Weekly Energy Update (October 6, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices remain in a downtrend.

(Source: Barchart.com)

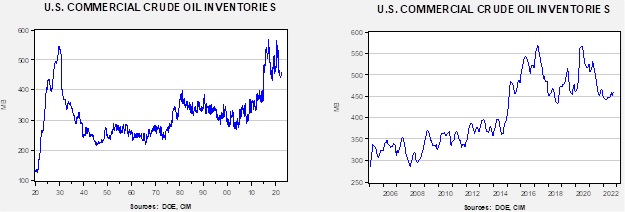

Crude oil inventories fell 1.4 mb compared to a 2.1 mb build forecast. The SPR declined 6.2 mb, meaning the net draw was 7.6 mb.

In the details, U.S. crude oil production was steady at 12.0 mbpd. Exports fell 0.1 mbpd, while imports fell 0.5 mbpd. Refining activity rose 0.7% to 91.3% of capacity. We are in the usual period for autumn refinery maintenance, so falling refining activity should be expected for the next few weeks.

(Sources: DOE, CIM)

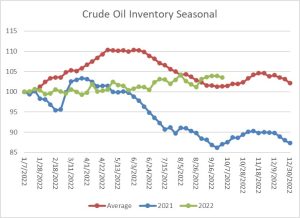

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are at the seasonal trough in inventories. The build seen in October into November is usually due to refinery maintenance. With the SPR withdrawals continuing, the seasonal build could be exaggerated this year.

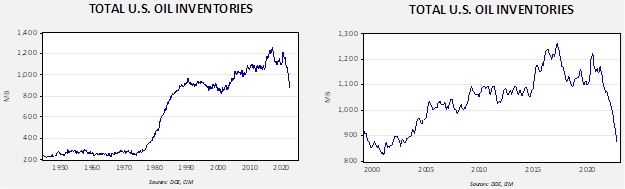

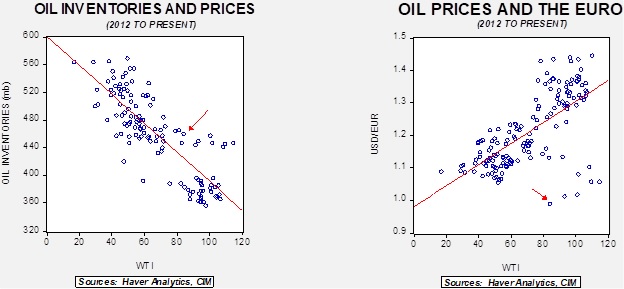

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $108.71.

Market News:

- This week’s big news is that OPEC+ has agreed to a production cut to bolster prices. A reduction of two million barrels per day has been confirmed. This news offers a number of insights into the thinking of the cartel. First, such action would have to be considered an affront to the Biden administration who has taken great pains to reduce oil prices to improve consumer confidence. A rise in oil prices will eventually lead to higher product prices, thwarting that goal. In fact, Washington is raising diplomatic pressure on the Gulf states to try and prevent such actions. Second, the news suggests that prices under $80 are not making producers happy. Third, worries about global recession are likely leading producers to try to prop up revenues, even though higher oil prices will also tend to hurt global growth. Finally, the KSA may be trying to reduce output to build a capacity buffer. It appears that OPEC+ is close to being out of capacity, and the fact that most nations can’t meet their quotas suggests that the cartel may not be able to lift output during an emergency. By cutting production, the KSA could create some excess supply, but it is unmistakable that the KSA/U.S. alliance that has existed since the end of WWII is fraying badly.

- Although the U.S. could continue SPR withdrawals in response to an OPEC+ cut, there is growing risk that the reserve is being depleted with little chance of rebuilding.

- The administration is considering a ban on product exports to keep gasoline and diesel prices low in the U.S. Such talk smacks of desperation. Europe will likely shift to oil from natural gas if the latter becomes too scarce to maintain electricity production, and it will need U.S. diesel to do so. Cutting off exports would show a profound lack of leadership from Washington and undermine support for the Ukraine war effort among Europeans. The fact this is even being considered shows a cost of political polarization as once both parties believe that the other being in power will lead to catastrophic outcomes, any action appears justified. Cutting off product exports, however, could have profound geopolitical effects and may, in the end, not even lower prices in the U.S. It is not hard to imagine that refining activity would decline if refining margins narrow.

- The Dallas Fed’s survey of oil and gas activity in its district paints a picture of deteriorating conditions for energy firms. Most participants expect oil market supplies to tighten into 2024. The industry is bracing for a recession.

- The head of Saudi Aramco (2222, SAR, 35.95) is warning that the world lacks adequate productive capacity for oil and natural gas, mostly because of the lack of investment in production. Oil and natural gas are depleting assets and without constant investment, production will decline. Although recession will likely reduce demand, once growth resumes, oil and gas prices could move higher.

- The rise in EU natural gas inventories suggests that the region has been trying to prepare for winter. Unfortunately, we still don’t know if the plan demand and supply actions will be sufficient. Germany’s energy regulator warns that consumption is still too high, raising concerns about a crisis this winter. Complicating matters is that Germany, like other nations in Europe, is planning subsidies to shield consumers from higher prices. Although understandable, preventing consumers from feeling higher prices will simply add to demand.

- One way the EU will likely try to address natural gas shortages is through fuel switching. Unfortunately, diesel inventories are also tight.

- Germany is building new LNG terminals to replace lost Russian production. There were no Russian natural gas imports to Germany in September.

- Europeans have opposed fracking, which has denied them potential energy supplies.

- A new gas pipeline to Poland from Norway has recently opened.

- Russia has shut off natural gas flows to Austria.

- China has been rerouting U.S. LNG to Europe since China’s economy has been sluggish, which frees up this resource for resale. The sale has been profitable for Beijing.

- The Inflation Reduction Act has measures designed to reduce methane emissions. This report offers a primer on the impact.

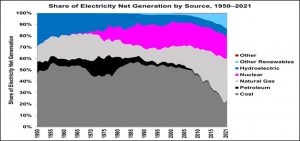

- The following chart shows how coal has lost market share for U.S. electricity generation.

(Source: EIA)

Geopolitical News:

- We continue to monitor the Nord Stream 1 and 2 situation. The EU and NATO have both declared the act to be sabotage. Although Russia is suspected to be behind the attacks, it is still uncertain who actually attacked the pipelines. The gas that was leaking was mostly for line pressure, and Danish officials have noted that it appears that most of the gas that was in the line has dissipated. Both Sweden and Demark claim that the pipeline leaks were caused by “several hundred kilos” of explosives, increasing the likelihood that a state actor was involved. NATO may not have the wherewithal to protect Europe’s energy infrastructure.

- The EU is expanding its sanctions against Russia. The current package includes an oil price cap along with other measures. A price cap on natural gas hasn’t been agreed upon quite yet. We are starting to see protests against high energy prices in Europe, and if the winter turns out to be cold, such unrest could spread and undermine support for Ukraine. Meanwhile, the U.S. appears to be calling for a phased implementation, likely to reduce the potential for price spikes.

- Germany caused a firestorm in the EU by unveiling a support package for its industrial sector that would likely harm smaller nations in the EU. The “go it alone” approach is coming under strong criticism as other countries fear that Germany’s subsidy program would lift German demand for natural gas and reduce supplies available to other areas of Europe.

- Adding to concerns about the fracturing of the EU are reports that Germany may cut electricity exports to keep the lights on at home.

- Iran is continuing to shell Kurdish areas of Iraq which Tehran suspects are supporting the unrest in Iran. The U.S. shot down an Iranian drone that was threatening a U.S. installation. Unrest continues for the third week. Rioting has moved to universities where security officials are responding harshly. Officials are warning against further protests, with both the parliamentary speaker and Ayatollah Khamenei calling for calm. There are reports that shopkeepers are joining the protests, and there is greater risk to the regime if participation widens. History is generally on the side of the regime. Although it has faced unrest before, harsh reprisals have tended to turn back protests. However, authoritarian regimes can unexpectedly fall, and with Ayatollah Khamenei suffering from cancer and being elderly, it is possible that the clerics could lose control of the government to a coup.

- In a related note, Tehran may be reconsidering its position with regard to the nuclear talks in light of the protests. Accepting a deal may be attractive if it would boost the economy. However, given the protests, it might be hard for the Biden administration to offer any concessions.

- As we noted last week, Israel and Lebanon were close to an agreement to share offshore natural gas fields. The deal has now been made.

Alternative Energy/Policy News:

- There is increasing interest in placing nuclear power plants on the sites of existing and closed coal utilities. Since the sites are already brownfields, there is less likely to be opposition and the coal plants are already connected to the grid.

- High prices for lithium are spurring interest in other materials for batteries. The search for alternatives is a risk to lithium investment. One battery design that might work for stationary requirements (like utilities) would be a flow battery.

- The world’s largest CO2 removal plant will begin operations soon in Wyoming.

- Energy storage other than batteries is another area of interest. Stored hydropower, where water is pumped to an elevated reservoir during periods of lower power demand to flow down through turbines during periods of high power demand, has been around for years. China is working on a project that uses compressed air to accomplish the same outcome.

- One of the great ironies of the clean energy industry is that it relies heavily on rare earths, which require large amounts of energy to mine and refine. So, as oil and gas prices have increased, production of these metals is starting to decline.