Daily Comment (August 26, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment examines why Thursday’s economic data could encourage the Fed to raise rates more aggressively. Next, we explain how elections in Russia could impact its war with Ukraine. We conclude the report by discussing the U.S.-China rivalry and how it could impact Asia.

More Hikes? The positive Gross Domestic Income (GDI) report for Q2 could overshadow the negative Gross Domestic Product (GDP) numbers and pave the way for more Fed tightening.

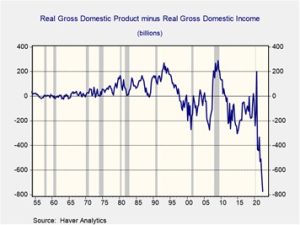

- An alternative measure of economic output has bolstered the Federal Reserve’s claim that GDP might not reflect the underlying fundamentals of the economy. In the second quarter, GDI, adjusted for inflation, rose at an annualized rate of 1.4% from the previous period. The number contradicts the GDP reading of a 0.6% drop in economic activity in the same period and suggests that the economy may not have contracted at all this year. In an ideal world, the two numbers should be identical, as total spending should equal total income. However, statistical differences between the two variables have widened to levels never before seen in the series history.

- A strong labor market might be responsible for the divergence between the real GDP and real GDI. While GDP is the sum of the total market value of all the final goods and services produced, GDI is the aggregate income earned and cost incurred during production. In theory, the latter should reflect the underlying labor market strength. Although the initial claims have risen over the last few months, many workers that reentered the workforce were able to find jobs quickly. As a result, the tight labor market may have shielded the economy from the negative impacts of monetary tightening.

- The positive GDI number could push the Fed to raise interest rates aggressively over its next few meetings. St. Louis Fed President James Bullard has insisted that the central bank should lift its policy rate to 4.0%. Kansas City President Esther George has advocated that the bank should go even further. Assuming that the FOMC follows Bullard’s lead, it would suggest that they could raise rates by 50 bps in each of its next three sessions. Hence, financial conditions could tighten significantly throughout the rest of the year and possibly worsen in 2023.

The market will be on pins and needles when Fed Chair Jerome Powell gives the keynote address at the Jackson Hole Symposium. Over the last two days, investors have purchased more than $1 billion in short-term bond ETFs and have pulled over $2 billion from ETFs attached to the S&P 500. So far, it is speculated that Powell will make hawkish comments during his speech; however, a dovish tone could lead to a strong rally.

Russia-Ukraine: The Kremlin is ramping up pressure in Ukraine to solidify gains before election season for Russia begins in September.

- Russian President Vladimir Putin signed an order to boost the Russian troop total by 137,000 to 1.15 million. It was the first time that Putin had expanded the military headcount in over five years. The new decree has added to speculation that Russia believes that the war will be protracted. However, there is also the possibility that the order could be a bluff. Russia has not been able to take over Ukraine as swiftly as it initially implied it would. In short, Putin likely has a credibility problem. The war has lasted six months despite assurances from Putin that the conflict would only be a few weeks. Additionally, the government was forced to delay annexation referendums in Donbas due to its inability to secure the region properly. Thus, the Kremlin’s decision to increase the number of troops could be a way to signal to its population that the Russian military is still determined to win.

- The Moscow exchange plans to allow evening trading next month. Stock trading was halted for a month after the conflict began as the government attempted to hide the financial damage of the war. The government then began to allow limited securities trading in the morning sessions. The Russian Central Bank has maintained that regulators will block investors from “unfriendly” countries from trading on the exchange. The move to open the market for a full day reflects the government’s attempt to show a return to normalization after the invasion of Ukraine.

- Ukrainian President Volodymyr Zelensky has stated that the world narrowly avoided a radiation disaster. On Thursday, Ukraine’s largest power plant was forced to disconnect after fires damaged a transmission line. The incident has heightened concerns that the war could lead to a major nuclear disaster as Russian forces continue to use the power plant as a shield against attacks from Ukrainian troops. In addition, there was a mass power outage in areas nearby. A nuclear accident in Ukraine could lead to a global crisis and possibly slow the global push to use nuclear energy in other countries.

Elections are essential, even for authoritarian governments. Regional elections will take place on September 11, and this will be the first time Russian constituents are able to showcase their level of satisfaction with the government. A low turnout would suggest that the war has dented sentiment in the country. It could also force Putin to take more extreme measures to end the war as he prepares to run for reelection in early 2024.

Asia Risks: Friction between the U.S. and China remains the top risk in Asia.

- Regulators in the U.S. and China achieved a breakthrough in negotiations to keep Chinese firms listed on American exchanges. Chinese regulators have requested major accounting firms to bring relevant audit documents of Chinese firms to the U.S Public Company Accounting Oversight Board. The order will prevent Chinese companies from being delisted from American exchanges. Although this is a positive development, it does not change the trajectory of the U.S.-China relationship.

- Tensions between the U.S. and China continue to escalate as U.S. lawmakers continue to travel to Taiwan. Senator Marsha Blackburn (R-TN) is the third politician to travel to the self-governing island this month. House Speaker Nancy Pelosi (D-CA) and Senator Ed Markey (D-MA) also made the trip. China responded to the Pelosi trip by holding military exercises near Taiwan. Thus, Blackburn’s trip could also have a similar response. The big takeaway is that American lawmakers believe it is politically beneficial to poke China in its eye over Taiwan. Although China’s reaction has been mild, relative to its threat to the U.S. “not to play with fire,” their response to such provocation could escalate after President Xi is sworn in for a third term. Therefore, we still believe the risk of conflict between the U.S. and China remains elevated.

- Additionally, China has urged the U.S. not to engage India in planned military drills along the two countries’ shared border, referred to as the Line of Actual Control (LAC). China believes that such exercises would violate the Beijing-New Delhi accords.

- China’s assertiveness has finally pushed Japan to ramp up its defense budget drastically. The Japanese government will double its defense spending over the next five years to address national security threats. In June, the government released a report showing the country’s concern about the Russia-Ukraine war, China’s intimidation of Taiwan, and their vulnerable supply chain technology. Behind only the U.S. and China, Japan will have the third largest military budget in the world.

The rivalry between the U.S. and China could lead to a broader war in the Indo-Pacific. Many countries in the region fear China’s rise as a military power and look to expand their capabilities in the event of a conflict. Although we do not expect tensions to rise significantly over the next few months, we do believe that the Chinese will become more assertive after the National Party Congress in the fall. The increase in defense spending likely favors our analysis that defense industries are positioned to benefit from increased global tensions.