Weekly Energy Update (October 20, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

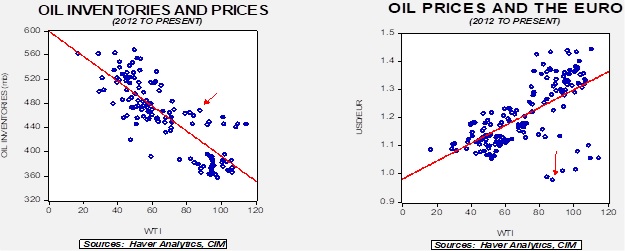

Crude oil prices remain in a downtrend as concerns about global growth, especially with China, are weighing on prices.

(Source: Barchart.com)

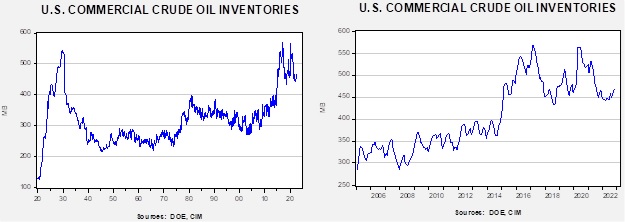

Crude oil inventories fell 1.7 mb compared to a 2.0 mb build forecast. The SPR declined 3.6 mb, meaning the net draw was 5.3 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.0 mbpd. Exports rose 1.3 mbpd, while imports fell 0.2 mbpd. Refining activity fell 0.4% to 89.5% of capacity. We are approaching the end of refinery maintenance season, which means oil demand should begin to rise soon.

(Sources: DOE, CIM)

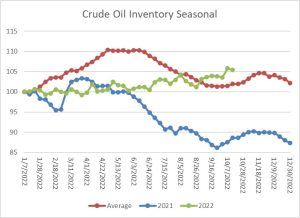

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are past the seasonal trough in inventories. The build seen from October into November is usually strong due to refinery maintenance. With the SPR withdrawals continuing, the seasonal build has been exaggerated this year.

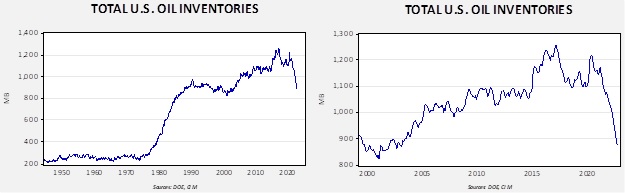

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2003. Using total stocks since 2015, fair value is $105.59.

Market News:

- In a widely anticipated move, Germany has extended its use of nuclear power plants into next April.

- Although the actual cuts in production from OPEC+, as we noted last week, won’t be as dire as the headlines suggest, it will still remove some barrels from the world’s oil supply. Unfortunately, the U.S. won’t be able to fill the gap, despite rising production in the Permian.

- As world trade flows for energy adjust, Europe is moving away from Russia as an energy supplier and working to establish new flows with other nations. The U.S. has become an important supplier and so has Qatar.

- Currently, Russia is supplying the EU with about 0.6 mbpd of crude oil. Those flows will be cut off on December 5. Not only will the EU stop importing Russian oil, but European insurance firms will no longer be able to underwrite cargo insurance for oil tankers. Without this insurance, the costs of Russia shipments will soar because some of the key chokepoints won’t allow vessels to pass without this insurance. It is not obvious, as we note in the above bullet point, where this crude will come from. This is where the price cap idea comes into play. If a buyer were willing to pay less than the cap, insurance would be provided. Of course, the opposition of OPEC+ to the price cap was likely part of the reason to cut production targets.

- Interestingly enough, Indian refiners, who have been large buyers of Russian crude oil, have suspended purchases until clarity is provided on how the EU sanctions will work.

- One potential place for the EU to purchase oil would be from the U.S. SPR. However, some members of Congress are pushing for a bill that would ban the export of SPR crude oil. However, this action would contradict the original SPR measures created by the IEA. Under IEA rules, in a global emergency, national SPRs could be under the IEA’s jurisdiction. The goal of the SPR is to discourage hoarding. If we were to see national governments prevent the export of SPR oil, it is quite likely that global oil prices would soar. If this bill gains traction, it could cause further disruption to global oil markets. However, we could also see a situation where SPR oil would simply displace the domestic oil that would have been exported instead.

- On the topic of the SPR, the Biden administration has announced additional sales, although the announcement did cause some confusion. There is about 15 mb of sales left in the original announcement and 26 mb scheduled for release next year (as part of a budgetary agreement), but the administration is worried about high gasoline prices and has suggested even more could be sold from the reserve.

- As we noted in earlier reports, the administration seems to be moving the SPR from a strategic reserve to a buffer stock. Buffer stocks have been used in commodity markets before, with the goal being to stabilize prices. The trick to managing the stock is getting the price right (which begs the question: why bother?). Set it too low, and the stock becomes exhausted. Set it too high, and it becomes too large. When first floated, the administration suggested $80 as a baseline to begin buying oil. That has now fallen to a range of $67 to $72. We don’t expect that ANY oil will be bought by this administration as there does not seem to be a price that is politically low enough.

- The EU has been able to build natural gas inventories, in part, because weak Chinese demand for LNG has allowed for shipments to be diverted. China is signaling this diversion will end, although Chinese demand is expected to remain sluggish. China is also indicating that it will increase its energy reserves as winter approaches.

- As the EU attempts to shift its natural gas supply away from Russia and to LNG, it is finding that bottlenecks at terminals are becoming a problem.

- The EU has generally been unable to craft a functioning price cap for natural gas, so the group is trying to create other measures to bolster available supply.

- To a great extent, the world’s energy situation is dependent upon the weather.

- Currently, Russia is supplying the EU with about 0.6 mbpd of crude oil. Those flows will be cut off on December 5. Not only will the EU stop importing Russian oil, but European insurance firms will no longer be able to underwrite cargo insurance for oil tankers. Without this insurance, the costs of Russia shipments will soar because some of the key chokepoints won’t allow vessels to pass without this insurance. It is not obvious, as we note in the above bullet point, where this crude will come from. This is where the price cap idea comes into play. If a buyer were willing to pay less than the cap, insurance would be provided. Of course, the opposition of OPEC+ to the price cap was likely part of the reason to cut production targets.

- The DOE has issued estimates for this winter’s heating costs, and although natural gas remains the cheapest source of heating, it is poised to have the fastest price increases.

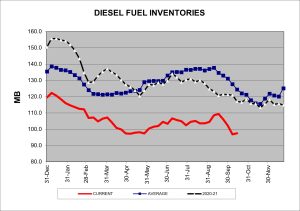

- Although crude oil inventories appear adequate, the situation in diesel fuels is a growing concern.

(Sources: DOE, CIM)

- Diesel fuel is often used for emergency electricity generation, and so, if there are disruptions in electricity this winter, demand could rise into a tight market which will then lift crude oil prices as well.

- One of the factors that has reduced U.S. crude oil production has been the demand from investors that companies focus on profits and returns to shareholders. This desire is partly driven by the ESG movement and the fears that peak oil demand is near. If oil and gas are going to be industries in decline, then shareholders will tend to focus on near-term returns. In terms of net-zero promises, there is evidence to suggest that publicly traded firms are more sensitive to such goals than are private firms. It appears that such pressures are leading Harold Hamm to take Continental Resources (CLR, $73.68) private.

- Prime Minister Truss of the U.K. has essentially lost control of her government after proposing a radical economic program that the financial markets fundamentally rejected. The new Chancellor, Jeremy Hunt, has reversed nearly her entire fiscal package. Part of the original package was massive support measures to protect businesses and consumers from higher energy prices. The original bill was expected to cost £60 billion and its generosity was part of the reason that the financial markets panicked. However, in walking back the package, Hunt didn’t offer a replacement to protect less affluent households that may be at risk due to higher prices.

Geopolitical News:

- Mohammed al-Sudani has been appointed to be the new prime minister of Iraq. It is unclear how long he will be in office because he is not popular with the al-Sadr faction.

- Last week, Saudi Arabia argued that its decision to support a cut in oil production targets was based on market concerns and was not done to support Russia. The U.S. has dismissed the explanation as “spin.”

- Russia is proposing to make Turkey a hub for natural gas transfers. Although clearly attractive for Turkey, we doubt the EU would see this as a viable alternative. It might not help Russia either, because if Iran ever normalizes relations, Turkey could be a conduit for Iranian gas as well.

- Exxon (XOM, $101.23) announced that it has fully withdrawn from Russia after accusing Moscow of “expropriation.” The charge could signal that the company is planning to sue Russia over its exit.

- Unrest and atrocities continue in Iran. Recently, there was a fire at the infamous Evin prison which houses dissidents and political prisoners. It appears that the fire was related to recent national protests. There is a general question about the stability of the regime, and one of the keys to watch for is if the security services turn on the government. There is little evidence that that most potent Iranian forces have joined the protesters.

- Iran’s support for Russia’s war effort has triggered a response from the U.S. Washington is planning various penalties against Iran that could target third parties.

- As an aside, the sale of drones to Russia by Iran would seem to make it nearly impossible for the U.S. to return to the JCPOA. Even the Europeans are now acknowledging this outcome.

- In France, protests against high fuel prices have evolved into complaints about inflation in general.

- In light of the Inflation Reduction Act’s measures to encourage battery makers to build facilities in the U.S., French President Macron is calling for a similar industrial policy for the EU.

Alternative Energy/Policy News:

- One of the more controversial issues in environmentalism is geoengineering. As defined, these are various technologies designed to offset some environmental ill. Trees, for example, can be used to reduce CO2. However, some measures that would reflect sunlight out into space in order to keep the planet cool could raise fears concerning unexpected side effects such as changing rainfall patterns that could then create distributional or geopolitical concerns. And so, these worries have tended to dampen investment in such technologies. However, the White House has announced a five-year research study on geoengineering to investigate its various technologies.

- CO2 emissions growth looks set to unexpectedly slow this year after declining global growth.

- Financial analysts argue that there is ample liquidity available for the private sector to fund alternative energy. However, the bulk of this investing power is in the energy and mining sector, which may not be keen on investments that will harm its basic industry.

- At the CPC conference, General Secretary Xi said China would not “rush” its clean energy transformation, likely meaning that fossil-fuels consumption will remain elevated.

- Although there is a wide debate over climate change and its effects, one area where the impact is quantified is in insurance. The insurance industry and the Treasury are analyzing climate risk, which may result in some areas paying much more for coverage. Insurers are pushing back against the government’s investigation.

- The SEC is pressing publicly traded firms for information on climate issues. Lobbying efforts to shape regulation are increasing.

- Russian drones have attacked an important sunflower oil terminal in Ukraine. Although this attack will obviously affect the world supply of edible oils, it may also have an impact on biofuels.

- Although starting from a low base, carbon capture project activity is increasing rapidly.

- We are also starting to see increased investment in green hydrogen projects.