Daily Comment (June 27, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] British politics is in deep turmoil. The Labour Party is in disarray after 17 members called for the ouster of party leader Jeremy Corbyn. The Labour leader is deeply unpopular with the MPs but the party faithful adore him. Labour Party officials partly blame Corbyn for Brexit as he refused to campaign with PM Cameron for the Bremain position. So far, Corbyn has accepted the resignation of much of his shadow cabinet and will work on appointing new members in the coming days. The Brexit issue should have been an opening for the opposition to push for a no confidence vote and oust the Conservatives. Instead, the Brexit vote may signal the end of the Labour Party as we know it.

Meanwhile, the Tories are trying to figure out who will be the next PM. Most likely, the former London mayor, Boris Johnson, will win the position. EU officials are divided on how to deal with Brexit. Chancellor Merkel is holding to a moderate line, while French officials and much of the EU bureaucracy clearly want to make the U.K. suffer greatly in order to make an example for others.

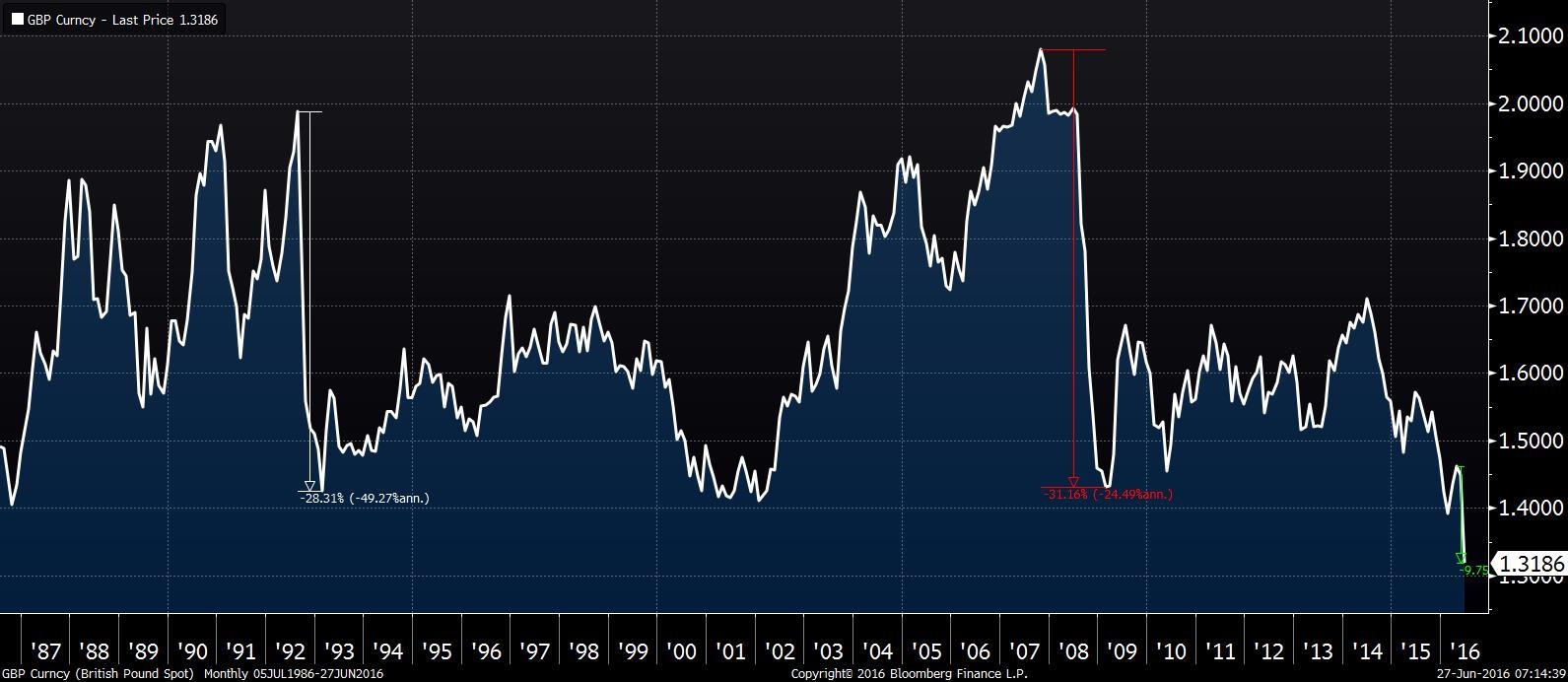

Most of the market effects are being seen in the currency markets. The GBP has plunged to new depths on Brexit. The chart below shows the GBP/USD exchange rate over the past three decades. We have highlighted two major depreciations, the 1992 exit from the European Monetary System and the Great Financial Crisis. Both events caused about a 30% decline in the currency. So far, we are down about 10%; if history is any guide, this could get much worse. Meanwhile, Japanese PM Abe has instructed his finance minister to “take needed FX steps” in the wake of Brexit. We would not be surprised to see the BOJ aggressively intervene to halt the JPY’s strength. We note Treasury Secretary Lew indicated today that the U.S. viewed recent forex moves as “orderly” and suggested that the U.S. is not considering direct intervention. These comments will likely trigger more dollar strength.

Finally, China appears to be viewing the turmoil as an opportunity to depreciate its currency.

This chart shows the CNY/USD exchange rate on an inverted scale. The Chinese currency is also making new lows. China greatly fears a stronger dollar and so, as the greenback rises, it is allowing its currency to weaken in order to remain competitive. Of course, this action risks increased capital flight.

Two other points: Spanish elections actually favored the establishment parties over the populist insurgents, which is good news. The bad news is that the results probably won’t allow for a government to be formed. Thus, political turmoil in Europe continues. Second, we are seeing a remarkable adjustment to expectations for U.S. monetary policy. Fed funds futures put the odds of a rate hike for February 2017 at 8.1% but have a 17.1% likelihood of a rate cut in the same time frame.

Until the currency markets stabilize, overall financial market turmoil will remain elevated. Perhaps the most disconcerting factor we are seeing in world markets is the lack of leadership. There isn’t a “committee to save the world” on the horizon as we saw during the Asian Economic Crisis. Thus, the potential for fallout in global markets is elevated. On the other hand, when global capital is frightened it tends to flee to safety, which would be the U.S.