Daily Comment (December 15, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with a discussion on the Federal Reserve’s rate decision from Wednesday. Next, we provide an overview of both the European Central Bank and Bank of England’s decision to tighten monetary policy. Lastly, we give our thoughts about the latest chapter in the fight against global inflation.

The Fed Presses On: Fed Chair Jerome Powell insists that the Fed will tighten policy until it makes noticeable improvements toward its 2% inflation objective; however, the market is not convinced.

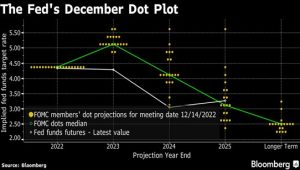

- The Federal Reserve reduced the size of its rate hike but warned markets that peak interest rates would be higher than it had previously anticipated. On Wednesday, the Federal Open Market Committee raised its benchmark rate by 50 bps to a target range of 4.25% to 4.50%. During a press conference, Powell stuck to the Fed statement and maintained that the central bank’s fight against inflation is not over. The latest dot plot shows that the overwhelming majority of Fed officials support peak fed funds above 5.0% in 2023, while the following year shows a sizeable dispersion around a median range of 4.1% (See chart below). As of this morning, Eurodollar futures signaled terminal fed funds of 4.9% in 2023 and 3.4% the year after.

- Despite his hawkish talk, Powell let slip that the Fed could reexamine its 2% inflation target at some point in the distant future, signaling that the Fed could become significantly more dovish over the next few years.

- The market reaction was mixed. Equities appeared to have accepted that the Fed will raise rates higher than initially anticipated. Although the S&P 500 fluctuated following the announcement, it ultimately closed down 0.6% from the previous trading day. The dollar and bond market had a somewhat muted response to Powell. The U.S. dollar index closed down 0.12% from the prior day. Meanwhile, the spread between the 2- and 10-year Treasury narrowed to a paltry 3 bps lower in the same period. The lack of a reaction suggests that fixed-income and currency traders believe that the Fed will not tighten policy in a downturn. If they are right, the U.S. dollar could weaken in 2023.

- A strong economy and a tight labor market will likely allow the Fed to raise rates without much hassle. However, an economic downturn could complicate matters. The latest summary of economic projections shows that the median forecast for GDP growth will be 0.5% for 2023, with some officials predicting a contraction. A recession could lead the Fed to discontinue hiking rates and, if it is severe enough, could force the central bank to cut rates. An inflation rate of less than 3% could also lead to a Fed pivot, but this is more fantasy than anything. At this time, it appears that the Fed would like to either hike or pause depending on the economic data.

Other Central Bank News: The European Central Bank and the Bank of England followed the Federal Reserve’s lead but are likely less committed to raising interest rates in 2023.

- The ECB and BOE have both decided to raise interest rates by 50 bps. The two central banks have elected to downshift their hikes to accommodate for a slowdown in inflation and economic growth. The BOE lifted its bank rate from 3.0% to 3.5%, while the ECB pushed its deposit rate from 1.5% to 2.0%. Although the banks maintained that their peaks are likely higher, it appears that both are paying attention to the economic ramifications of continuing to tighten policy. Unlike the Fed, the BOE and ECB are both predicting recessions for 2023.

- There was a stronger-than-expected consensus at the BOE. Six of the nine members voted for a 50 bps hike, one for a 75 bps hike, and the other two members wanted policy to remain unchanged. This suggests that the BOE has become more dovish.

- The ECB is signaling that it would like to tighten policy more aggressively, but it is unclear if it has the policy flexibility to do so. In its statement, the ECB announced plans to wind down its €5 trillion balance sheet in March 2023. The move comes as the financial stress, as measured by the spread between 10-year German and Italian bonds, has declined more than 50 bps since September. That said, as interest rates rise it will likely worsen European fragmentation. Additionally, ECB President Christine Lagarde stated that the bank could continue hiking rates in 50 bps intervals. Tightening policy during a recession will likely be politically unpopular, and, as a result, the ECB may be more assertive in the short-term to maneuver its policy rate into restrictive territory before it begins receiving pushback.

- Another sign that they may not raise rates throughout 2023, is that it appears that these is not a strong consensus among council members.

- The tighter monetary policy within these countries may not be as long-lived as these banks are implying. Both the Eurozone and the U.K. are either in or headed toward contraction. As a result, these countries risk harming their economy with higher rate hikes. Although this does not mean that these central banks will cut rates in 2023, it does signal that they are close to finishing their tightening cycle. Assuming that the U.S. does not enter a deep recession, this outcome should be supportive of the dollar as it will likely mean that European inflation will be a persistent problem.

A New World: Central Bankers are unlikely to be as hawkish in 2023.

- Unlike the U.S., there may not be policy space for other central banks to tighten more than needed. In Europe, governments are becoming more comfortable in dealing with the problem through subsidies and price ceilings. The U.K. and Germany have funded payments to households and businesses to offset rising energy costs. Meanwhile, the Netherlands will implement rental caps to deal with shelter shortages. The government interventions should help reduce inflationary pressures and allow the central banks to become more measured in how they raise rates; however, there is an additional risk of higher inflation volatility in the future once these caps are removed.

- That said, there are many headwinds that could prevent banks from abandoning rate hikes altogether. The major unknown is how China’s reopening will impact global price pressures. China’s recent decision to accept western medicine to help contain the COVID virus shows how eager the government is to reopen. Although there has been much discussion about the future demand for commodities, there is also the possibility of an improvement in supply chains due to the lessening of restrictions. Additionally, rising union power and the war in Ukraine are also likely to boost price pressures as the potential rise in wages and raw materials could force firms to push cost adjustments onto consumers.

- Major central banks are entering a new phase of their tightening cycle. Monetary policymakers will begin to look for signs that they should moderate policy rather than continue to tighten it. Assuming that prices continue to fall globally, we expect the ECB and BOE to be the first of the five major five central banks (which include the Swiss Central Bank, the Federal Reserve, and the Bank of Japan) to signal a pause in tightening. This should make equities within these countries relatively more attractive when compared to the U.S.