Daily Comment (October 31, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including the latest on Russia’s apparent withdrawal from the UN-brokered deal which allowed Ukraine to export grain from its southern ports. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including news of an unexpectedly high rate of inflation in the Eurozone and a leftist win in Brazil’s presidential election.

Russia-Ukraine: Ukrainian forces continue to recapture modest amounts of territory in the northeastern Donbas region, but Russian forces have apparently pushed them back in some areas as both sides jockey for position ahead of winter. The Ukrainians also continue pressing their counteroffensive in the southern region around Kherson, although it appears that their gains there may have stalled. In any case, the Russian military continues to strike back at Ukraine with air, missile, and kamikaze drone attacks on the country’s civilian energy infrastructure in an effort to break the Ukrainians’ will to fight. Reports on whether Russia will try to defend Kherson rather than abandoning it have become contradictory.

- In an extensive interview with Politico last week, NATO General Secretary Stoltenberg provided an important explanation as to why it’s in the U.S.’s best interest to remain engaged in Europe and to continue supporting Ukraine in its war with Russia. Stoltenberg highlighted that strong political, military, and economic bonds across the Atlantic Ocean help to create a safe space for democracy and free markets that would otherwise be at risk from the aggression by authoritarian countries.

- Importantly, Stoltenberg warned that if Putin were allowed to win in his invasion of Ukraine, it would embolden Chinese President Xi to be more aggressive against Taiwan and the democratic, free-market nations of the Indo-Pacific region.

- As we have long argued, Stoltenberg also expressed confidence that Putin’s invasion will touch off a prolonged period of increased defense spending and military modernization efforts among the NATO allies. This is a key reason why our current asset allocation strategies include positions in defense companies.

- As we warned last week, Russia suspended participating in the UN-brokered deal to allow Ukraine to export grain from its southern ports on Saturday. The decision, which the Kremlin linked to an apparent Ukrainian attack on Russian military vessels in the port of Sevastopol, Crimea, has the potential to push global food prices higher again in the coming weeks and months. As of this morning, grain ships are reportedly continuing to sail out of Ukraine, but global prices have already begun to jump.

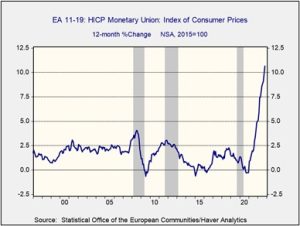

Eurozone: As shown in the data tables below, the Eurozone’s October consumer price index was up 10.7% from the same month one year earlier, far worse than expected and much higher than the 10.0% increase in the year to September. The inflation rate in October was a record for the Eurozone, but its data only goes back to the late 1990s. Germany’s rate in October, at 11.6%, was its highest since 1951.

- The October inflation figures largely reflect the spike in energy prices touched off by the war in Ukraine.

- The sky-high inflation rate has the potential to spark further social unrest in Europe. Indeed, thousands of German industrial workers walked out for several hours over the weekend in an escalating pay dispute sparked by high inflation, and leaders of Germany’s powerful IG Metall union warned of more strikes to come if employers failed to improve their offer. High inflation also ensures that the European Central Bank will continue to hike interest rates aggressively.

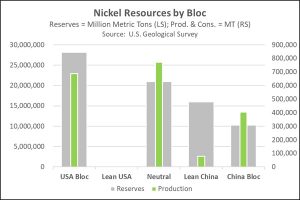

Indonesia: Investment Minister Bahlil Lahadalia said Indonesia, the world’s largest nickel producer, is exploring the possibility of establishing a cartel for nickel and other key battery metals in order to control supply and boost prices, much like the Organization of the Petroleum Exporting Countries (OPEC).

- Forming such a cartel would likely discourage new foreign investment in Indonesia’s metals sector, and it isn’t clear whether Indonesia could get the cooperation of other major producers, such as Russia, Canada, and Australia.

- In our recent study of how the world is breaking up into relatively separate geopolitical and economic blocs, we projected that Indonesia would attempt to remain in the “Neutral” bloc. That helps explain its consideration of a cartel, as such a grouping would help it leverage its mineral resources in a fractured world. However, since big producers like Canada, Australia, and the Philippines are likely to be in the U.S. bloc and may not participate in such a cartel, Indonesia’s move may not be successful.

Brazil: In a run-off election yesterday, leftist Former President Luiz Inácio Lula da Silva appeared to beat incumbent right-wing President Jair Bolsonaro by 50.9% to 49.1%. In the runup to the election, Bolsonaro had pushed the argument that the country’s voting machines are subject to fraud, so there is probably still some chance that he will challenge the vote.

- If Lula prevails, however, he is likely to push for looser fiscal policy to support greater spending on social programs and infrastructure, and he is likely to impose tougher environmental regulations and other rules.

- Lula’s expected economic policies are likely to scare investors, so the election outcome could result in lower values for Brazilian stocks and bonds in the near term.

China: The main iPhone assembler for Apple (AAPL, $155.74) said that it is shifting production away from its main Chinese plant in Zhengzhou after a botched COVID-19 lockdown in that city prompted masses of workers to flee. The shutdown of the Zhengzhou plant will reportedly affect about 10% of the company’s iPhone output. Both Apple and the assembler, Hon Hai Precision Industry (HNHPF, $6.40), are facing downward pressure on their stock prices thus far this morning.

United States-China: Under Secretary of Commerce for Industry and Security Alan Alvarez stated in a speech last week that the administration’s broad new ban on selling U.S. computer chips, chipmaking technology, and related services to China will likely be followed by similar curbs on quantum computing, high-end biotechnology, and artificial intelligence software. According to Alvarez, who transferred to the Commerce Department after a long career at the Defense Department, the U.S. restrictions are aimed solely at protecting U.S. national security.

- Alvarez insisted that the U.S. technology bans are not aimed at stifling Chinese economic development. Based on the imperative of national security, he also warned that the additional technology restrictions could be implemented even if they hurt business for U.S. companies.

- Overall, the statements by Alvarez confirm that the U.S. government will probably keep squeezing technology flows between the U.S. geopolitical bloc and the Chinese bloc out into the future. That will likely hurt even more Chinese stocks in technology and other sectors, even beyond those that have already been impacted.

U.S. Defense Strategy: As required by law, last week the Biden administration released the unclassified version of its National Defense Strategy. The document identifies China as the U.S.’s key “strategic competitor” and the military’s “pacing challenge,” while it recognizes Russia as merely an “acute threat.” The overall strategy is based on “integrated deterrence,” or coordinating military, diplomatic, and economic levers from across the U.S. government to deter an adversary from taking an aggressive action. It also stresses “campaigning” to build up the capability of international coalitions and complicate adversaries’ actions.

- The strategy also emphasizes making new investments in advanced, cutting-edge technologies such as hypersonic missiles and artificial intelligence. The strategy’s integrated Nuclear Posture Review emphasizes the need to modernize U.S. nuclear forces and highlights the dilemma of simultaneously deterring two nuclear-armed competitors: Russia and China.

- It also includes a nod to President Biden’s hope to reduce the nation’s nuclear weapons effort by retiring the B83-1 nuclear gravity bomb and ceasing development of the nuclear sea-launched cruise missile (SLCM).

- However, a bipartisan group of Congressmen has already taken steps to keep the SLCM program alive.

- The document’s approach to the posture of force focuses on the geographical access and warfighting capabilities needed to deter potential Chinese and Russian aggression against vital U.S. national interests, and to prevail in conflicts if deterrence fails. The strategy suggests that the U.S. will continue to replace large, expensive, politically unpopular foreign bases with “heel to toe” rotational deployments.

U.S. Monetary Policy: Officials at the Federal Reserve begin their latest policymaking meeting tomorrow, with their decision due out on Wednesday afternoon. The officials are widely expected to hike their benchmark fed funds interest rate by another 75 basis points, but investors are also hoping that they will signal more moderate rate hikes going forward.

U.S. Bond Market: When the Treasury Department issues its fourth-quarter funding plan in the coming days, investors will be looking for signs that it will start repurchasing older Treasury bonds in an effort to improve market liquidity. Limited liquidity this year has produced volatile swings in Treasury prices and has made it much harder for investors to buy and sell government obligations.

U.S. Real Estate Investment Trusts: Publicly-traded real estate investment trusts (REITs) have registered negative total returns of more than 25% so far this year, but non-traded REITs have produced positive total returns of as much as 10%. The disparity is raising concerns that the non-traded funds are not properly marking down the value of their properties and are therefore over-valued. If so, the non-traded REITs could be at risk of a sudden drop in value.