Daily Comment (July 26, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, with a focus on its associated disruptions to global natural gas and grain supplies. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a preview of the Federal Reserve’s latest monetary policy meeting.

Russia-Ukraine: Russian forces are once again making small territorial gains in Ukraine’s eastern Donbas region, but at a very high cost. Meanwhile, Ukrainian forces continue to attack Russian positions around the occupied southern city of Kherson.

- On the economic front, Russian state-owned energy giant Gazprom (GAZP.ME, $198.00) warned that natural gas exports through the vital Nord Stream 1 pipeline to Germany would drop to about a fifth of the pipe’s capacity this week, blaming sanctions-related problems with turbines. Separately, Ukraine’s gas transmission system operator said Gazprom had sharply increased pressure in the Urengoy-Pomary-Uzhgorod pipeline without giving any notice, which the operator said “can lead to emergency situations” such as damage to pipelines.

- The announcements show that Russia continues trying to use energy as a weapon of war, especially to pressure Western European countries to stop supporting Ukraine. The latest cuts are probably designed to prevent Western Europe from building up sufficient inventories to get it through the winter heating season. Running out of energy in the winter would maximize the pain of Russian energy cut-offs. In response to the news, European gas prices jumped some 12% yesterday and a further 10% or so this morning.

- Separately, EU energy ministers approved last week’s European Commission proposal for a system of 15% energy consumption cutbacks, but with a long list of exceptions. For example, the approved plan will exempt Ireland and Malta who are not directly connected to the European grid, states that are heavily reliant on gas for electricity, and countries that are exporting gas at 90% of their total capacity to other member states. Coupled with the new Russian gas disruptions, the exemptions will make it even harder for Western Europe to build up sufficient inventories to get through the winter.

- Separately, a Ukrainian official yesterday said Kyiv is still preparing to implement the Russia-Ukraine deal on grain exports that was brokered by Turkey last week. Despite the Russians’ weekend attack on port facilities in Odessa, the Ukrainians are removing mines and setting up special naval corridors for the safe passage of merchant vessels, as well as constructing a coordination center in Istanbul. However, we think it’s still possible that Russian attacks will short-circuit the deal and keep Ukraine’s grain bottled up, worsening the evolving global food crisis.

- Finally, Russian Foreign Minister Lavrov is touring Africa to make the case that the West is responsible for the global food crisis touched off by the war.

- The warm welcome Lavrov has received shows how Moscow’s military and economic aid to Africa has bought it some much needed political support.

- More broadly, our analyses show that as the U.S. steps back from its traditional role as global hegemon, and as the world breaks up into relatively separate geopolitical and economic blocs, less-developed countries like those in Africa are much more likely to end up in the bloc led by China and Russia.

Global Economy: Today, the International Monetary Fund sharply cut its forecasts for global economic growth and raised its expectations for world price inflation. Because of Russia’s invasion of Ukraine, supply disruptions caused by the coronavirus pandemic, and rapidly tightening financial conditions, the IMF now expects global gross domestic product to grow just 3.2% in 2022, which is down 0.4% from its April forecast. It sees growth of just 2.9% in 2023, down 0.7% from its previous outlook. The figures are consistent with our view that growing headwinds are combining to significantly slow global economic activity and will likely weigh on global stocks in the near term.

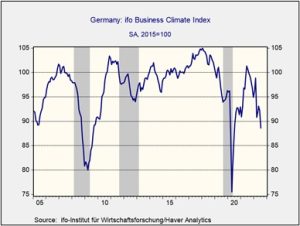

Germany: The IFO Economic Institute said its July business sentiment indicator dropped sharply to 88.6 from 92.2 in June, reflecting German businesses’ worsening outlook for the coming months. The figure provides more evidence that falling global growth, the evolving European energy crisis, and other fallout from the Russia-Ukraine war are pushing Germany and the rest of Europe to the brink of recession.

Pakistan: In an interview with the Financial Times, Pakistan Central Bank Governor Murtaza Syed played down financial market concerns about the country’s worsening liquidity crunch. Even as Pakistan contends with rising commodity prices, falling foreign exchange reserves, and a depreciating currency, Syed said he expected the IMF to sign off on $1.3 billion of new loans for the country in August, to be supplemented by funds from China, Saudi Arabia, and other Middle Eastern countries.

United States-China: An investigation by Senate Republicans found that, over the last decade, China has tried to build a network of informants within the Federal Reserve system to provide it with nonpublic intelligence on U.S. economic performance and monetary policy. The efforts included both threats to Fed officials and offers of monetary compensation for information.

- The investigation also faulted the Fed for lax security efforts, but Fed Chairman Powell pushed back against that suggestion.

- In any case, the finding illustrates the broad intelligence effort China has mounted against the U.S. and its aggressiveness in seeking ways to undermine the U.S. government. The incident will likely contribute further to the frictions between the U.S. and China.

U.S. Monetary Policy: The Fed begins its latest two-day monetary policy meeting today, with its rate hike decision expected to be announced on Wednesday afternoon. The officials have signaled they will hike their benchmark fed funds interest rate by another 0.75% to a range of 2.25% to 2.50%, and investors widely expect further aggressive rate hikes through the end of the year before the officials reverse course sometime in 2023.

- Reflecting those expectations, the yield curve remains inverted.

- As of this morning, the yield on the 2-year Treasury note stands at 3.000%, while the yield on the 10-year Treasury stands at 2.769%.

U.S. Dollar: In a Financial Times opinion article today, well-known international economist Barry Eichengreen warned that if the U.S. economy slows precipitously, inflation falls, and the Fed pauses its interest-rate hikes, the dollar could suddenly reverse course and begin depreciating.

- According to Eichengreen, the risk stems from the fact that many foreign central banks are now starting to catch the Fed’s fever to tighten monetary policy aggressively. If the Fed pauses while those central banks keep hiking, those countries’ currencies could suddenly look more attractive.

- Reflecting the broad hikes in interest rates and rising bond yields around the world, a separate report today shows that the world’s total stock of negative-yielding debt stood at just $2.4 trillion last week, down 87% from the $18.4 trillion peak in December 2020.

U.S. Corporate Earnings: After market close yesterday, Walmart (WMT, $132.02) warned that rising food and fuel costs are forcing the company’s customers to cut back on purchases of higher-margin products, even as the firm struggles with an earlier announced excess of inventory. As a result, the company said it now expects its operating profit to fall between 10% and 12% this fiscal year. The news is weighing heavily on the stock of Walmart and other major consumer businesses so far today.