Daily Comment (October 25, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where Russia appears to have ratcheted down its recent missile, air, and drone attacks as it runs low on its inventory of weapons. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including further fallout from China’s recent Communist Party conference and the installation of a new prime minister in the U.K.

Russia-Ukraine: As Ukrainian forces continue to slowly press the Russians back in the northeastern Donbas region and the southern Kherson region, Russian forces continue to attack Ukrainian civilian infrastructure targets with missile, air, and kamikaze drone attacks. However, Ukrainian officials report that the scale of the Russian strikes on Monday was markedly smaller than in previous days, probably because the Russians have now depleted much of their stockpiles of missiles and drones and because the attacks have proven largely inconsequential.

- Meanwhile, Russian military officials continue to push their misinformation campaign claiming that Ukraine plans to detonate a “dirty bomb” consisting of a conventional explosive laced with radioactive material.

- The Russian misinformation campaign is being taken mostly as a threat that Russia plans to use such a weapon itself.

- All the same, U.S. officials said they had detected no signs that Russia is planning to use nuclear arms, and therefore had no reason to raise the alert level of U.S. nuclear forces.

- Meanwhile, financier Yevgeny Prigozhin continues to build a power base that could put him in position to challenge President Putin’s authority. Besides lambasting Russia’s uniformed military, Prigozhin’s Wagner Company mercenaries continue to threaten Ukraine’s hold on the Donbas city of Bakhmut, even as Prigozhin begins to build his own volunteer battalion.

EU Energy Crisis: European natural gas prices have dropped below €100 per megawatt hour this week for the first time since Russia slashed supplies earlier this summer. The drop reflects the unexpectedly warm weather and the fact that the EU’s gas storage facilities are now close to full, easing concerns about winter shortages.

- The drop in energy prices is a welcome development that has the potential to pull down inflation and minimize the impending recession in Europe.

- All the same, the EU still faces much worse conditions than it did in recent years, especially if weather patterns turn negative again.

- More broadly, EU energy ministers are meeting in Luxembourg today to continue hashing out a potential price cap on natural gas, and to consider a longer-term change in the EU’s energy-pricing mechanism.

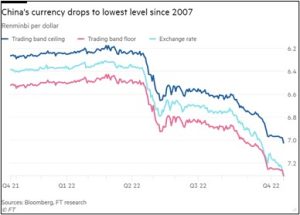

China: Chinese stocks stabilized today following foreign investors’ scrambling for the exits on Monday after President Xi’s election to a norm-breaking third term in office and his tightened political grip on the country. However, the renminbi has lost another 0.6% against the greenback to trade at 7.3084 per dollar. At that rate, the Chinese currency has now lost a whopping 12.8% year-to-date.

Turkey: In recent years, in a move largely unnoticed by investors around the world, Turkey has become a key supplier of advanced military goods, particularly drones and other autonomous weapons. In the latest development, a Turkish defense firm has been awarded government subsidies to produce one of the world’s first viable long-range, unmanned helicopters known as the Alpin. Once the drone chopper is field tested and combat proven, the government plans to export the Alpin worldwide.

South Korea-North Korea: South Korean President Yoon Suk-yeol warned that North Korea has now completed preparations for its seventh nuclear test. If North Korea goes ahead with the test, it would be the first such provocation since 2017 and would likely touch off a new geopolitical crisis and further sanction efforts against Pyongyang.

United Kingdom: Many British pension funds and the companies that manage their “liquidity driven investment” programs are reportedly amending their contracts to allow the funds to post liquid assets other than cash, such as government bonds, when they have to provide collateral to hedge their positions in the market.

- The need to sell Gilts was a key reason for the spike in British interest rates and the fall of former Prime Minister Truss after she released a budget-busting series of tax cuts and spending hikes last month. If enough pension funds amend their credit support documentation, it could make the British financial system less susceptible to a future run on Gilts.

- Separately, Rishi Sunak today formally became Britain’s new prime minister, succeeding Truss. Next week, Sunak’s government intends to release a new fiscal plan aiming to reassure investors that Britain’s debt is under control. In his speech today, Sunak said he would act with “compassion” but that he would not let future generations pay for debt that “we are too weak to pay ourselves.”

U.S. Semiconductor Industry: Pat Gelsinger, the CEO of Intel (INTC, $27.18), said at a conference that recently imposed U.S. restrictions on semiconductor-industry exports to China were a necessary shift in supply chains as the U.S. seeks to maintain technological leadership in its competition with China.

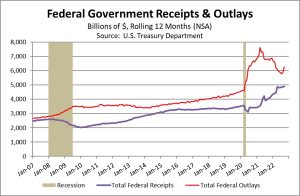

U.S. Fiscal Policy: Data late last week showed that the federal budget deficit for the fiscal year ending September 30 came in at $1.375 trillion, down from the deficit of $2.772 trillion in the previous fiscal year. The report showed that the improvement in the deficit mostly stemmed from a 21.0% surge in revenues as the recovering economy boosted tax receipts. In contrast, federal outlays declined 8.0% as many pandemic relief programs got scaled back.