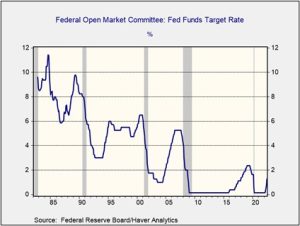

Central Bank News: Financial markets sputtered on Wednesday after a disappointing CPI report led to fresh concerns that the Federal Reserve could take more aggressive actions to tame inflation. The CPI report showed that the price index soared 9.1% from June the prior year, marking a four-decade high for inflation. The S&P 500 closed lower, and the two-to-10-year inversion deepened as investors priced in an increased likelihood of a 100 bps hike for the July Fed meeting. Atlanta Fed President Raphael Bostic, a notable dove, reinforced investor concerns after declaring that everything is in play as the FOMC looks to tame inflation. San Francisco Fed President Mary Daly also mentioned that a 100 bps hike is a possibility given the recent CPI report. Despite the hawkish tilt from non-voting FOMC members Bostic and Daly, there are some indications that the Fed may maintain its plans to raise rates by 75 bps. Cleveland Fed President Loretta Mester, a voting member, stated that the data suggested that at least a 75 bps hike was needed, but did not elaborate on whether she favored a more significant hike.

- The faster the Federal Reserve raises rates, the greater the likelihood it will push the economy into a recession. Over the last 40 years, the Fed has not been able to increase its benchmark rate above the previous cycle’s peak without causing an economic downturn. Now that the fed fund’s target rate is currently 1.675%, a 100 bps rate hike would place that target just above the previous peak.

- Four of the 12 Federal Reserve districts reported that economic growth either slowed or declined in the latest Beige Book. The report, which looks at the economic situation of each of the Fed districts, showed that business contacts reported signs of slower demand and substantial price increases. Although the report indicated that economic activity expanded at a modest pace, an improvement from six weeks ago, contacts in five districts noted concerns of an increased possibility of a recession.

- Shelter prices rose at their fastest pace since 1986, and it is still possible that prices will continue to speed up for at least another six to 12 months. Our data shows that shelter prices lag the FHFA House Price Index by about 18 months, with the peak hitting in June of last year. The increase in the prices for homes and shelter is likely the result of low residential inventory. Homebuilders over the last year have struggled to complete construction projects due to the shortage of labor and materials. Although prices for critical resources like lumber and steel have declined in recent weeks, it will probably be some time before the homebuilders can finish these projects.

Biden’s Middle East Trip: President Biden and Israeli Prime Minister Yair Lapid signed an agreement that the two countries are committed to stopping Iran from developing a nuclear weapon. Despite the appearance of a united front, the two sides appear to have differing views on how to deter Iran’s nuclear program. Biden would like to return to the 2015 nuclear deal, while Israel would like to take more direct action. Besides agreeing to stop Iran from developing nuclear weapons, the two sides have also discussed improvements in military integration.

- We suspect that President Biden’s visit was partially aimed at preventing Israel from taking unilateral action against Iran. The potential for conflict between Israel and Iran remains elevated. We are watching this situation closely.

Ukraine-Russia Update: In another change in the war’s tide, Russian forces have suffered several defeats on the ground in Ukraine as they try to take over smaller cities in the country’s eastern region. Meanwhile, the Kremlin has pushed the country closer to full-scale mobilization by ordering federal districts to recruit and financially reward volunteers willing to take part in the war. The latest development in Ukraine suggests that the investing environment in Europe will probably be fraught with risk as countries continue to struggle to adapt to the higher energy and food prices resulting from the conflict.

- A deal allowing Ukrainian wheat to leave ports in the Black Sea is close to being reached. The agreement is being worked out between Russia, Ukraine, Turkey, and the United Nations. Although there is optimism that all parties can sign a deal next week, there are some concerns that Russia may back out. If Ukrainian wheat can make it into global markets, it could bring down food prices and reduce the threat of global famine.

- Natural gas disruptions risk triggering a global recession, according to the International Monetary Fund. The multilateral organization warned that Russia’s war in Ukraine has weakened its global growth outlook.

Italy: A potential collapse of the Italian government is weighing on the euro. The Five Star Movement stated that it would pull its support from the current government over concerns that the coalition is not doing enough to help families deal with rising energy and food prices. Although the breakdown of cross-party alliances is not unusual for Italy, the resulting election could have implications for Ukraine. The Five Star Movement does not support offering Ukraine military weapons to fight against Russia due to concerns that it may prolong the war. Thus, if the Five Star Movement gains influence after the next election, Ukraine may have difficulty finding support for its war efforts.

- A pro-NATO right-wing party is expected to gain the most seats in the Italian parliament if the country heads to elections. Assuming polls are correct, the Brothers of Italy party should take the most seats in the parliamentary run-off. Although a populist right-wing party, the Brothers of Italy has recently moderated some of its policy stances to appeal to a broader base. Party leader Giorgia Meloni has been a vocal critic of Russia’s invasion of Ukraine and supports sending weapons to Kyiv. The party’s populist tilt, however, could make it difficult for the group to find partners to form a coalition. The group is known to challenge EU norms, such as marriage equality, and has a reputation for being a party for eurosceptics. As a result, the new elections will probably not improve financial conditions significantly in Italy as political uncertainty will likely remain.

China: Fears of a Chinese housing crisis are rising after a growing number of homebuyers refuse to pay mortgages for unfinished housing projects. As a result of the boycott, Chinese authorities met with major banks to discuss solutions to the upheaval. The rising defaults from property developers undermines the likelihood that the projects will be completed, leading homebuyers to refuse to repay mortgage loans on unfinished construction. The weakness in the property sector suggests that China’s traditional method of boosting growth through debt-driven real-estate investment may be losing its potency. Therefore, Beijing may have a more challenging time stimulating the economy as it moves away from its Zero-COVID strategy.

- In another setback for China, SEC Chair Gary Gensler dampened expectations about a deal with Beijing to keep Chinese companies listed on U.S. exchanges. Beijing and Washington are engaged in discussions that would allow a third-party to oversee the audit of Chinese companies listed in the U.S, as required by law. China is hesitant of foreign oversight of its companies, which is the source of the deadlock in talks. If an agreement is not reached, Chinese companies could be forced to delist from U.S. exchanges by 2023.