Weekly Energy Update (August 25, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices remain under pressure on fears of a deal with Iran and weakening economic growth.

(Source: Barchart.com)

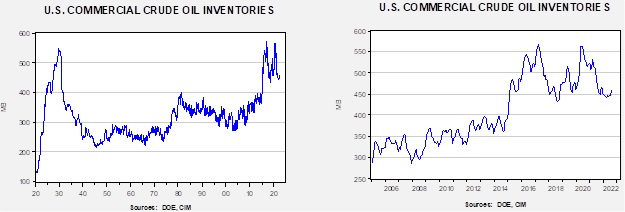

Crude oil inventories fell 3.3 mb compared to a 2.5 mb draw forecast. The SPR declined 8.1 mb, meaning the net draw was 11.4 mb.

In the details, U.S. crude oil production fell 0.2 mbpd to 12.0 mbpd. Exports fell 0.8 mbpd, while imports were unchanged. Refining activity rose 0.3% to 93.8% of capacity.

(Sources: DOE, CIM)

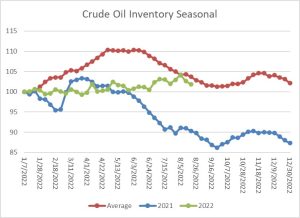

The above chart shows the seasonal pattern for crude oil inventories. Clearly, this year is deviating from the normal path of commercial inventory levels although the past two weeks are consistent with seasonal behavior. We will approach the usual seasonal trough for inventories in mid-September.

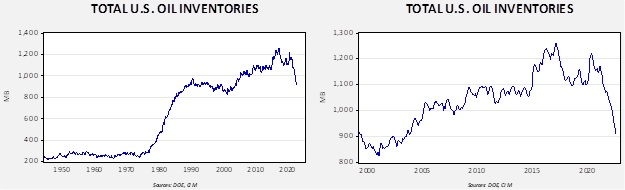

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $106.51.

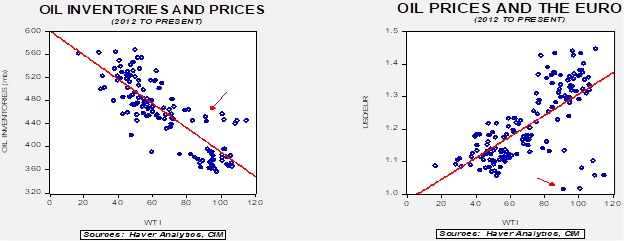

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $64 per barrel, so we are seeing about $24 of risk premium in the market.

Market news:

- In a surprise move, OPEC+ is apparently mulling production cuts in response to weaker prices and an apparent “disconnect” between the physical and futures markets.

- The Freeport LNG plant, which suffered a fire earlier this year, will be at 85% of capacity by late November and full capacity by March 2023. This restart is later and less than expected, leading to a decline in U.S. natural gas prices.

- The courts giveth and taketh away. An appellate court ruled against the Biden administration’s pause on oil and gas leases on Federal lands. However, it isn’t clear if this ruling will lead to immediate new activity. On the other hand, another court ruled oil companies can be held accountable for the impact of climate change.

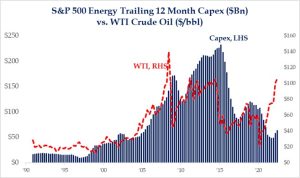

- We note that U.S. energy capital spending remains restrained.

(Source: Strategas)

- Russia announced a three-day closure of the Nord Stream 1 pipeline in late August. By itself, this isn’t a huge issue, but with natural gas supplies tight, the fear is that the three day closure will be extended.

- There are rumors that German industry has stopped hedging natural gas for future purchases. This may suggest that (a) the costs of hedging have become prohibitive or (b) they intend to simply buy in the spot market and if the price is too high, they will stop buying. In any case, if true, it would suggest the potential for a near halt of German industrial activity.

- The primary link of European natural gas prices to the U.S. is through LNG and the earlier-mentioned Freeport news does dampen U.S. prices a bit. Still, American exports are lifting the price of U.S. natural gas. There is a risk of political blowback.

- Santos Limited (STO, AUD, 7.52), an Australian oil company, announced a new project in Alaska.

- The EU is ramping up oil imports from Russia in advance of the December 5 ban.

- Canada and the EU are discussing future natural gas trade, with Canada building out LNG capacity on the Atlantic Coast for export to Europe. Although this idea might improve Europe’s natural gas situation in the long-term, it will probably not help the immediate need.

- Maximizing shareholder value isn’t just a U.S. energy company position as Saudi Aramco (2222, SAR, 39.50) is doing something similar.

- Norway is warning Germany it may be near its natural gas export capacity and won’t be able to increase supplies to the continent indefinitely.

- Colombia’s new president has announced new taxes on the oil industry.

- The Ukraine War has led the U.S. to increase oil exports to Europe.

- Higher energy prices are becoming a major burden to U.K. households.

- Aluminum is sometimes referred to as “molten electricity.” High electricity prices have led to a sharp drop in European aluminum output.

- High natural gas prices along with higher mining costs have sent fertilizer prices soaring. The cost of fertilizer is exacerbating food shortages in Africa.

- Despite talk about reducing carbon emissions, China is increasing investment in fossil fuel production.

- Even with a concerted effort to reduce oil usage in transportation, the expansion of plastic use will underpin demand for oil.

Geopolitical news:

- Iran continues to add conditions to the most recent “final offer” from the EU to bring Tehran back to the nuclear deal. Despite these conditions to a final offer, Tehran is blaming the U.S. for the lack of progress on a deal. As we noted last week, the market expects a jump in supplies if a deal is made, but we are not convinced. Sanctions regimes tend to deteriorate over time and reports suggest that Iranian oil is “leaking” into the market already.

- There are reports that the U.S. is “reassuring” Israel that resuming the nuclear deal won’t increase risks to the region.

- At the same time, the JCPOA is not popular in Congress on either side of the aisle. The administration is taking a chance that returning to the agreement will significantly lift oil supplies.

- Russia has been improving relations with Iran, and there is a risk that they could use Iran as a conduit to avoid sanctions.

- Recently, we have been reporting on political divisions in Iraq. The political tensions could very well undermine Iran’s influence on the country.

- Although the Gulf states, Israel, and perhaps Turkey are aligning against Iran, we do note that the Gulf nations are also cautiously opening diplomatic channels to Tehran. If the U.S. reduces its influence in the region, some degree of cooperation may be necessary. As the U.S. moves its emphasis elsewhere, Russia is attempting to fill the void.

- Klaus Ernst, a Bundestag member from The Left party, is calling for “negotiations” with Russia not only to increase natural gas supplies but to open Nord Stream 2. The Left is not in the government and cooperating with Russia isn’t the policy of the current administration. However, his comments raise concerns that support for sanctions against Russia may be under pressure.

- There is an interesting geopolitical ‘tug-of-war’ occurring between China and Russia over the Central Asian nations. Russia sees these nations as part of its sphere of influence whereas China wants them to feel free to export raw materials (include oil and natural gas) without concern over Moscow’s position. We note that there has been a suspension of oil loadings on the Caspian pipeline system, which may or may not be due to Russian interference.

- Mexico’s President Andrés Manuel López Obrador is taking steps not just to intervene in the oil industry but also to undermine efforts to diversify with renewables. His policy of resource nationalism may not lead to more oil production (it isn’t clear the state oil company can do this without foreign assistance) but could lead to less overall energy supply.

- There are reports that China is expanding its capacity to smuggle oil through tanker transfers in the open ocean. The U.S. is increasing efforts to tighten sanctions on Russia.

- Poland banned Russian coal imports and is now scrambling to build stockpiles.

Alternative energy/policy news:

- We continue to closely monitor drought, water levels, and temperatures around the world.

- In China, a tributary of the Yangtze River has run dry. Hot temperatures in China are boosting coal usage. Sichuan province has shut down all industrial activity for five days due to shortages of electricity. The province is increasing its consumption of coal for electricity, but that hasn’t been enough yet to overcome the drought and the loss of hydropower. Silicon production has been affected by the power outages. The Shanghai Bund light show has been cancelled due to electricity shortages and EV owners are finding supplies tight. Here are some pictures of China’s drought.

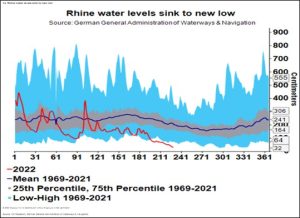

- In Europe, hot weather and low water levels have reduced hydropower from Norway, reduced nuclear power output, and cut coal shipments. Although the Rhine River levels have improved modestly recently, the chart below shows current levels relative to history.

(Source: Adam Tooze)

- High temperatures, unexpected flooding, and other weather events are contributing to inflation. The weather has interrupted shipping, damaged crops, and reduced productivity. Adding to worries is that, so far, the Atlantic hurricane season has been quiet, but history shows that tropical storm activity tends to rise into mid-September.

- One of our observations is that we live in a multi-variant world but create univariate narratives. Thus, that the current drought and heat are solely caused by greenhouse gases is a common theme. Clearly, this isn’t the sole cause otherwise how does one explain earlier drought periods when greenhouse gases were much less prevalent? This isn’t to say that greenhouse gases don’t matter as there is solid evidence that they do have an impact, but the current crisis is likely affected by other factors as well.

- The Inflation Reduction Act has funding for carbon capture projects.

- The SEC is proposing broad greenhouse gas rules for publicly traded companies. In their current form they would impose these rules on Europe as well.

- Although there are numerous Gigafactory projects in Europe, nearly all of them are facing serious delays.

- Lithium is the current state of the art for batteries, but research on other battery chemical mixes continues and there is growing evidence that sodium solid state batteries may prove to be a much better alternative. Not only is sodium plentiful and inexpensive, but the battery should last longer and charge much faster. However, the battery probably wouldn’t be used initially in transportation since salt is heavy, but could be used in industrial settings and for utilities. As the science improves, we could see this later used in transportation.

- Although Australia and Chile dominate lithium mining, China dominates processing of the metal.

- Will Germany close its remaining nuclear plants? The economics ministry says they will close on schedule, but there is a rising call to keep them running. Meanwhile, in the U.S., utilities with nuclear facilities are seeing better performance. Japan is turning the reactors back on to offset the risk of fewer LNG supplies.

- The gas emissions from farming have become major news in Europe. The Netherlands is implementing nitrogen restrictions on dairy farming that will end up reducing milk supplies and put farmers out of business. We are seeing a strong negative reaction. A similar plan in Canada is also upsetting farmers.

- Ford (F, $15.31) announced a workforce restructuring to shift toward EV production.

- Greenland is drawing new attention for sourcing rare earths. European automakers are increasing their focus on Canada as a source for battery metals.