Daily Comment (June 23, 2016)

by Bill O’Grady and Kaisa Stucke

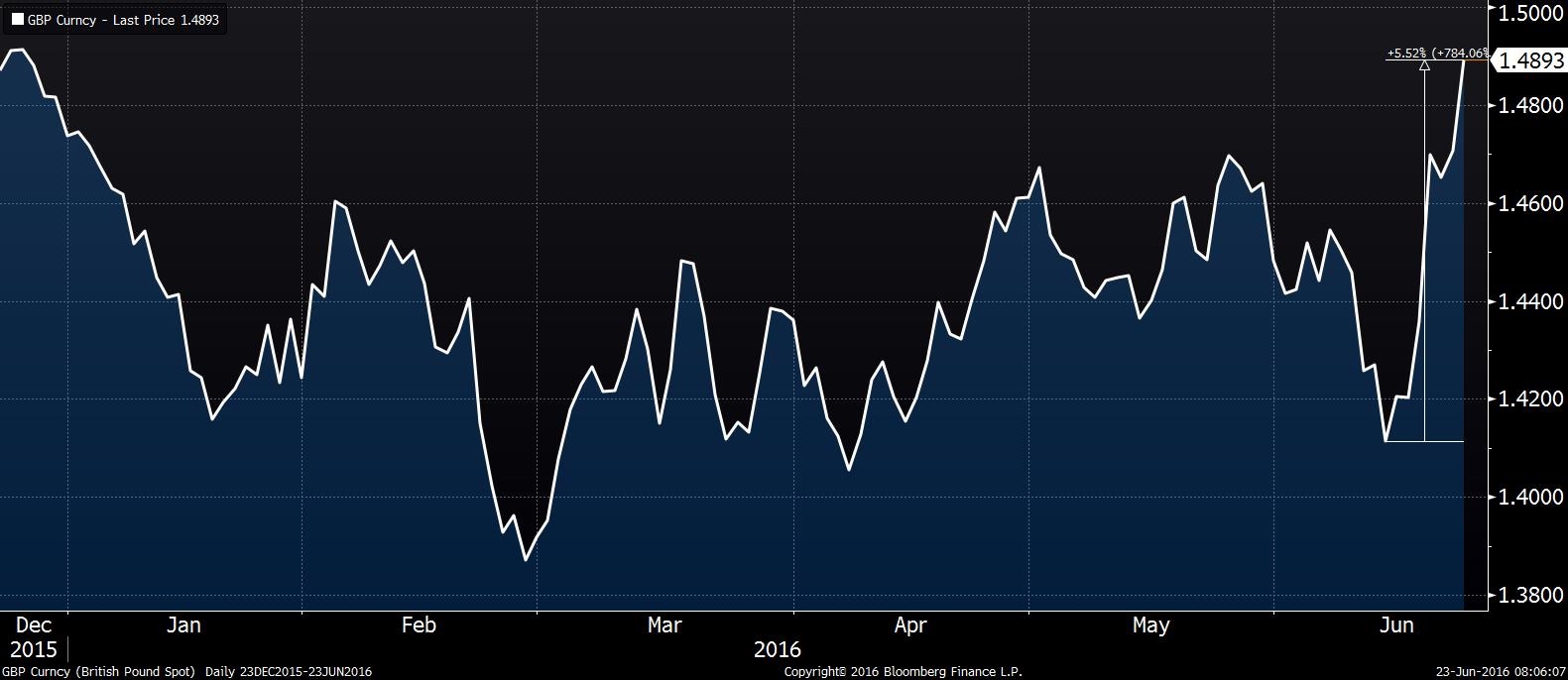

[Posted: 9:30 AM EDT] Voters in the U.K. go to the polls today to decide whether or not they are staying in the EU. The markets, however, appear to have already voted as we are seeing full “risk-on” activity, with the dollar and yen lower and Treasury yields higher. In fact, the GBP is on a tear.

This chart shows the closes for the GBP; we are breaking out to new highs for this year and up over 5.5% since June 14.

Simply put, the markets are shifting rapidly to discount a remain vote. If the voters decide to stay, we probably won’t see markets rise too much more. On the other hand, if Brexit is the outcome, markets will likely look much weaker tomorrow. We tend to think that remain will win but the preemptive market action is a concern in that we may be setting ourselves up for a nasty reversal tomorrow.

It’s PMI data day—flash readings for the U.S., Japan and much of the Eurozone are out today (see below). In general, the PMIs show slow growth. Although Germany is doing quite well, France and the Eurozone are lagging. U.S. data comes out later this morning (again, see below).

Our recap of yesterday’s energy data shows that oil inventories are declining but the pace of withdrawals is slowing. U.S. crude oil inventories fell less than expected; stockpiles fell 0.9 mb to 530.6 mb compared to estimates of a 2.6 mb decline.

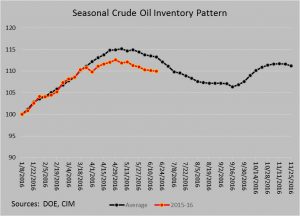

This chart shows current crude oil inventories, both over the long term and the last decade. We are starting to see inventories decline, but normal levels would be below 400 mb, some 130 mb lower than now.

So, obviously, inventories remain elevated. Inventories have been lagging the usual seasonal pattern. We are in a period of the year when crude oil stockpiles tend to fall at an increasing pace. Over the past three weeks, the pace of declines has slowed and it will be somewhat bearish for oil prices if this trend continues.

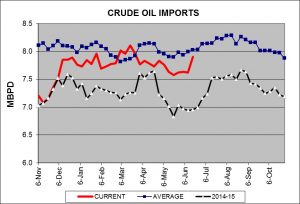

This chart shows oil imports on a four-week average basis. Oil imports have been running below average recently, in part due to the fires in Western Canada. As those disruptions ended, we expected a pickup in imports and the data does confirm this expectation. If imports continue to rise, the drop in oil inventories should slow and pressure prices.

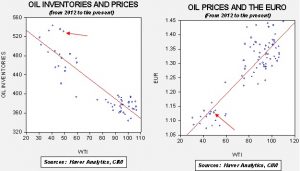

It is important to remember that the dollar is playing a bigger role in determining oil prices.

Based on inventories alone, oil prices are profoundly overvalued at a fair value price of $31.64. Meanwhile, the EUR/WTI model generates a fair value of $51.09. Together (which is a more sound methodology), fair value is $42.11, meaning that current prices are a bit rich. The dovish Fed should be considered bullish for the EUR and thus supportive for oil prices, which may offset the slowing decline of oil inventories.