Daily Comment (September 8, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will begin with a discussion concerning the European Central Bank’s rate decision. Afterward, we will discuss the impact monetary tightening has had on the global economy. Lastly, we review the latest moves by major powers to expand their influence in other countries.

The Euro Bounce: The euro is strengthening following the European Central Bank’s decision to raise rates. Meanwhile, rising inflation and slowing growth remains a risk for Europe.

- As expected, the ECB lifted its main refinancing rate by a record 75 bps. The massive jump in interest rates comes as the Eurozone combats unusually high inflation. The bank’s statement shows that it projects inflation to remain elevated but does not forecast a recession. During the press conference, ECB President Christine Lagarde emphasized that future rate decisions will be data dependent and be made on a meeting-to-meeting basis. She also added that the bank will continue to raise rates to 2.3% by end of the year and will proceed with its rate cycle if inflation remains a problem.

- That the ECB decided to downplay recession concerns suggests that it is less focused on growth and more on inflation. As a result, we suspect that the banks could consider large rate hikes in the future.

- Gas prices retreated on Thursday as investors brace for new emergency measures to help offset rising energy costs. European Union Ministers are scheduled to meet on Friday to discuss ways to curtail energy demand. The group is expected to discuss five moves to help bring down energy demand. Potential plans include the redistribution of some windfall energy profits, a price cap on Russian gas, mandatory targets during peak hours, and other measures. The decision to constrain energy usage is a response to concerns that Russia will halt the supply of gas to the region in the coming months. Limits on energy will worsen the impact of a European recession and disproportionately hurt industrialized countries such as Germany.

- That said, members will not share the pain equally. Spain, which has already filled its gas capacity to the critical 80 percent level, has been able to export some of its excess to neighboring France.

- Despite measures to curb energy demand, countries are likely to ease household pain through government intervention. For example, on Thursday, U.K. Prime Minister Liz Truss unveiled a £150B energy plan. The plan will cap annual household bills to £2,500 over the next two years. In Germany, the government has vowed to offer pandemic-era funds to companies struggling with the surge in energy costs. The increase in fiscal stimulus will likely prevent a worst-case scenario in Europe but will not stop the continent from falling into recession.

The Fed Strikes: Global currencies suffer as the Fed continues to tighten monetary policy; however, there are positive signs that inflation may be on a steady downward path.

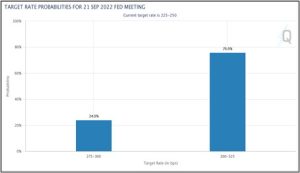

- Market confidence that the Federal Reserve will lift rates by 75 bps skyrocketed this month. Over the last several weeks, Fed officials dismissed assumptions that the central bank could reverse course in response to weakening economic data. On Wednesday, Cleveland Fed President Loretta Mester and Fed Governor Lael Brainard affirmed that the Fed still needed to raise rates to contain inflation. The latest projection from the CME FedWatch Tool suggests a 76% likelihood that the Fed will lift its policy rate to 3.25% in its next meeting.

-

- The newest Federal Beige Book showed that the economic outlook remained weak as business contacts expressed skepticism over future demand over the next six to 12 months. Although survey respondents reported moderation in price pressure and labor availability, firms still view inflation and hiring as an issue. The report suggests that the economy may head into a recession within the next few months.

- Hawkish Fed policy continues to push up the dollar’s value against its global peers. On Thursday, the British pound fell to its lowest against the dollar since 1985. Meanwhile, the Japanese yen slipped to a 24-year low. Out of the top three major currency pairs, the euro bucked the trend as anticipation of an ECB rate hike helped give it a slight boost against the greenback. As the dollar continues to gain in value, we expect other central banks to raise rates. Hence, global financial conditions will likely tighten over 6 to twelve months. Firms with U.S. dollar exposure are very attractive in this environment.

- Japan’s Chief Foreign Exchange Minister Masato Kanda signaled that the bank would consider all options to halt the yen’s slide but emphasized that the bank’s position has not changed. In addition, the Bank of Japan may purchase yen in the open market to help bring down the currency’s value. Traders expect that the BOJ could intervene when the yen breaches ¥147.

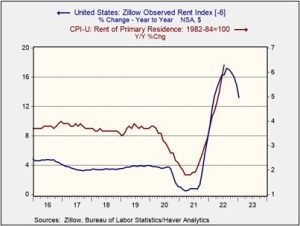

- Rent and home prices may be close to their respective peaks. According to data collected by Zillow, rental prices slowed for three consecutive months. Meanwhile, potential home buyers surveyed by Fannie Mae expressed optimism that home prices would decline over the next few months. If valid, the deceleration will affect the overall Consumer Price Index as shelter prices represent nearly a third of its weight. The Zillow index lags the CPI by about 6-9 months, and as a result, we suspect that category to rollover around March of next year.

The Great Power Tussle: The U.S. and China blocs continue to battle over global influence, while the war in Ukraine shows no signs of ending.

- In a speech, Russian President Vladimir Putin stated that his country was winning the war in Ukraine and vowed to proceed with the invasion in Ukraine. His remarks highlight the pressure of progress in the war as the country heads into regional elections over the weekend. Although the outcome is likely to be favorable for the Kremlin, low turnout would signal that the government is losing support. Although Putin insists that he feels no pressure to end the conflict, a potential voter backlash could force him to rethink the invasion, especially as he plans to run for reelection in early 2024.

- Ukrainian President Volodymyr Zelensky revealed that Ukrainian troops were able to retake territory lost to Russian troops.

- The U.S. will meet with 13 Asian countries to discuss an economic framework that limits China’s influence in the region. The deal has been low on details but appears to be focused on limiting tariffs in exchange for market access for exporters. It is not clear when an agreement will be reached, but we believe that it should be beneficial to firms which conduct business in Asia.

- President Putin is scheduled to meet with Chinese President Xi Jinping at the Shanghai Cooperation Organization summit in Uzbekistan next week. The two leaders will discuss the ongoing developments of the war as well as improvements in trade relations. Although it has maintained its neutrality in the war, China has allied with Russia. That said, the relationship still has its flaws. Thus, the meeting could give insights as to whether China still plans on expanding its support for Moscow.

- China’s reluctance to provide Russia with weapons has forced Moscow to look to pariah nations such as Iran and North Korea for its needs. Additionally, China has used the Ukraine war to expand its influence in Eurasia as earlier this month Beijing urged Russia to stop blocking oil exports from Kazakhstan.