Weekly Energy Update (August 11, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices have broken support but appear to be basing around $88 per barrel.

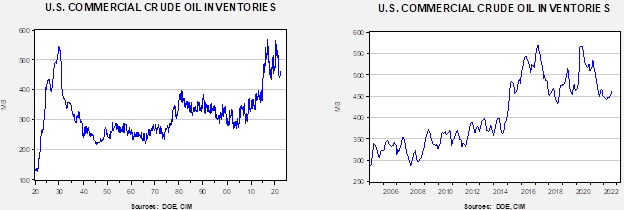

Crude oil inventories rose 5.5 mb compared to a 1.0 mb draw forecast. The SPR declined 5.3 mb, meaning the net build was 0.2 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.2 mbpd. Exports fell 1.4 mb, while imports declined 1.2 mbpd. Refining activity jumped 2.3% to 94.3% of capacity.

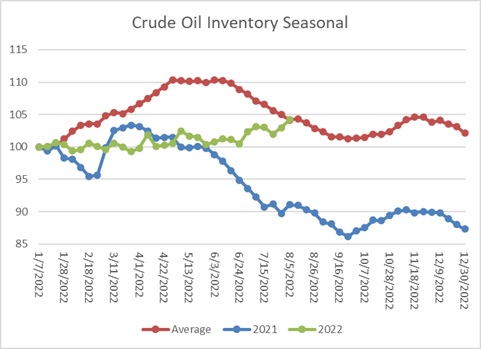

The above chart shows the seasonal pattern for crude oil inventories. Clearly, this year is deviating from the normal path of commercial inventory levels. The fact that we are not seeing the usual seasonal decline is a bearish factor for oil prices.

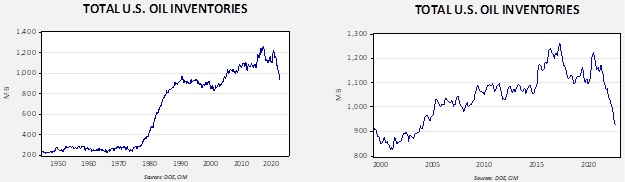

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2004. Using total stocks since 2015, fair value is $102.55.

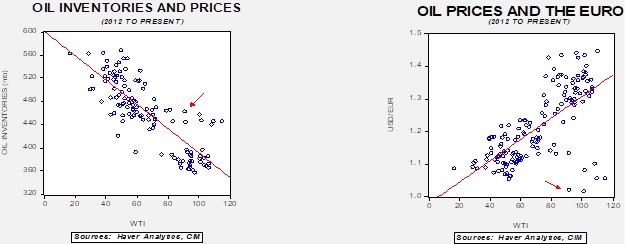

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $64 per barrel, so we are seeing about $24 of risk premium in the market.

Market news:

- Oil prices rose this week as Russia halted shipments to central Europe over a dispute on payments. According to reports, Russia cut throughput after sanctions prevented Russia from accepting transit fees. However, the market failed to hold gains as a workaround was created.

- In last week’s report, we noted that OPEC+ increased production targets by 0.1 mbpd, a remarkably small adjustment. This had to be a disappointment for the White House. But beyond this news reveals a more troubling problem—the cartel may be near maximum output. For most of my career, we spoke of OPEC production “quotas” that were routinely violated. The usual excess production would tend to quell prices and, occasionally, lead the KSA to enforce discipline by flooding the market with oil. We now are in a world where we have production “targets” that are not met. The reason for the small increase appears to be less of a snub to President Biden and more because the producers just don’t have the capacity. Now, that doesn’t mean that they have no more oil to tap, but using that capacity would mean there is no additional buffer if something happens this winter. In any case, the price weakness we are seeing now is mostly a function of weakening demand.

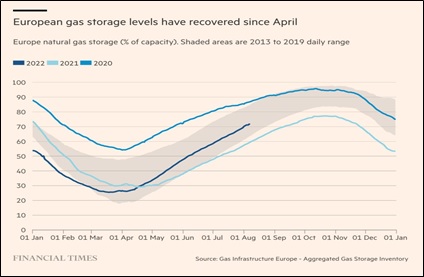

- Meanwhile, in Europe, countries are trying to figure out how to reduce demand to shore up inventories of natural gas without relying solely on price to ration demand. Such schemes have some usefulness, but there is a clear incentive to “free ride” the conservation of others. For example, Greek authorities are pressing for citizens to maintain an air conditioning temperature of 80o, but actually doing that is hard. So far, a weakening EU economy coupled with these measures is allowing inventories to accumulate, but at much higher costs. The other action we are seeing is fuel switching, which has mixed value. Still, research from the IMF suggests that with better coordination, the EU could offset some of the supply issues with better distribution.

- Although we have doubts that such demand “scolding” will work, EU storage levels are about normal.

- The negative effect on fertilizer and chemical plant operations in Europe could be significant if natural gas supplies remain constrained.

- After cutting off flows of natural gas to Latvia, supplies returned; it is not obvious why Russia restarted flows.

- Freeport LNG will resume partial operations in October. Although that is good news for Europe, it may result in higher U.S. natural gas prices. Various outages at gasification facilities have been very costly for natural gas firms.

- Reports suggest that Russian oil prices are starting to rise, which signals some degree of normalization of trade flows. Although bans on Russian oil in some markets will remain in place, nations open to buying Russian oil, namely, China and India, are likely creating a trading infrastructure to facilitate these sales.

- As Asia and Europe scramble to secure natural gas supplies, buyers are finding themselves competing for the same cargos. Meanwhile, as the U.K. steps up its LNG regasification, it is confronting a situation where some of the gas is tainted; if not rectified, this contamination could harm gas pipelines to the continent

- In Asia, a strike at an Australian LNG facility will delay maintenance and may reduce available supplies.

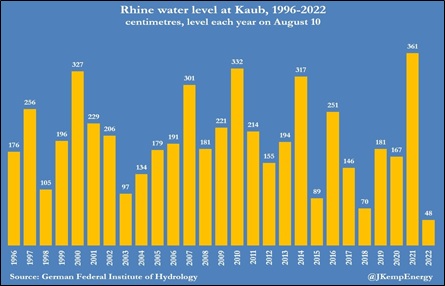

- As we noted last week, Rhine River water levels are declining due to unusually warm weather and the lack of rain. As levels decline, freight costs rise as ships can only be partially loaded.

- Factories in Bangladesh are planning for “holidays” to reduce energy demand.

- Gulf of Mexico oil production has been flat for the past two years. Most projects are longer term in nature and the investing environment is such that oil companies are being cautious, wanting to avoid stranded assets. In addition, production in the region is always at risk to tropical storm activity. That said, there are some projects coming on line which could lift production from this area in the coming months. Still, given where prices are, oil production has shown little growth, mostly because of capital discipline.

- The ESG movement has pressed financial firms to cut lending and investment to fossil fuels. As backlash has developed, banks and other financial firms are finding themselves caught between competing political trends.

- A Cuban tank farm caught fire after a lightening strike.

- Although the Biden administration hasn’t moved to restrict oil exports like President Nixon did in the 1970s, there is a risk that such policies might be considered again. However, given different grades of crude oil and their compatibility with the U.S. refining system, it is quite possible that the oil that isn’t exported would not be used domestically. This outcome would likely lower U.S. crude oil prices without lower product prices. In addition, such a ban would discourage U.S. production.

- High energy prices are translating into high food costs.

- China is producing oil and gas with ultra-deep drilling techniques.

Geopolitical news:

- According to reports, EU mediators negotiating between the U.S. and Iran have submitted their “final text.” Although Iran has returned to nuclear talks, the odds of success appear very low. For one thing, Tehran looks to be moving rapidly toward a nuclear weapon. For another, Tehran is trying to prevent the IAEA from investigating suspected weapons sites. We continue to expect that the talks will fail.

- Russia is launching a satellite for Iran to spy on the region.

- In Iraq, Muqtada al-Sadr is calling for new elections. Turmoil has been high in Iraq since al-Sadr’s supporters resigned from parliament.

- We have been reporting about high European temperatures this summer. One potential fallout is that hot weather could be contributing to geopolitical tensions in the Balkans.

Alternative energy/policy news:

- As the Inflation Reduction Act of 2022 careens toward passage, the climate change portions appear to be quite remarkable. Obviously, these projections are just that; it remains to be seen how this bill will work in practice. Nevertheless, it is notable that a political deal with a supporter of fossil fuels was open to signing off on such a measure.

- The bill does offer some political lessons. In a closely divided nation, carrots work better than sticks. This bill doesn’t have a carbon tax or items that will restrict demand; instead, there are subsidies and incentives.

- The parts of the bill that streamline permitting for pipelines is, in our opinion, a significant win for the oil and gas industry.

- One of the stranger elements of the bill is that to receive the EV tax credits, the supply chain has to exclude China. Since many of the EV elements come from China (batteries, some key metals in batteries, etc.), most EVs will be excluded. Although this rule does make sense, it also makes sense to buy your EV ASAP.

- As EVs become more popular, drawbacks are starting to emerge. First, EVs are expensive, even with generous subsidies. For widespread adoption, more affordable models will be required. Second, it will be difficult to source key inputs, such as lithium, nickel, and cobalt; there simply are not enough mines to meet the demand. Third, the charging infrastructure isn’t built out yet, and allocating the costs for that infrastructure will be partly absorbed by those not driving EVs.

- China’s CATL (300750, CNY, 505.65) intends to go ahead with its plans to build a battery facility in the U.S. With all the turmoil tied to Speaker Pelosi’s (D-CA) visit to Taiwan, there were doubts the investment would occur.

- Sanctions on imports from Xinjiang will likely reduce the availability of solar panels in the U.S.

- In some respects, hydrogen is the future of the energy industry and always will be. Hydrogen is not only ecologically friendly (using it in a fuel cell creates water as a byproduct), but it could conceivably use the existing filling station network and avoid the buildout of charging stations. Still, making hydrogen on a commercial scale has always been cost prohibitive. Fuel cells mostly use platinum, lifting costs as well. But, emerging research suggests that iron might be an acceptable catalyst, which could reduce costs significantly.

- Over the summer, we have been commenting on extreme temperatures and other weather events around the world. Iraq, for example, is reporting 120o temps this week. In the face of rising temperatures, cities are beginning to build and expand cooling centers to give people a place to cool off during the day. Drought conditions exist in 60% of the EU plus the U.K. The latter is bracing for another dangerous heat wave.

- The lack of rainfall is reducing Norway’s hydroelectricity supply; consequently, exports to the continent will be cut.

- U.S. power demand is set to make a new record this year.

- Thermal storage is increasingly becoming an alternative for absorbing excess electricity from wind and solar.

- One of the “dirty little secrets” of green energy is that it relies heavily on rare earths minerals. These tend to be mined in the developing world at terrible environmental costs.

- In a bid to clean up the plastics chain, investments in bioplastics are starting to ramp up.

- Although nuclear energy offers a path toward carbon-free energy, the U.S. is heavily dependent on Russia for uranium supplies.

- Solar and wind farms can take up space in farmlands. China is considering reducing such installations to ensure ample food supplies.