Daily Comment (September 19, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where the Ukrainians continue to make progress in their key counteroffensives. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a preview of this week’s Federal Reserve policy meeting and how it’s affecting the financial markets so far this morning.

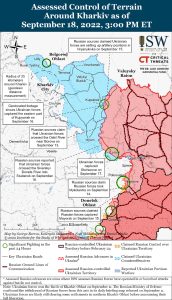

Russia-Ukraine: Ukrainian forces continue to press their counteroffensives both in the country’s northeast near the city of Kharkiv and in the south around the Russian-occupied city of Kherson. The northeastern attacks have slowed somewhat as the Ukrainians focus on consolidating last week’s gains, although the Ukrainian military says it now controls the key eastern bank of the Oskil River. The bulk of the Ukrainian effort now appears to be on the Kherson axis. Meanwhile, Russian forces continue to cede ground and are struggling to establish new defensive lines, at least in part because they are mostly left with poorly trained, poorly motivated volunteers, and other irregular troops. The Russians are progressively turning to rocket and missile attacks on Ukraine’s civilian energy and other infrastructure in an effort to break the Ukrainians’ will to fight.

- On the economic front, Russia’s effort to undermine the West’s will to support Ukraine by shutting off energy supplies is increasingly looking like it’s blowing back on Russia itself. The strategy will undoubtedly cause economic pain in Western Europe this winter but falling global prices and reduced exports have sharply curtailed the Russian government’s revenues. As Western European countries quickly build infrastructure to import energy from the U.S. and elsewhere, Russia’s strategy will have even less impact on Western Europe while leading to ever-increasing budget deficits at home.

- Meanwhile, we continue to assess Russian President Putin’s meetings with Chinese President Xi and Indian Prime Minister Modi last week. The press read-outs from those meetings suggest China and India have stepped back from their support for Russia, whether it be tacit or otherwise. A key question is whether Putin will respond by doubling down on his Ukrainian attacks in an effort to win the war quickly, or whether he will start looking for an excuse to start winding down the effort.

- Of course, another key consideration for Putin is that Russia’s recent failures in the war have prompted increased criticism of his government, and, by implication, himself.

Global Diplomacy: Queen Elizabeth II’s funeral was held today in Westminster Abbey, with leaders from dozens of major countries in attendance. With all those leaders rubbing shoulders, it would be no surprise if we see lots of market-impacting diplomatic news from the gathering. Remarkably, many of those leaders will then head off to New York for this week’s opening of the United Nations General Assembly, so there will actually be several days of major diplomacy to wade through.

- One event we’re especially keen on is British Prime Minister Truss’s speech at the UN, in which she is expected to link domestic economic conditions to geopolitics and argue that the liberal democracies must reduce their dependence on commodities and other goods from authoritarian countries.

- That argument would dovetail with our belief that globalization is being replaced with regionalization, in which the world’s countries are fracturing into relatively separate geopolitical and economic blocs. As we’ve written before, this regionalization will probably lead to shorter supply chains, less efficient production, higher prices, and higher inflation going forward.

European Union: Today, the European Commission proposed new legislation that would give it the power to force member states to stockpile key products and break contracts during a crisis such as the war in Ukraine or the coronavirus pandemic.

- The proposed law would give the Commission ample space to declare an emergency. It would then be able trigger a number of interventionist measures to ensure the availability of goods, for example, by facilitating the expansion or repurposing of production lines.

- The proposal is an example of how geopolitical frictions, war, and other crises often strengthen the state over the private sector.

European Union-Hungary: The European Commission yesterday proposed freezing about €7.5 billion of EU “cohesion funds” earmarked for Hungary over corruption concerns, although it also opened the door for a compromise under which Hungary could get the cash if it addresses its corruption issues. The move is the latest in the EU’s long-running battle with Hungary, which has chafed at many EU regulations and policies, including the EU’s support for Ukraine in its war with Russia.

Taiwan: An earthquake measuring 6.8 on the Richter scale struck southeastern Taiwan and reverberated across the island yesterday, causing building damage, derailing a train, and triggering concerns of a tsunami. As of this writing, however, there have been no reports of damage at the country’s globally-critical semiconductor production facilities.

United States-Taiwan-China: In an interview yesterday, President Biden again said the U.S. would defend Taiwan “if in fact there was an unprecedented attack” on the island by China. That marks at least the third time Biden has made the commitment, which suggests he has decided to deliberately shift the U.S. away from its previous “strategic ambiguity” policy toward the island.

- Under that policy, the U.S. left its commitment to the island unclear, both to discourage any Taiwanese independence moves and to deter China from getting too aggressive with the island.

- The administration’s decision to explicitly commit to a defense of Taiwan likely reflects concerns about China’s growing military strength and aggressiveness. The new U.S. commitment hasn’t been expressed formally, but it does suggest a tougher approach that will likely help keep U.S.-China tensions high and create more headwinds for Chinese stocks.

U.S. Monetary Policy: Tomorrow, Fed officials begin their latest two-day policy meeting, with their decision due out on Wednesday afternoon. Investors are broadly expecting that the officials will again hike their benchmark fed funds interest rate by an aggressive 75 bps.

- However, there has been some whispering among observers that the rate hike could be a full percentage point as the officials try to re-establish their inflation-fighting credibility amid continuing fast price hikes.

- As we have been warning, investors in late summer seemed too complacent about the Fed’s rate-hiking program. While many investors thought the policymakers would quickly pivot to steady or falling rates, we think there is a high chance they will over-shoot and spark a recession. As more investors buy into our view, we are noting meaningful drops in the values of stocks, bonds, commodities, and foreign currencies so far today.

U.S. Petroleum Industry: New reports indicate smaller private oil companies that helped boost the country’s oil output over the last couple of years have now begun to deplete their fracking opportunities and are starting to pull back from the market. With publicly-traded companies still held under a tight leash by investors demanding capital discipline, that raises the prospect of further tightness in supply that could again give a boost to prices, and inflation, going forward.

- Separately, the continued rise in natural gas prices prompted by the war in Ukraine and supply shortages is pushing up electricity prices in the U.S.

- The rise in gas and electricity prices threatens to impose big costs on households as autumn turns to winter and heating demand rises.

Hurricane Fiona: Over the weekend, Hurricane Fiona slammed into Puerto Rico, knocking out electricity for the entire island at times. The island’s power company warned that fully restoring electricity service could take several days.