Weekly Energy Update (July 28, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

It appears that oil prices are settling into a broad trading range between $125 and $95 per barrel.

(Source: Barchart.com)

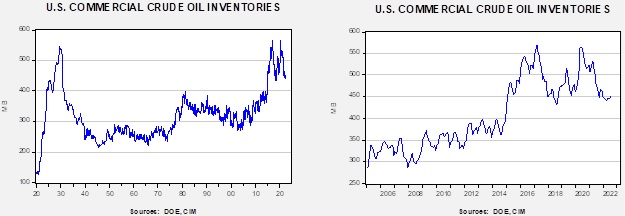

Crude oil inventories fell 4.5 mb compared to a 1.5 mb draw forecast. The SPR declined 5.6 mb, meaning the net draw was 10.1 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 12.1 mbpd. Exports rose 0.8 mb, while imports fell 0.4 mbpd. Refining activity declined 1.5% to 92.2% of capacity.

(Sources: DOE, CIM)

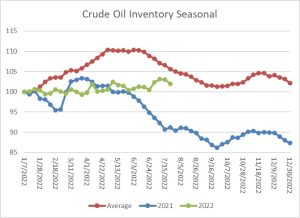

The above chart shows the seasonal pattern for crude oil inventories. Clearly, this year is deviating from the normal path of commercial inventory levels. Although it is rarely mentioned, the fact that we are not seeing the usual seasonal decline is a bearish factor for oil prices.

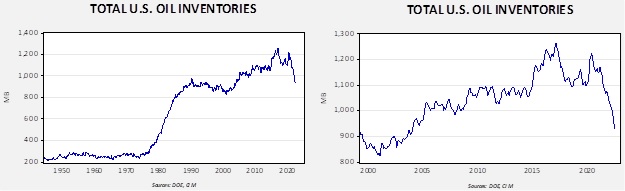

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2004. Using total stocks since 2015, fair value is $103.88.

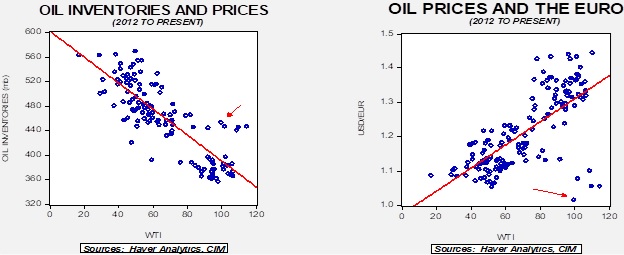

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $65 per barrel, so we are seeing about $30 of risk premium in the market.

Gasoline Demand

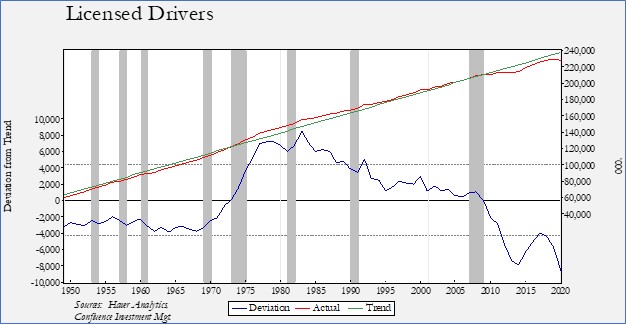

Last week, we noted that gasoline demand was weakening and that has been putting pressure on oil prices. This week, we take a look at the number of licensed drivers in the U.S.

The data is annual, and the last available year is 2020 so we don’t know how this metric was affected by the pandemic. On a trend basis, the number of drivers rose above trend in the early 1970s as baby boomers reached driving age. As population growth slowed, the number of drivers fell steadily back to trend. However, after the Great Financial Crisis, the number of drivers fell rapidly and has yet to recover. It doesn’t appear to be the boomers. In looking at the number of licensed drivers aged 65 and over, the growth rate is still 3% per year. What we do find is that the number of drivers aged 29 years and younger declined over the past three years, falling 2.2% in 2020. Social media might play a role, or the urbanization of younger households could play a role as well.

In observing the above chart, it again begs the question, “Why would anyone build additional refinery capacity if the number of drivers is falling below trend?”

Market news:

- The long-awaited return of Nord Stream 1 occurred last week, but the amount supplied is underwhelming at only about 20% of capacity. President Putin announced the resumption, but warned that sanctions may reduce flows. The Russians are claiming maintenance issues yet again, while Germany says there is no technical reason to reduce flows. As one would expect, natural gas prices jumped on the news. These flow rates appear to be too low to build adequate supplies for winter.

- We also note that Russia increased flows unexpectedly to other pipelines, threatening the pipeline’s integrity.

- Although natural gas is a key input to electricity and home heating, it is also an important ingredient for petrochemicals. Russia’s reduced supplies of natural gas are threatening Germany’s petrochemical industry.

- It’s not just Europe seeing high prices. As LNG is being diverted to Europe, Asian gas prices are rising.

- Although the lack of investment in oil and gas is a key reason for high energy prices, the disruption of trade and payments flows, triggered by the Ukraine war, has led to supply and price divergences. Over time, we do expect these flows to adjust to the new reality. For the past few weeks, we have documented how Russian oil was flowing to India and China (although we note Beijing is cutting Russian purchases on price considerations). This expansion reduced supplies to Europe; however, we are seeing Middle Eastern oil and African oil, which would usually end up in the Far East, now routing to Europe. North Africa is also increasing supplies to Europe, but the infrastructure to increase supplies further isn’t in place to fully replace Russian energy. There are reports that Russian energy exports are falling, although as we note below, this may not account for smuggling.

- The EU is easing sanctions on third-party transactions to increase available supplies.

- There are reports of increased smuggling efforts to increase Russian oil on world markets.

- The EU has put together a natural gas rationing plan to weaken Russia’s leverage, overcoming the free-rider problem that emerged as individual members of the union lobbied for exemptions. Spain and Portugal complained about the program as they obtain much of their natural gas from places other than Russia, so they didn’t feel the need to participate. Although we suspect most nations understand the need for rationing, their logical hope is to force other nations to bear a higher burden of the cost. In the end, an agreement was reached by making the deal less stringent than what Brussels wanted. So far, the plan is voluntary, which has reduced its effectiveness. We doubt this plan will do much to cut demand until it becomes mandatory.

- Germany is expanding energy-reducing measures due to fears of reduced Russian supplies. Industry leaders are warning that continued cuts will adversely affect industrial output. There are reports that ammonia production is being cut; the chemical is a key feedstock for fertilizer.

- Germany is also trying to boost coal power generation, but supply issues are hampering that effort. It is also reconsidering its exit from nuclear power.

- The U.S. has announced an additional 20 mb of crude oil will be sold from the SPR. The DOE also laid out a plan to replenish the SPR but is considering fixed-price contracts that wouldn’t begin refilling the reserve until 2023. We suspect this replenishment will not occur.

- The EU ban on tanker insurance for Russian oil is scheduled to become effective in December and the U.S. is increasing calls to use a price cap instead. The Biden administration fears that the insurance ban will be too effective, leading to tighter oil supplies.

- There is increasing evidence that the KSA is near its productive capacity for crude oil. OPEC+ production is well below its quotas.

- As U.S. LNG exports ramp up, impediments on pipeline construction, a favorite tool of the environmental lobby, have come under greater scrutiny. Recent court decisions are improving pipeline approvals which should reduce export bottlenecks. The general stance of the Supreme Court on regulation may bolster this trend.

- Across the U.S. corn belt, propane is used in crop drying. Current inventories are tight relative to history. U.S. exports have been strong, and rising petrochemical demand in Canada may reduce imports. Farmers should consider locking in supplies now before harvest.

- Earnings reports suggest that exploration activity may finally be reacting to high oil prices.

- The administration intends to make energy company profits a political issue. Of course, such criticism usually eases investment, notwithstanding the above bullet point.

- Reports indicate that oil tanker orders are at new lows. Some of the lack of orders is due to uncertainty about future oil demand. But, if this lack of orders persists, we could see oil prices rise on higher transportation costs.

Geopolitical news:

- Although China is buying more Russian energy, its investments into Russia through the “belt and road” project have fallen to zero. Beijing is trying to avoid Russian sanctions.

- One of the reasons given for President Biden’s trip to the Middle East was to reduce Chinese influence in the region. Washington fears that China is attempting to expand its footprint in the region as the U.S. slowly withdraws. One area of interest for Beijing is Iraq. However, China will have to navigate increasing intra-Shiite tensions.

- Iran announced it has arrested suspected Mossad spies who were conspiring to attack Iran’s “sensitive” sites. This action occurs just as evidence appears to show that Iran’s nuclear program is expanding rapidly.

- Iran’s foreign minister canceled a trip to the U.N. for meetings on nuclear non-proliferation. The IAEA wants Iran to turn on monitoring devices on its nuclear facilities; Iran has refused.

- The last of the former administration’s nuclear negotiators has been replaced, reducing the odds that Iran will return to the 2015 JCPOA.

- China and Australia have been at odds over pandemic policy. The PRC has retaliated against Australia by cutting imports. But, as coal inventories fall, China may be forced to ease import bans on coal.

- Cryptocurrencies have been used in cybercrime and sanctions evasion for some time. The Treasury Department is investigating whether a U.S. crypto exchange facilitated Iranian transactions in violation of sanctions.

Alternative energy/policy news:

- Globalization and national security are often at odds. Sometimes, the lowest cost producer is in a country that is deemed a security problem. At that point, tradeoffs can occur. Does one simply continue to buy the product as cheaply as possible, or does one pay more for “safer” products?

- We discuss nuclear power often as it can provide carbon-free baseload power, which is something that wind and solar struggle to produce. Unfortunately, most of the world’s nuclear power plants are constructed by China and Russia. Complicating matters further, much of the uranium used comes from the former Soviet Union. The nuclear power industry in the West is notorious for cost overruns. It is possible that China and Russia construct them faster because they are less finicky about safety. But, in any case, if nuclear is going to make a comeback in the West, it probably can’t rely on Russia and China to meet that demand. The same case can be made for uranium stocks, which are the inputs to nuclear power. US. production of uranium concentrate fell to near all-time lows last year.

- Other key metals are under the control of China and Russia.

- In Utah, a massive clean energy storage facility, which will generate green hydrogen from wind and solar to store until needed, relies on critical components from China.

- Ford Motor’s (F, $12.81) plan to ramp up EVs depends on Chinese batteries.

- China seems to be developing an “all of the above” approach to energy security. We have documented China’s expansion of coal for electricity production. But, at the same time, it is aggressively expanding solar power as well by taking steps to lower the cost of solar panels.

- Utilities are increasingly using battery storage for price arbitrage. If this practice expands, it will tend to reduce price volatility.

- Ford is moving aggressively to expand its battery supply and find lower cost materials for the batteries themselves. For example, the company is opting for iron and phosphorous batteries instead of the usual nickel and cobalt metals. The batteries will still use lithium, but using U.S. sources means running afoul of environmentalists.

- General Motors (GM, $33.53) has secured a loan from the DOE for a battery venture.

- The “holy grail” of auto batteries continues to be solid state, which promise to go farther and recharge faster than current batteries.

- One of the problems with meeting climate targets is that auto turnover is slow, and therefore, gasoline autos will be with us for many years.

- For the past couple of weeks, we have been reporting on the heat wave that has plagued much of the U.S. and Europe. The heat is straining electrical grids in Europe, sending prices higher and increasing the risk of blackouts.

- The heat in Texas has also reduced electricity available for bitcoin mining.

- Mexico’s resource nationalism has run afoul of the USMCA, leading to a call for talks.

- Separating carbon from hydrogen leaves a clean fuel that could replace fossil fuels. Of course, a classic high school chemistry experiment separates hydrogen from water. Accordingly, marriage of nuclear power to make hydrogen is in the works. In related news, the DOE is partly funding a “hydrogen hub” in the Houston area.

- Extreme weather continues.

- Here in St. Louis, we recently experienced rainfall totals that set new records. Over a six-hour period, rainfall exceeded nine inches. To put that in perspective, this area typically sees about seven inches of rain in July and August combined. Over a 24-hour period, the city and surrounding area received about 25% of its annual rainfall.

- China is experiencing a heatwave that is sending electricity demand to record levels; so is the Pacific Northwest.

- The NOAA has released a new website to track hot weather.