Daily Comment (July 8, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] We discuss the labor market data in more detail below but the initial response is that the Bureau of Labor Statistics (BLS) seems to have lost its way. We saw a massive jump in June non-farm payrolls by 287k with a net revision of -6k, reversing the 11k rise (revised downward) in May. The household survey indicated a significant recovery in the labor force, up 414k after seeing an over 800k drop in the labor force in April and May. However, employment in the household survey only rose by 67k, leading to a 0.2% jump in the unemployment rate to 4.9%. Wage growth came in below forecast, up 2.6% from last year. Given the volatility of the monthly data, it would seem that one should be smoothing the numbers with three-month averages at a minimum.

Market reaction is reasonably predictable after the data—equities and the dollar rallied, while Treasuries and gold declined. We doubt this data will change the policy stance of the FOMC. The June data will quell any worries about an immediate recession, which is good news. However, the inconsistencies between the surveys make it difficult to determine how strong the labor markets are at the moment. On balance, though, we would call the report supportive for the economy.

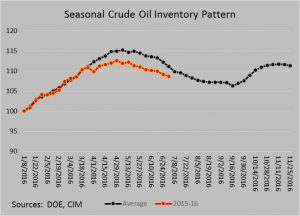

U.S. crude oil inventories fell less than forecast, dipping 2.2 mb versus estimates of a 2.4 mb decline.

The above chart shows current crude oil inventories, both over the long term and the last decade. We are starting to see inventories decline, but normal levels would be below 400 mb, some 130 mb lower than now.

So, obviously, inventories remain elevated. Inventories have been lagging the usual seasonal pattern. We are in a period of the year when crude oil stockpiles tend to fall at an increasing pace. The pace of declines will slow in the coming weeks as we are halfway through the summer driving season.

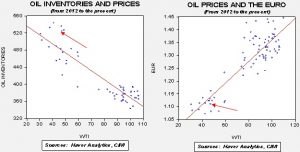

It is important to remember that the dollar is playing a bigger role in determining oil prices.

Based on inventories alone, oil prices are profoundly overvalued with the fair value price of $34.98. Meanwhile, the EUR/WTI model generates a fair value of $47.07. Together (which is a more sound methodology), fair value is $40.80, meaning that current prices are a bit rich.