Weekly Energy Update (September 1, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(The Weekly Energy Update will not be published next week. The report will return on September 15.)

Crude oil prices remain under pressure on fears of a deal with Iran and weakening economic growth.

(Source: Barchart.com)

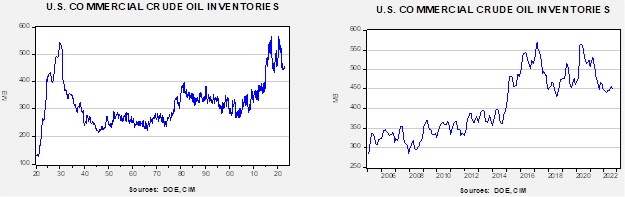

Crude oil inventories fell 3.3 mb compared to a 2.5 mb draw forecast. The SPR declined 3.1 mb, meaning the net draw was 6.4 mb.

In the details, U.S. crude oil production fell 0.2 mbpd to 12.0 mbpd. Exports fell 0.8 mbpd, while imports were unchanged. Refining activity rose 0.3% to 93.8% of capacity.

(Sources: DOE, CIM)

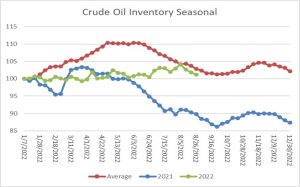

The above chart shows the seasonal pattern for crude oil inventories. Clearly, this year is deviating from the normal path of commercial inventory levels although the past months’ inventory changes are more consistent with seasonal behavior. We will approach the usual seasonal trough for inventories in mid-September.

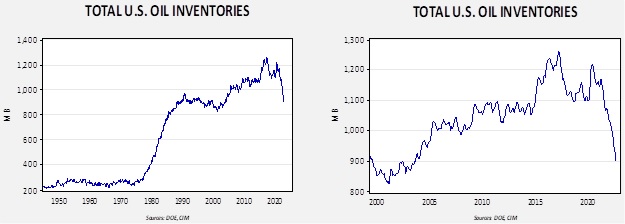

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $107.69.

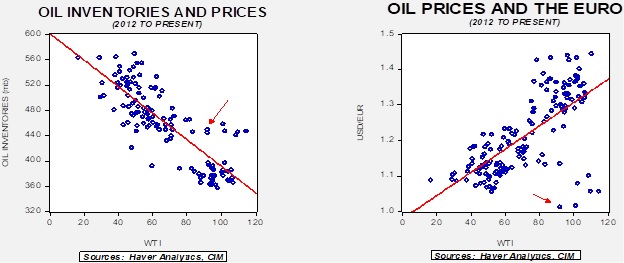

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $64 per barrel, so we are seeing about $24 of risk premium in the market.

Market news:

- There are grave concerns about how Europe will manage energy this winter. Natural gas inventories have been rising, but it is probable that the European economy, likely in recession now, will see weaker economic activity in the coming months. However, conditions are improving and it is possible that, barring an unusually cold winter or some other crisis, the situation might be more manageable than it looked earlier this year. Some of this improvement is due to European industrial consumers making adjustments.

- However, even with an improved supply situation, consumer costs will be very high this winter. The U.K. government is warning households to expect an 80% increase in their energy bills. Europeans are facing difficult choices over home heating or eating.

- Although the focus remains on this winter, policymakers are starting to realize that disruptions will likely continue for the next several years, meaning a broader response is necessary.

- As China’s economy slumps, it has been reselling LNG to Europe. Although the EU can certainly use the gas, the concern is that this development will make the EU increasingly dependent on Beijing.

- Russia has halted flows of natural gas over the Nord Stream 1 pipeline for maintenance. The shutdown is supposed to last three days, although there are worries that it could be extended. One of the issues about these periodic shutdowns is that Russia doesn’t have extensive storage networks for natural gas. We have been concerned that if Russia starts closing in wells, there could be a permanent loss of production. Apparently, Russia is avoiding this outcome by massive flaring of natural gas. In effect, Russia is simply burning the gas into the atmosphere rather than put it in the pipeline. Flaring does avoid the issue of shutdowns.

- Russia has suspended natural gas flows to the French industrial company Engie (ENGIY, $11.97) over a contract dispute.

- The Canadian natural gas market is mostly isolated. Although there are pipelines that interconnect to the U.S. system, they occasionally reach capacity, leading to large discounts on Canadian natural gas. We are seeing that situation now as the chart below shows the U.S. market trading at a nearly $7.00 premium.

(Source: Bloomberg)

- Canada’s energy industry is heavily dependent on pipelines to the U.S. It is facing numerous threats to close ageing pipelines which, if these blocks are successful, would “bottle up” Canadian oil and natural gas and lead to lower prices.

- Canada would benefit by building out an LNG infrastructure.

- We have been reporting on the negative impact of ESG on oil and gas production. We note that the state of Texas is restricting investments in firms that support ESG investing.

- As natural gas prices rise, ancillary gases are seeing price hikes too. In the U.K., high natural gas prices have made ammonia prices uneconomical. Carbon dioxide is a by-product of ammonia production and now that gas is in short supply. Carbon dioxide is used by beer and soft drink makers and is used by the meatpacking industry to stun animals before slaughter. This situation shows the ripple effects caused by excessively high natural gas prices.

- Although we haven’t said much about it in this report, we are closely monitoring the intersection of energy and agriculture. Drought is hurting crop yields, but high fertilizer costs look to cause food shortages.

- Elevated natural gas prices are triggering a surge in LNG infrastructure investments. In the immediate term, however, Freeport LNG has pushed back its full recovery until March 2023.

- So far, the Atlantic hurricane season has been quiet, which, given the tightness of energy markets, is remarkably fortunate. This report highlights the risk from tropical storms and how it could disrupt production and LNG exports.

- In Europe, data centers are stockpiling diesel fuel to power local generators in case of blackouts. Major tourist attractions have been dimming the lights to reduce costs.

- Semiconductor production is remarkably energy intensive.

Geopolitical news:

- One issue we have been watching closely is the political tension caused by high U.S. energy prices juxtaposed with the geopolitical goal of supplying Europe with energy. With midterms looming, the administration is clearly sensitive to domestic energy prices. The massive SPR withdrawal, which we document each week in the above data, is part of the response. However, this goal of keeping domestic energy prices low is in conflict with exporting enough energy to keep European nations “onside” with supporting Ukraine. Over the past week, we have been starting to see signs of cracking. The U.S. energy secretary is warning U.S. refiners not to increase exports to Europe, and threatening “actions” for companies that don’t comply. At this point, we don’t think the administration would ban exports, but the idea remains under consideration.

- Energy nationalism isn’t just a U.S. issue as the U.K. has threatened to cut natural gas interconnecting pipelines to the continent.

- On the other hand, the Russian economy appears to be doing better than expected. Appears is a key word, because the Kremlin hasn’t been forthcoming with economic data since the war started. A report out of Yale suggests the Russian economy has been crippled by sanctions, but there has been a notable pushback against this claim. An article in The Economist suggests the Russian economy is holding up, in part, because Russia is still selling oil and natural gas. Greek tankers seem to be the conduit of much of these sales; however, when the EU enforces new insurance rules later this year, those sales may dry up. There is no doubt that sanctions have had a negative impact on Russia, but Russia’s reaction to them has also had an ill effect on the West as well.

- There are reports that Israeli warplanes (F-35s) penetrated Iranian airspace. Although unconfirmed, it appears this action was designed to test Iranian radar defenses. Along with reports that the U.S. and Israel held exercises over the Red Sea to simulate an attack on Iran, this news does suggest the idea of an attack on Iran remains a possibility.

- We also note that tensions between Iraqi Kurds and Iran are escalating, with the latter trying to influence governance and policy in this region of Iraq. Although the Kurds themselves are divided, they are united on the goal of controlling oil and gas flows from their region. Baghdad has never been comfortable with this arrangement, but at times has been forced to tolerate it. At present, there is no national Iraqi government in place, and so it is likely that Iran is trying to keep the Kurds from expressing their independence.

- The U.S. and Iran rarely agree on much, but there are reports Washington and Tehran are not comfortable with the lack of a government in Iraq and Muqtada al-Sadr’s behavior in preventing a new administration from forming. Tensions between Shiite groups aligned with al-Sadr and with Iran led to riots and some fatalities. At present, the rioting has ended, but tensions remain high. The crux of this issue between al-Sadr and the other Shiite groups is that Iraq has been governed, since the fall of Saddam Hussein, by a Shiite-dominated legislature that apportions power to all the various Shiite groups. Much like Lebanon, those not part of al-Sadr’s group want to keep it that way. Al-Sadr dominated the last elections and wants to control the legislature without sharing power.

- Despite the report above, the U.S., EU and Iran continue to negotiate a return to the JCPOA. The U.S. has responded to Iran’s recent demands, but it isn’t clear that Tehran will accept this proposal or call for additional negotiations. Iran continues to make demands, suggesting that it isn’t in a rush to resume the pact.

- Israel has sent its defense minister to Washington along with the head of the Mossad to discuss the negotiations. Israel has opposed the pact.

- Swedish and German intelligence suggest Iran has been trying to acquire nuclear technology for weapons.

- As we noted last week, Iran has been holding crude oil, condensate, and products offshore in tankers. It is estimated that this source could rapidly add around 90 mb of oil and related products to global oil supplies. This expansion is one reason why the administration is pursing a resumption of the deal.

- It is also becoming clear that the Kingdom of Saudi Arabia is leading an effort to offset the return of Iranian crude oil by pushing for OPEC+ production cuts. This is a clear sign from the KSA of its opposition to a resumption of the agreement. The drop in oil prices at mid-week was said to be due to OPEC+ signaling no output reductions, which may be an indication that the Iran nuclear deal is stalled.

- The U.S. Navy had a confrontation with Iranian naval forces in the Persian Gulf. The Iranians apparently tried to capture a U.S. surface drone.

- The sanctions on Russia have mostly removed Moscow from the dollar system. India is starting to settle trade with Russia in INR. Although this decision clearly benefits India, it isn’t obvious what Russia will do with the INR.

- Fighting has intensified in Libya, which has been in a civil conflict since Qaddafi was ousted in 2011. Often when conflict rises, oil flows are adversely affected.

Alternative energy/policy news:

- Renewable energy consumption is rising rapidly, with China holding the position of largest consumer.

- California is banning the sale of gasoline powered internal combustion engine vehicles by 2035. If the state holds to this plan, it will likely push automakers to expand EV production.

- Last week, we noted that Texas was banning firms from conducting business with the state if they had an ESG policy that curtailed investment in fossil fuels. This appears to be a bid to sway national policy via state regulations. California does similar actions, such as what the above bullet point suggests. Given that California’s state GDP is 14.6% of U.S. GDP compared to 8.8% for Texas, businesses tend to pay closer attention to the former.

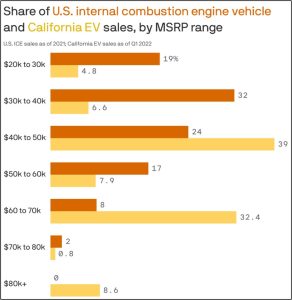

- EVs remain a high-cost vehicle choice. Although there are a few lower cost options, as the chart below suggests, getting into an EV is mostly a $40k+ purchase.

(Source: Axios)

(Source: Axios)

-

- One factor driving the price of EVs higher is the goal of giving the cars the same range as a gasoline powered vehicle. However, when “fill up” of electricity can be done daily in one’s garage, an EV with a much smaller range might be more practical for everyday use and be cheaper to make.

- We remain bullish on metals required in the conversion away from fossil fuels because it doesn’t appear that the demand is impossible to fill. At the same time, miners continue to find that local opposition is delaying the building of new mines for the materials required for batteries.

- Where are the hurricanes? So far, this has been a remarkably quiet Atlantic hurricane season. Strong wind shear in the Caribbean has dissipated tropical waves and there haven’t been a lot of squalls coming from Africa. It’s still too early to declare an “all clear” as the usual peak is around September 10, but, given the tightness of the energy markets, a slow hurricane season is a bit of good fortune.

- The Western U.S. is facing a hot week.

- China has seen some rain which has eased drought conditions, but energy conditions remain fraught. China has persistent water issues that appear to be worsening. The drought is leading to greater coal use.

- Mexico announced the opening of a state-owned lithium miner.

- Nuclear power is making a comeback. We noted recently that Japan is reopening reactors closed after the Fukushima incident. Germany is reconsidering its decision to end nuclear power. So is California. Although strong opposition will likely continue, nuclear offers carbon-free baseload electricity which is attractive.

- One response to climate concerns is geoengineering. Geoengineering is the process of using engineering interventions to cool the planet, reduce carbon in the atmosphere, adjust rainfall, etc. These interventions are highly controversial because, in theory, they could change weather patterns that could disadvantage some areas of the world while supporting others. They could also have unanticipated side effects. Also, given that geoengineering could be introduced by private actors, there is grave concern about how to control the process. At the same time, we are already seeing efforts by nations in the Middle East to change rainfall patterns through cloud seeding and other techniques.

- Major oil companies are making further investments into carbon capture.

- Coal is a dirty fuel in more than one way since not only is it the most carbon intensive of fossil fuels, but it also creates water pollution and solid waste. These wastes often are laced with heavy metals. However, researchers are taking that waste and are working to extract these metals for the potential use in batteries.

- The Danish energy minister is calling for the streamlining of permits for wind farms. We note that permitting issues were a key part of the Inflation Reduction Act.

- “Smart glass” a product that adjusts to light in a way to increase the efficiency of HVAC units in buildings, is expected to expand due to a provision in the Inflation Reduction Act.

- China is expected to continue to dominate the solar panel industry. However, the emergence of U.S. industrial policy is expected to see the U.S. increase solar equipment manufacturing.